Eurozone Inflation Preview: Price pressures expected to ease further in May

- Eurostat will release crucial European inflation data on Friday.

- Headline inflation is expected to tick higher in May.

- The European Central Bank remains cautious regarding rate cuts.

The Harmonized Index of Consumer Prices (HICP), a broad measure of inflation in the Eurozone, is set to be released on Friday, May 31. The European Central Bank (ECB) will closely analyze this inflation data amidst renewed doubts regarding the potential start of its easing cycle at its June meeting.

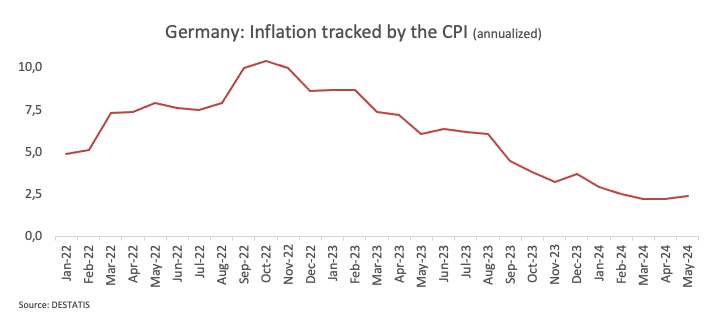

Following a gradual drop of the Consumer Price Index (CPI) in the Euro Area since December 2023, the index seems to have met some decent contention around 2.4% YoY, as per March and April prints.

In her last comments on April 19, ECB President Christine Lagarde argued that Euro Zone inflation is expected to decrease further and that the ECB might reduce interest rates if its long-standing price growth criteria are satisfied.

Lagarde also emphasized that the ECB Governing Council is not committing to a specific rate trajectory, reiterating the bank's latest guidance.

She noted that risks to the inflation outlook are two-sided, citing potential upside risks such as increased geopolitical tensions, higher wage growth, and more resilient profit margins than anticipated.

What can we expect in the next European inflation report?

In line with inflation data observed in other G10 countries, the consensus among economists predicts that Core HICP inflation will increase by 2.8% in the year to May, up from 2.7%, while the headline measure is expected to rise by 2.5% compared to the previous year, from a 2.4% increase seen in the prior month.

Supporting the expected uptick in consumer prices, Germany's preliminary headline Consumer Price Index (CPI) rose by 2.4% over the last twelve months in May, an increase from April’s 2.2% rise.

Back to the ECB, the bank published its Consumer Expectations Survey for the month of April on May 28, where consumers in the region reduced their inflation expectations, coinciding with the bank's plans to begin rolling back a record series of interest rate hikes. Indeed, expectations for inflation over the next 12 months decreased to 2.9% from 3.0% the previous month, reaching their lowest level since September 2021. Meanwhile, expectations for inflation three years out declined to 2.4% from 2.5%, though still significantly above the bank’s 2% target.

When will the HICP report be released, and how could it affect EUR/USD?

The Eurozone's preliminary HICP is scheduled to be released at 09:00 GMT on Friday. As this highly anticipated inflation data approaches, the Euro (EUR) is struggling to stay above the significant level of 1.0800 against the US Dollar (USD) in a sustainable fashion, with investors weighing the possibility of the Federal Reserve (Fed) beginning its easing cycle at some point towards year end.

Pablo Piovano, Senior Analyst at FXStreet, notes, "In case the bullish sentiment kicks in, EUR/USD is expected to face initial resistance at monthly peaks near the 1.0900 barrier. The surpass of this region in a convincing mood should allow for a potential move to the March top at 1.0981 (March 8)".

Pablo adds, "On the other hand, if the selling pressure accelerates, spot might confront the key 200-day SMA at 1.0787 ahead of the May low of 1.0649 (May 1). A deeper pullback could then see the 2024 bottom of 1.0601 (April 16)."

Economic Indicator

Harmonized Index of Consumer Prices (MoM)

The Harmonized Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, released by Eurostat on a monthly basis, is harmonized because the same methodology is used across all member states and their contribution is weighted. The MoM figure compares the prices of goods in the reference month to the previous month. Generally, a high reading is seen as bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Fri May 31, 2024 09:00 (Prel)

Frequency: Monthly

Consensus: -

Previous: 0.6%

Source: Eurostat

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.