US Dollar whipsaws with China retaliating against Trump and tariffs on Canada and Mexico delayed

- The US Dollar whipsaws across the board in major crosses against other currencies.

- US President Trump pauses Mexico and Canada tariffs while China retaliates.

- The US Dollar Index (DXY) tries to hold ground above 108.00 while looking for direction through tariff headlines.

The US Dollar Index (DXY), which tracks the performance of the US Dollar against six major currencies, is having a tough Tuesday, hitting 109.00 before falling back to the lower 108.37 level. The DXY trades around 108.50 at the time of writing. Markets are reacting to a mixture of headlines with a sigh of relief from Mexico and Canada, which saw the imposition of US tariffs delayed. Meanwhile, China has retaliated against US President Trump’s tariffs by issuing its own levies over US imported goods.

The economic data calendar is taking its shape in the runup towards Friday’s Nonfarm Payrolls data. The US JOLTS Job Openings report will be released later in the day and could give more insights into the tightness of the labor market. In addition, two Federal Reserve (Fed) speakers, Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly, will speak and might leave comments for markets to consider.

Daily digest market movers: Tariff fog

- China has announced this Tuesday a 15% levy on less than $5 billion in US energy imports, such as Coal and Liquified Natural Gas (LNG), and a 10% fee on American Oil and agricultural equipment, and it will also investigate Google for alleged antitrust violations, Bloomberg reports. Meanwhile, Canada and Mexico are seeing US-imposed tariffs being delayed thanks to their actions to comply with US President Donald Trump.

- At 15:00 GMT, the monthly Factory Orders for December are due. Expectations are for a further decline of -0.7% from -0.4% in the previous month.

- At the same time, the TechnoMetrica Institute of Policy and Politics (TIPP) will release its monthly Economic Optimism reading for February. The consensus is for an uptick to 53, coming from 51.9.

- The US JOLTS Job Openings for December will be released as well. A small decrease to 8 million job openings is expected, down from 8.098 million in November.

- The Federal Reserve has two speakers lined up as well:

- Atlanta Fed President Raphael Bostic moderates a conversation with Atlanta Mayor Andre Dickens at a National Housing Crisis Task Force meeting at Atlanta at 16:00 GMT.

- San Francisco Fed President Mary Daly will participate in the Walter E. Hoadley Annual Economic Forecast panel, hosted by the Commonwealth Club World Affairs of California at 19:00 GMT.

- Equities are in the red, unable to find a clear direction, having difficulties to digest the string of tariff headlines.

- The CME FedWatch tool projects an 86.5% chance of keeping interest rates unchanged in the Fed’s next meeting on March 19.

- The US 10-year yield is trading around 4.575%, up from its fresh yearly low at 4.46% seen Monday.

US Dollar Index Technical Analysis: Moves and counter-moves

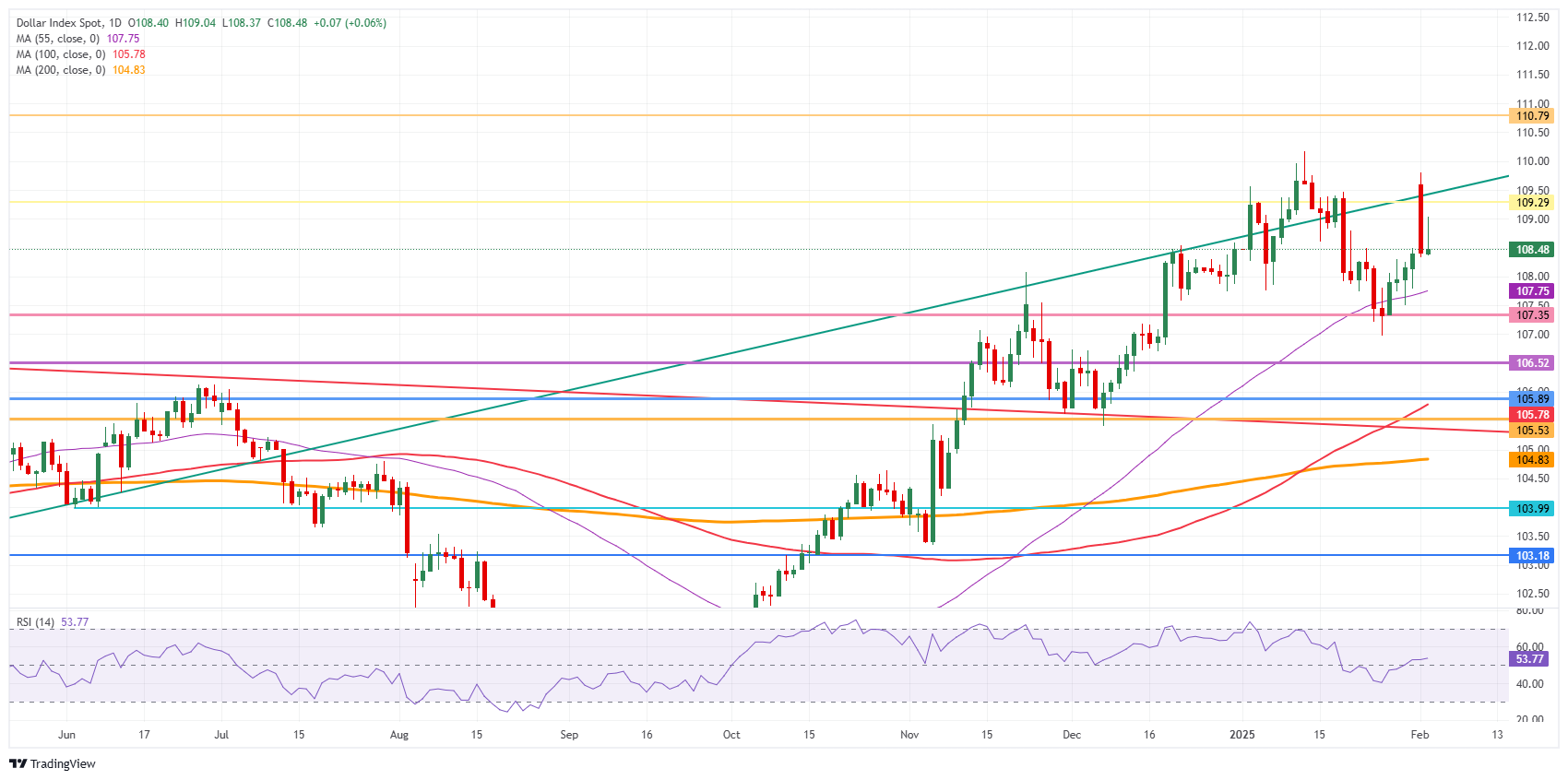

The US Dollar Index (DXY) is all over the place, though zooming out, actually going nowhere. A range is defined as 107.00 on the downside and 110.00 on the upside. Expect to see the DXY keeping range trading between these two bigger levels for now.

On the upside, the first barrier at 109.30 (July 14, 2022, high and rising trendline) was briefly surpassed but did not hold on Monday. Once that level is reclaimed, the next level to hit before advancing further remains at 110.79 (September 7, 2022, high).

On the downside, the 55-day Simple Moving Average (SMA) at 107.75 and the October 3, 2023, high at 107.35 acts as a double support to the DXY price. For now, that looks to be holding, though the Relative Strength Index (RSI) still has some room for the downside. Hence, look for 106.52 or even 105.89 as better levels.

US Dollar Index: Daily Chart

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.