Ripple Price Forecast: XRP eyes 16% surge, but tapering open interest paints a grim picture

- XRP rises slightly amid broad consolidation above $3.00 ahead of the Fed’s decision on interest rates.

- A sharp decline in derivatives market Open Interest hints at the changing market dynamics amid risk-off sentiment.

- XRP’s technical structure offers mixed signals: the MACD indicator falling while the RSI steadies above the 50 midline.

Ripple (XRP) price is choppy, trading broadly sideways on Tuesday with support at $3.00 and short-term resistance at $3.20. Several attempts to erase the 16% decline from the token’s record high of $3.66 have been subdued amid increasing selling pressure and fading bullish momentum.

XRP recovery stalls amid open interest slump

The correction from the all-time high, achieved on July 18, can be attributed to crypto prices taking a breather last week when Bitcoin (BTC) price dropped slightly below $115,000.

Other factors that may have contributed to the sell-off, which saw XRP price slide to $2.95 support, include possible profit-taking activities and a shift in market sentiment, especially with key United States (US) macroeconomic data release expected this week.

The US Federal Reserve (Fed) will make its decision on interest rates on Wednesday. While expectations are that the Federal Open Market Committee (FOMC) meeting will leave interest rates unchanged in the range of 4.25% to 4.50%, Fed Chair Jerome Powell’s speech will provide key insights into the central bank’s policy direction.

Still, this week, President Donald Trump’s reciprocal tariffs are expected to take effect on Friday — an event that could trigger volatility, which could explain the drop in interest in the broader cryptocurrency market.

“Trump’s August 1 tariff deadline, the FOMC meeting, and key U.S. employment data suggest a potentially volatile week for markets,” K33 Research highlighted.

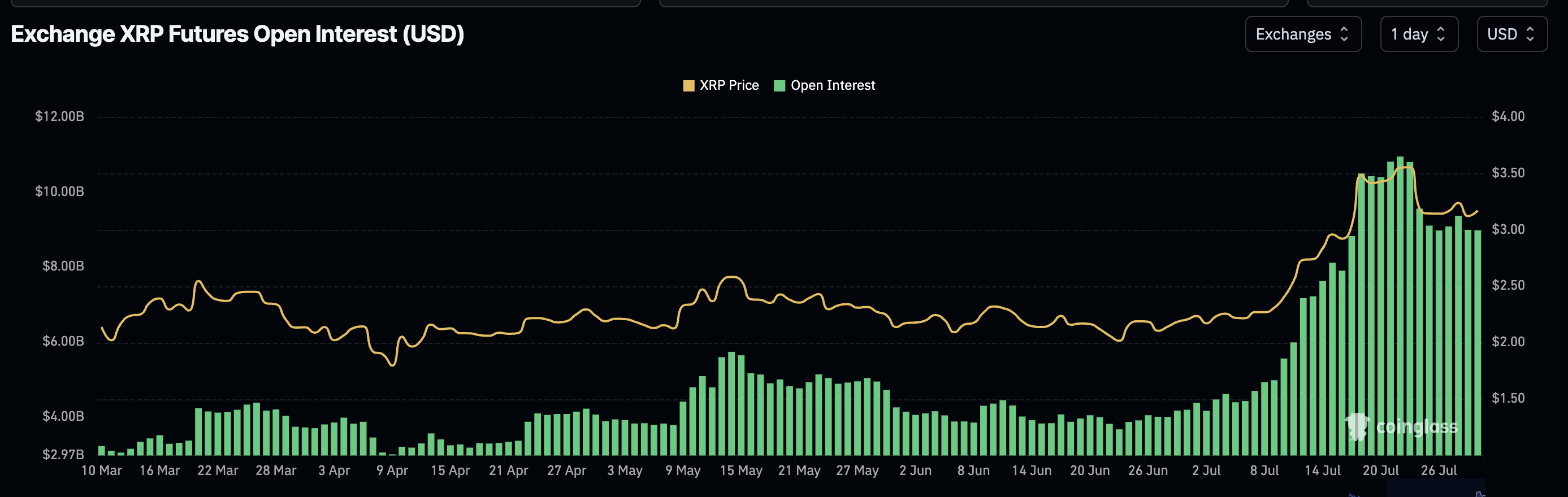

The sideways price action observed with XRP in the last few days mirrors a noticeable drop in the futures market Open Interest (OI). After peaking at $10.94 billion on July 22, the chart below shows a persistent decline, averaging around $8.97 on Tuesday.

OI represents the notional value of outstanding futures or options contracts, with a decline in the indicator suggesting that trader conviction in the uptrend is faltering amid reduced leveraged bets on the price of XRP increasing in the short term.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP technical indicators offer mixed signals

XRP bulls are walking on eggshells, with the price action capped under resistance at $3.20 while downside risks mount. The Moving Average Convergence Divergence (MACD) indicator confirmed a sell signal on Thursday when the blue line crossed below the red signal line.

Investors often consider reducing their exposure after identifying this signal, currently accentuated by the red histogram bars below the zero line.

Although the Relative Strength Index shows signs of stabilizing after falling from its overbought peak of 88, the overall trend is downward. In case the RSI extends the decline below the midline, indicating a reduction in buying pressure, the sell-off may continue below the short-term support range between $2.95 and $3.00.

XRP/USDT daily chart

The 50-day Exponential Moving Average (EMA) at $2.74 and the 100-day EMA at $2.53 could absorb the selling pressure, preventing the price from accelerating below the $2.50 level. On the flip side, the potential breach of resistance at $3.20 could bolster the uptrend toward the record high and perhaps the next key milestone at $4.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.