Could This Under-the-Radar AI Company Become the Next Nvidia?

Key Points

Investors are pouring unprecedented sums into quantum computing stocks.

However, many popular quantum computing stocks are speculative companies as opposed to the usual, megacap beneficiaries from the artificial intelligence (AI) boom.

D-Wave Quantum is an interesting quantum AI stock, and its popularity rhymes with that of the rise of Nvidia over the last few years.

- 10 stocks we like better than D-Wave Quantum ›

As investors hunt for the next Nvidia, attention is shifting toward quantum computing -- a field that could mark the next major leap in processing power.

D-Wave Quantum (NYSE: QBTS) stands out as one of the few public companies focused on building practical quantum computers -- machines designed to tackle problems that are simply beyond the capabilities of today's classical systems.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The question for investors is whether comparing D-Wave to Nvidia is a bold insight -- or the start of another speculative bubble.

What D-Wave is trying to solve -- and why it matters

D-Wave's mission is to commercialize quantum annealing technology, a specialized form of quantum computing designed to tackle optimization problems -- the kind of complex challenges that involve countless independent variables, such as supply chain logistics, portfolio risk management, or traffic routing.

Unlike traditional computers that rely on binary bits, quantum systems use qubits, which can exist in multiple states simultaneously. This property, known as superposition, enables quantum machines to evaluate vast numbers of possible outcomes at once -- providing a theoretical edge over even the fastest GPUs on the planet.

As AI workloads grow exponentially, the limits of classical computing -- even with Nvidia's most advanced chips -- will eventually run into physical and economic constraints. Quantum computing offers a potential way around those barriers, solving in seconds what might take today's supercomputers thousands of years.

If successful, D-Wave's technology could transform industries ranging from drug discovery and energy exploration to cybersecurity and AI model optimization. The company is already collaborating with partners across defense, automotive, and blockchain sectors to explore real-world applications through its platform.

Image source: Getty Images.

Could D-Wave be the next Nvidia?

Any comparison between D-Wave and Nvidia stems from their shared position at the forefront of computational innovation. Just as Nvidia's GPUs ignited the AI revolution, D-Wave's systems aim to spark the next wave: quantum acceleration.

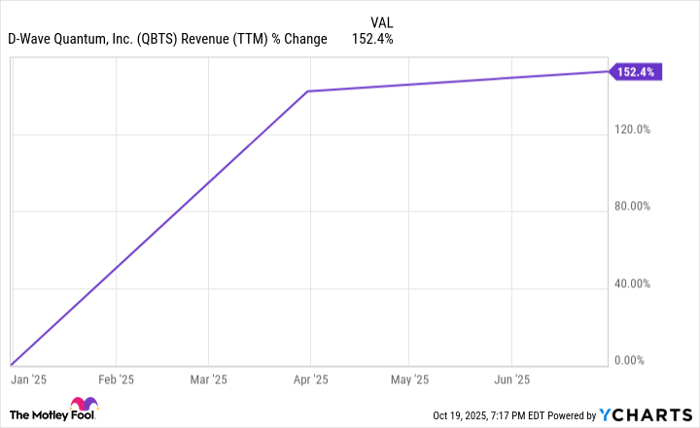

The company's revenue growth has been eye-catching, with triple-digit percentage gains year over year. That momentum has fueled retail investor enthusiasm and social media buzz reminiscent of the early days of AI investing.

QBTS Revenue (TTM) data by YCharts

Yet the absolute numbers tell a more measured story. D-Wave's quarterly revenue still sits in the single-digit millions, and its operating losses remain substantial. During the second quarter, the company reported just $3.1 million in revenue and an operating loss of $26.5 million.

The company continues to rely heavily on capital raises to fund operations -- a strategy that inevitably dilutes existing shareholders. In essence, while Nvidia's narrative is one of compounding profitability, D-Wave's is still a fight for commercial validation and financial sustainability.

Nvidia spent decades refining its architecture, cultivating a vast developer ecosystem, and building out software frameworks like CUDA -- all of which now form the backbone of modern AI computing. D-Wave, by contrast, is still proving both its technical advantage and business model in a domain that remains largely experimental.

The hype may rhyme, but the fundamentals couldn't be more different.

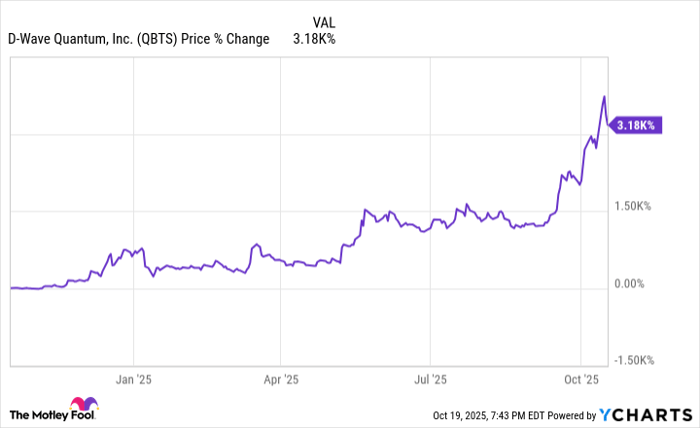

Image source: Nvidia.

The verdict: Breakthrough potential or meme stock?

Could D-Wave become the next Nvidia? It's not impossible -- but the odds are slim. For that to happen, the company would need to demonstrate that its quantum annealing systems can outperform classical supercomputers on commercially meaningful applications, scale revenue fast enough to offset steep losses, and do so before competition and dilution erode its runway.

For now, profitability remains distant, and D-Wave's technology may take years -- if not decades -- to reach mainstream utility. Unlike Nvidia, whose chips are indispensable to AI workloads today, D-Wave is selling access to a technology still validating its relevance. That makes the stock fertile ground for traders chasing volatility, but a risky bet for long-term investors seeking reliable compounding returns.

QBTS data by YCharts

Ultimately, D-Wave is a fascinating moonshot at the frontier of computing -- a company that could redefine what's possible if quantum technology fulfills its promise. But calling it the "next Nvidia" is premature at best and misleading at worst.

Until revenue growth accelerates and cash burn stabilizes, D-Wave remains a high-risk curiosity within the AI ecosystem -- one that's better suited for speculating meme traders than for patient investors seeking durable, Nvidia-like growth.

Should you invest $1,000 in D-Wave Quantum right now?

Before you buy stock in D-Wave Quantum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D-Wave Quantum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $600,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,116,616!*

Now, it’s worth noting Stock Advisor’s total average return is 1,032% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.