Bank of Japan set to keep rates on hold after July’s hike shocked markets

- The Bank of Japan is anticipated to maintain its policy rate unchanged.

- Investors’ focus should remain on the bank’s rate path for the next few months.

- BoJ Governor Kazuo Ueda is seen sticking to the recent hawkish narrative.

The Bank of Japan (BoJ) is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review.

The decision is set to be announced during the early Asian session. Notably, in March, the BoJ raised interest rates for the first time in 17 years, ending the negative interest rate policy that had been in place since 2016. On July 31, the central bank further surprised markets by hiking its policy rate by 15 basis points to 0.25%.

What can we expect from the BoJ interest rate decision?

As the meeting approaches, most expect a steady policy stance, but market participants will be closely watching for any shifts in the policy statement that might offer clues about when the bank plans to raise rates next.

Currently, money markets are anticipating an increase of about 25 basis points by the end of the year, which would bring the bank's policy rate to a maximum of 0.50% at the December 19 meeting.

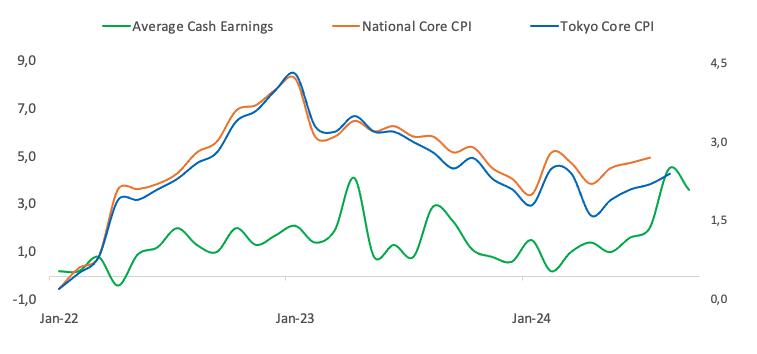

On the consumer front, real wage growth saw a positive turn in June (1.1% YoY) and July (0.4% YoY), which could encourage more spending and potentially push inflation higher. For now, inflation remains above the 2% target.

These factors make it tricky for the central bank to decide when to raise interest rates. If rising prices driven by cost pressures start to weigh on consumer spending, it could hinder the demand-driven inflation the Bank of Japan aims for before it can consider scaling back its stimulus measures.

Sanae Takaichi, a potential successor to Japanese Prime Minister Fumio Kishida, has suggested that the BoJ should avoid raising interest rates further, as it could dampen consumer sentiment and hinder capital expenditure.

From the BoJ, policymaker Naoki Tamura believed that the central bank must increase interest rates to at least 1% by the second half of the next fiscal year, highlighting the bank's commitment to steady monetary tightening. In addition, board member Junko Nakagawa argued that the BoJ would continue raising interest rates if inflation aligns with its forecast, but emphasized the need to consider market movements' effects on the broader economic and price outlook before deciding to increase rates. Furthermore, his colleague Hajime Takata cautioned that interest rate hikes should be cautious to avoid significant harm to businesses.

In the meantime, it is worth recalling that BoJ Governor Kazuo Ueda spoke before the Japanese Parliament in late August. In his testimony, he reaffirmed his commitment to raising interest rates if inflation continues to move toward the 2% target, indicating that recent market volatility would not disrupt the BoJ’s long-term plan for rate hikes. However, Ueda cautioned that markets remain unstable, which could influence the central bank’s inflation forecasts.

Ueda’s comments suggested that the central bank might take longer than initially anticipated to decide on its next rate hike, but remained on track to gradually raise borrowing costs from the current ultra-low levels.

According to a Reuters poll published last week, economists unanimously agreed that the BoJ will not raise interest rates at its September policy meeting, though a majority still anticipated an increase at some point by year-end.

As we get closer to the interest rate decision, analysts at Standard Chartered Global Research noted: “We now expect the Bank of Japan (BoJ) to hike the base rate by 25 bps in December (from 15 bps in Q2 and 10 bps in Q3-2025 prior) to 0.50% by end-2024 (0.25% prior) on stronger-than-expected inflation that has stayed above its 2% target for the past 21 months. Wages grew in real terms in June for the first time since March 2022, adding to concerns over demand-side inflation. The BoJ may hike earlier to avoid losing an opportunity to normalise policy before dovish pressures kick in from possible Fed rate cuts of 75 bps by end-2024, risk of a global recession, and China’s slowdown.”

How could the Bank of Japan interest rate decision affect USD/JPY?

The BoJ is largely expected to refrain from acting on the policy rate. However, Governor Ueda is seen sticking to his hawkish narrative, leaving the door open to the continuation of the “normalization” of the monetary policy in the next few months.

A glimpse at the broader picture shows that Fed-BoJ policy divergence remains at center stage. Following the recent 50 basis points rate cut by the Federal Reserve (Fed) in September and prospects of an additional 50 basis points of easing in the latter part of the year, a further downside in USD/JPY does appear as the most favourable scenario for the time being.

Looking at the techs surrounding USD/JPY, Senior Analyst at FXStreet Pablo Piovano suggests that “the resumption of the bid bias in the Japanese yen carries the potential to drag the pair to its 2024 bottom of 139.57 (September 16). A deeper retracement could see the spot revisit the July 2023 low of 137.23 (July 14) ahead of the March 2023 low of 129.63 (March 24)”.

On the upside, “there are initial barriers at the September peak of 147.20 (September 3), and the weekly high of 149.39 (August 15)”, Pablo adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Last release: Wed Jul 31, 2024 03:55

Frequency: Irregular

Actual: 0.15%

Consensus: 0%

Previous: 0%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.