Australian Dollar maintains position due to US-China trade optimism

- Gold remains bid as lack of Fed clarity and geopolitical frictions persist

- Gold Price Forecast: XAU/USD drifts higher above $4,200 as Fed delivers expected cut

- Gold Price Steady Climb and the Sudden Surge of Silver and Copper: Will Their Bull Run Extend Into 2026?

- Gold Price Forecast: XAU/USD climbs above $4,250 as Fed rate cut weakens US Dollar

- Silver Price Forecast: XAG/USD refreshes record high, looks to build on move beyond $61.00

- Fed Cuts Rates: Bitcoin Rallies Then Retreats - Bear Market Ahead?

Australian Dollar opened at a gap up due to positive developments in the US-China trade deals.

US Treasury Secretary Scott Bessent said President Trump’s threat to impose 100% tariffs on Chinese goods is “off the table.”

The US Dollar weakens as softer US inflation data strengthen expectations of a Federal Reserve rate cut.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) after opening from a gap up on Monday due to optimism over progress in the United States (US)–China trade negotiations. Traders await key upcoming Q3 and the September monthly inflation data for Australia this week that could shape the Reserve Bank of Australia’s (RBA) policy outlook.

The AUD/USD pair received support after United States (US) and Chinese negotiators reached a consensus on major disputes, which paves the way for Presidents Donald Trump and Xi Jinping to meet on Thursday to finalize a trade deal aimed at easing tensions. Officials in Malaysia announced after two days of talks that both sides had agreed on key issues, including export controls, fentanyl, and shipping levies. Any shift in China’s economic conditions could also affect the Australian dollar (AUD), given the close trade ties between China and Australia.

US Treasury Secretary Scott Bessent told CBS News that President Trump’s threat to impose 100% tariffs on Chinese goods “is effectively off the table.” Bessent added that China has agreed to make “substantial” soybean purchases and to postpone its rare-earth export controls “for a year while they re-examine it.”

US Dollar struggles following softer inflation data

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is remaining subdued and trading around 98.90 at the time of writing. The Greenback struggles as softer US inflation data reinforce the Federal Reserve (Fed) rate cut bets.

The US Bureau of Labor Statistics (BLS) reported on Friday that showed that the US Consumer Price Index (CPI) rose 3.0% year-over-year (YoY) in September, following a 2.9% the prior month. This reading came in below the market expectation of 3.1%. Meanwhile, the monthly CPI increased 0.3%, against the 0.4% rise seen in August. The core CPI increased 0.2% month-over-month, compared to the market consensus of 0.3%, while the yearly core CPI was up 3.0% in September.

The CME FedWatch Tool indicates that markets are now pricing in nearly a 97% chance of a Fed rate cut in October and a 96% possibility of another reduction in December.

The preliminary Australia's S&P Global Manufacturing Purchasing Managers Index (PMI) fell to 49.7 in October from 51.4 prior. Meanwhile, Services PMI rose to 53.1 in October from the previous reading of 52.4, while the Composite PMI increased to 52.6 in October against 52.4 prior.

Traders expect the Reserve Bank of Australia (RBA) to deliver a rate cut after Australia’s latest employment report threw an unexpected curveball, with the jobless rate climbing to its highest level in nearly four years this September. ASX 30 Day Interbank Cash Rate Futures indicate a 67% expectation of an interest rate decrease to 3.35% at the next RBA Board meeting.

Australian Dollar pulls back from 50-day EMA near 0.6550

AUD/USD is trading around 0.6530 on Monday. Technical analysis of a daily chart suggests a potential for weakening of a bearish bias, with the pair positioned near the upper boundary of the descending channel. The pair is trading above the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is stronger.

On the upside, the immediate barrier lies at the 50-day EMA of 0.6540, followed by the descending channel’s upper boundary around 0.6550. A successful break above this confluence resistance zone would support the AUD/USD pair to explore the region around the 12-month high of 0.6707, which was recorded on September 17.

The initial support lies at the nine-day EMA of 0.6513. A break below this level would weaken the short-term price momentum and prompt the AUD/USD pair to navigate the area around the four-month low of 0.6414, followed by the lower boundary of the descending channel around 0.6390.

AUD/USD: Daily Chart

Australian Dollar Price Today

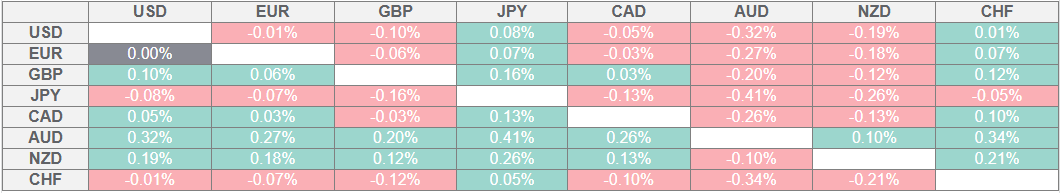

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.