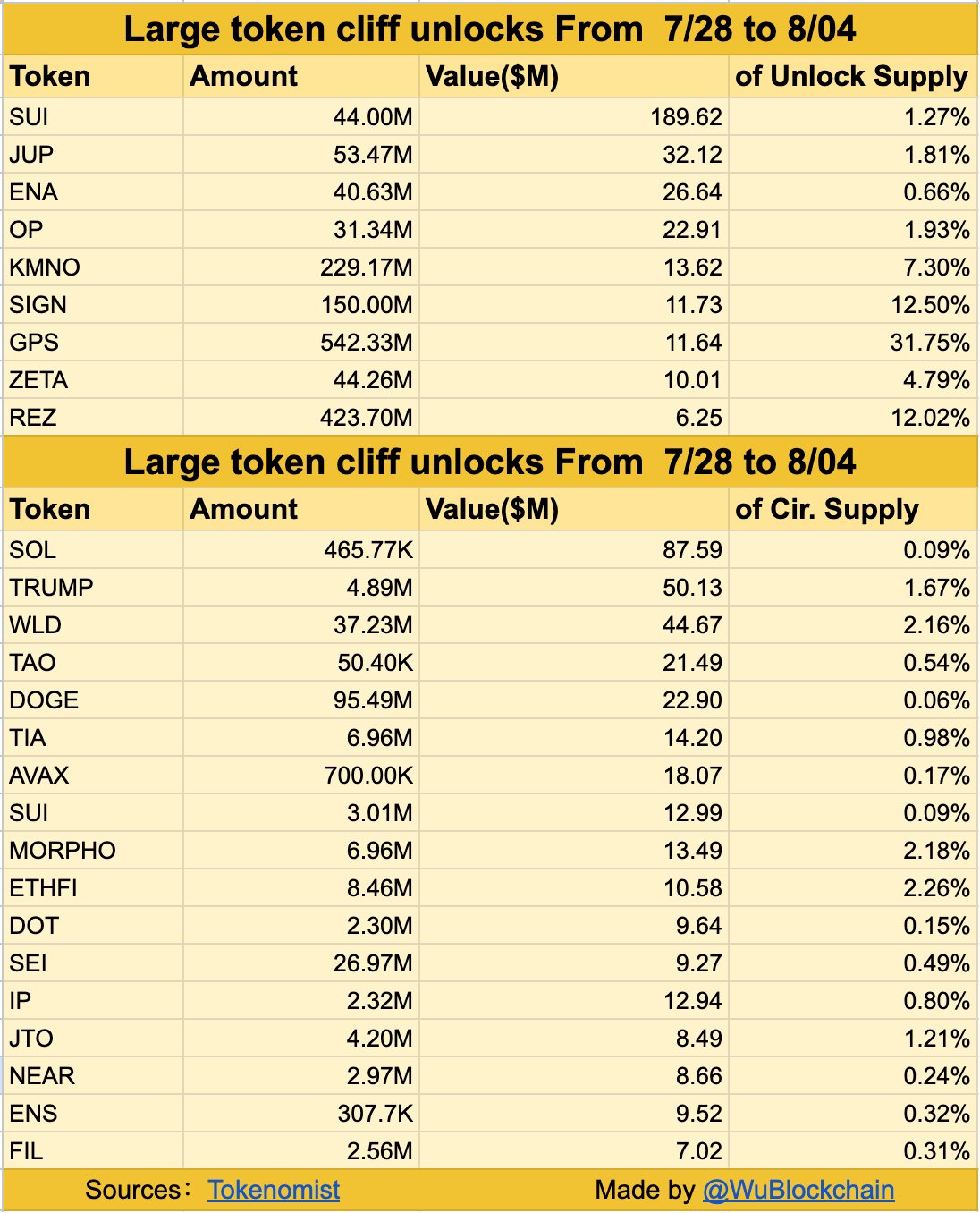

SUI leads with 44 million tokens worth $189.62 million affecting 1.27% of unlock supply

SUI and Jupiter lead $686 million token unlocks scheduled for this week. Major cliff unlocks include SUI, JUP, ENA, OP, KMNO, SIGN, GPS, ZETA, and REZ tokens.

Linear unlocks continue for SOL, WLD, TIA, DOGE, and other cryptocurrencies daily. The combined unlock value creates substantial supply pressure across multiple projects.

According to Tokenomist data, SUI leads all cliff unlocks with 44 million tokens scheduled for release this week. The unlock carries $189.62 million value affecting 1.27% of unlock supply across markets. This marks the largest single token unlock by dollar value.

Jupiter follows with 53.47 million JUP tokens worth $32.12 million unlocking during the period. The release impacts 1.81% of unlock supply for the Solana-based project. ENA unlocks 40.63 million tokens valued at $26.64 million affecting 0.66% supply.

Optimism releases 31.34 million OP tokens worth $22.91 million impacting 1.93% circulation. KMNO unlocks 229.17 million tokens valued at $13.62 million affecting 7.30% supply. SIGN releases 150 million tokens worth $11.73 million impacting 12.50% supply.

GPS unlocks 542.33 million tokens valued at $11.64 million affecting 31.75% supply. ZETA releases 44.26 million tokens worth $10.01 million impacting 4.79% circulation. REZ unlocks 423.70 million tokens valued at $6.25 million affecting 12.02% supply.

Delabs Games shows 0.00% unlock progress with 750.3M DELABS tokens in circulation. The next unlock releases 750.3M DELABS tokens worth $0.00 accounting for 25.01% locked. Renzo displays 36.87% unlock progress with 3.27B REZ tokens circulating currently.

MilkyWay maintains 21.11% unlock progress with 238.9M MILK tokens in circulation. GoGoPool shows 26.43% unlock progress with 187.97K GGP tokens circulating. Treehouse displays 0.00% unlock progress with 156.12M TREE tokens available.

Linear unlocks maintain steady daily releases

Solana leads linear unlocks with 465.77K SOL tokens releasing daily worth $87.59 million. The continuous release affects 0.09% of the circulating supply, creating predictable pressure. SOL maintains the highest weekly unlock value among linear distributions.

TRUMP token releases 4.89 million tokens daily valued at $50.13 million weekly. The unlock impacts 1.67% of circulating supply through automated distributions consistently. Worldcoin unlocks 37.23 million WLD tokens daily worth $44.67 million.

Bittensor releases 50.40K TAO tokens daily valued at $21.49 million weekly. Dogecoin unlocks 95.49 million DOGE tokens daily worth $22.90 million affecting circulation. Celestia releases 6.96 million TIA tokens daily valued at $14.20 million.

Avalanche unlocks 700K AVAX tokens daily worth $18.07 million weekly. SUI releases 3.01 million tokens daily valued at $12.99 million affecting supply. Morpho unlocks 6.96 million tokens daily worth $13.49 million impacting 2.18% circulation.

Additional linear unlocks include ETHFI, DOT, SEI, IP, JTO, and NEAR tokens. These daily releases range from $8.49 million to $12.94 million weekly values. ENS and FIL complete the linear unlock schedule with smaller amounts.

Linear unlocks provide predictable supply increases compared to cliff events entirely. The combined releases maintain steady token distribution across multiple projects. Daily unlocks create consistent market pressure for participants to monitor carefully. Total weekly linear unlock value exceeds $400 million across all cryptocurrencies.

Less popular unlocks

As per CoinMarketCap data, Renzo shows 36.87% unlock progress with 3.27B REZ tokens currently in circulation. The next unlock releases 423.7M REZ tokens worth $6.31 million in total value. This accounts for 4.24% of total locked tokens scheduled for distribution.

MilkyWay displays 21.11% unlock progress with 238.9M MILK tokens circulating currently. The upcoming unlock distributes 32.19M MILK tokens valued at $1.62M. This affects 2.68% of total locked token supply for the project.

GoGoPool maintains 26.43% unlock progress with 187.97K GGP tokens in circulation. The next release unlocks 719,625 GGP tokens worth $1.22M total. This impacts 3.20% of total locked supply for future distribution.

Delabs Games and Treehouse both show 0.00% unlock progress indicating early stages. Delabs holds 750.3M DELABS tokens with 750.3M scheduled for release. Treehouse maintains 156.12M TREE tokens with 355M tokens locked entirely.

Lower unlock progress percentages shows projects face larger future unlock events. Higher progress levels show most tokens already distributed to markets. The varying stages create different supply pressure timelines across projects.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites