Eurozone Inflation Preview: Price pressures expected to ease after May bounce

- Eurostat will release crucial European inflation data on Tuesday.

- Headline inflation is expected to recede in June.

- Uncertainty prevails regarding future rate cuts by the ECB.

The Harmonized Index of Consumer Prices (HICP), a key indicator of inflation in the broader euro bloc, is scheduled for release on Tuesday, July 2. The European Central Bank (ECB) will closely scrutinize this data amid persistent uncertainty about the continuation of its easing cycle that started at the June 6 event.

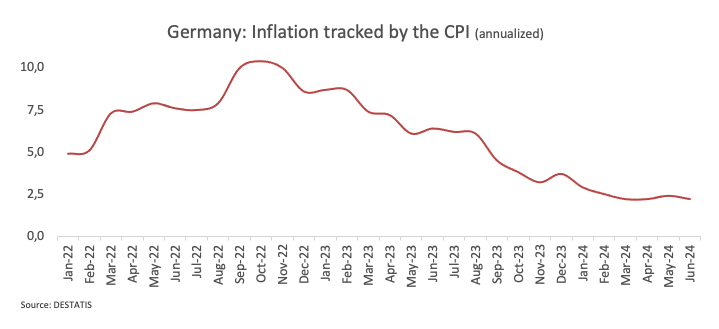

Since December 2023, the Consumer Price Index (CPI) in the euro area has gradually declined, with the exception of the May 2024 hiccup.

At the latest ECB meeting, where the central bank trimmed its policy rate by 25 bps for the first time since 2019, the bank revised its economic growth and inflation forecasts upward, predicting that price growth will return to its 2% target later than previously expected. On this, inflation is now projected to be 2.2% next year, exceeding the earlier forecast of 2.0%, and is anticipated to reach the target only by 2026. This suggests that achieving the "last mile" to the target may be more challenging than initially hoped.

At that gathering, ECB President Christine Lagarde acknowledged progress in the bank’s fight against high inflation, but she also indicated that the battle is not yet over, as inflation is expected to remain elevated until next year.

What can we expect in the next European inflation report?

Reflecting similar inflation trends in other G10 countries, economists generally predict that headline HICP inflation will decrease a tad to 2.5% over the last twelve months to June, down from the 2.6% rate in May. The core measure, which strips food and energy costs, is expected to rise by 2.8% compared to the previous year, following a 2.9% increase in the prior month.

Somewhat bolstering this expected downtick in consumer prices, Germany's preliminary headline Consumer Price Index (CPI) rose by 2.2% from a year earlier in June, down from a 2.4% increase in the previous month.

Returning to the ECB, the bank released its Consumer Expectations Survey for May on June 28, revealing that consumers in the region have lowered their inflation expectations. Expectations for inflation over the next 12 months decreased to 2.8% from 2.9% in April. Similarly, expectations for inflation three years ahead fell to 2.3% from 2.4%, though they remain above the bank’s 2% target.

When will the HICP report be released, and how could it affect EUR/USD?

The Eurozone's preliminary HICP is scheduled to be released at 09:00 GMT on Tuesday, July 2. As this highly anticipated inflation data approaches, the Euro (EUR) is struggling to leave behind the area of recent lows near 1.0660 against the US Dollar (USD) on a convincing note, with investors still looking at the Fed-ECB policy divergence and the hawkish narrative from the majority of Fed officials as the exclusive drivers of the pair’s decline since June peaks north of 1.0900 the figure.

Pablo Piovano, Senior Analyst at FXStreet, notes, "In case the bullish sentiment kicks in, EUR/USD is expected to face initial resistance at the key 200-day SMA of 1.0790. The surpass of this region on a sustainable basis carries the potential to open the door to the continuation of the bull run until the June high of 1.0916 (June 4) prior to the March top at 1.0981 (March 8)".

Pablo adds, "On the other hand, if the selling pressure accelerates, spot might once again challenge the June low of 1.0666 (June 26) ahead of the May low of 1.0649 (May 1). A deeper pullback could then see the 2024 bottom of 1.0601 (April 16) revisited."

Economic Indicator

Harmonized Index of Consumer Prices (YoY)

The Harmonized Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, released by Eurostat on a monthly basis, is harmonized because the same methodology is used across all member states and their contribution is weighted. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Tue Jul 02, 2024 09:00 (Prel)

Frequency: Monthly

Consensus: 2.5%

Previous: 2.6%

Source: Eurostat

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.