Dogecoin Price Forecast: DOGE could drop 13% amid suppressed network activity

- Dogecoin extends decline from recent highs by 23%, triggering $53 million worth of liquidations.

- Dogecoin’s active addresses hold significantly below the levels seen in June and May, suggesting a lack of adoption and demand catalysts.

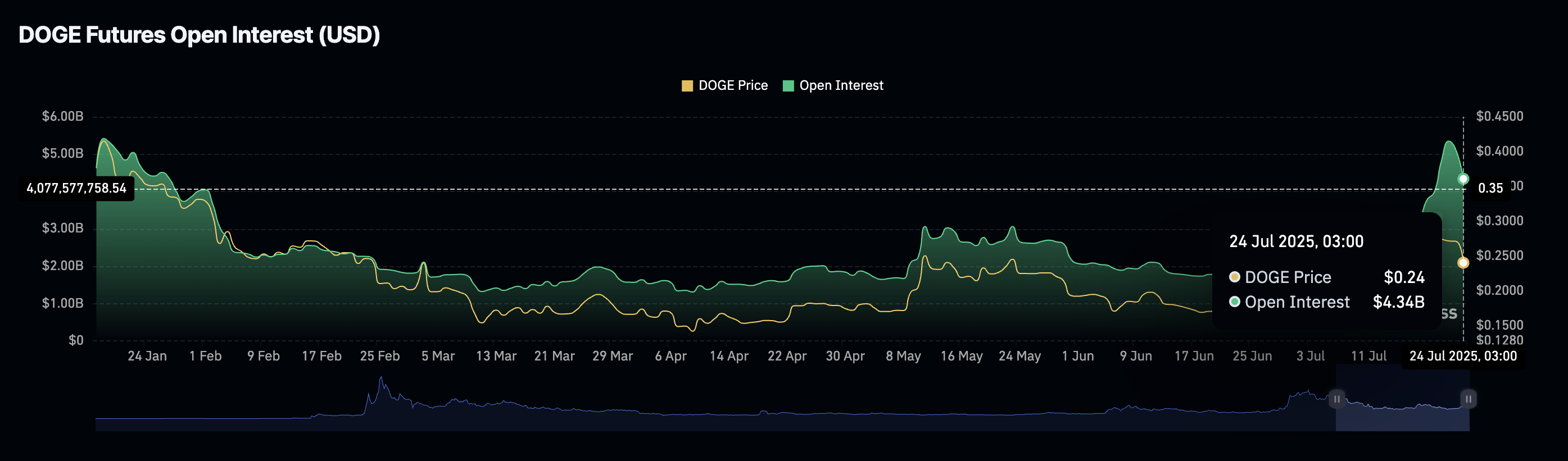

- A slump in the futures Open Interest to $4.34 billion from $5.35 billion hints at declining interest and confidence in DOGE.

Dogecoin (DOGE) price is attempting recovery on Thursday after dropping nearly 23% from its recent high of $0.2873, and testing $0.2219 as support. The leading meme coin by market capitalization exchanges hands at around $0.2372 at the time of writing, marking a decline of more than 1.5% on the day.

DOGE’s short-term outlook appears bearish, as indicated on the 4-hour chart below. This could be an extension of weakening sentiment in the derivatives market, which has seen the futures Open Interest (OI) begin to shrink.

Dogecoin faces headwinds as network activity slows

Dogecoin is facing headwinds from both micro and fundamental aspects, which could prevent the price from extending the recent upswing to $0.2873. According to Sentiment, interest in DOGE has not increased despite the recent 84% surge in price from the July 1 low of $0.1568.

The Daily Active Addresses metric below highlights suppressed network activity, with the number of users actively interacting with the protocol averaging significantly below the levels seen at the peaks in June and May.

Approximately 70,000 addresses interacted with the network, sending and receiving DOGE on Tuesday compared to peaks of 517,000 and 675,000 in June and May, respectively. In other words, despite the recent price increase of Dogecoin, interaction and bullish speculation remain subdued compared to previous months. If this metric remains at current levels, it would not be easy for the DOGE price to sustain its uptrend.

[14-1753359292908.08.58, 24 Jul, 2025].png)

Dogecoin Daily Active Addresses stats | Source: Santiment

The drop in price over the last 24 hours mirrors a significant decline in the Dogecoin futures contracts’ Open Interest, which averaged $4.34 billion at the time of writing, after peaking at $5.35 billion on Tuesday.

OI refers to the total number of outstanding Dogecoin futures or options contracts in the market. Notably, it measures the amount of money invested in DOGE derivatives at any given time. A slump in this fundamental metric indicates declining interest in the token; hence, demand slows, resulting in the price falling or lacking bullish momentum.

Dogecoin Futures Open Interest | Source: CoinGlass

The slump in price triggered a surge in liquidations in the derivatives market, with $53 million being wiped out over the past 24 hours. Long position holders accounted for the lion’s share of the liquidations, at 85% or $45 million, compared to around $7.8 million in shorts.

If the decline persists, a long squeeze could keep the DOGE price suppressed near the support tested at $0.2219 or even extend the down leg to almost 13% to the next tentative support at $0.2064.

Dogecoin derivatives market data | Source: CoinGlass

Technical outlook: Dogecoin offers bearish signals

Dogecoin price flaunts a short-term sell signal, triggered by the Moving Average Convergence Divergence (MACD) indicator on Tuesday on the 4-hour chart. Traders watching the indicator are likely to have started reducing exposure when the blue MACD line crossed and settled below the red signal line.

The red histogram bars below the zero line emphasize that bearish momentum is apparent and cannot be ignored. Meanwhile, two levels stand out for DOGE: the 100-period Exponential Moving Average (EMA), which provides support at $0.2244, and the 50-day EMA, serving as resistance at $0.2428.

A break to either side of this range could provide insight into the direction Dogecoin's price could sustain in upcoming sessions.

DOGE/USDT 4-hour chart

The Relative Strength Index (RSI), which stabilized at 36 before reversing the trend upward to 40, indicates that bullish momentum is building. However, traders must consider the drop from overbought territory at 78, which could still weigh on the meme coin, holding the price closer to the 100-period EMA support at $0.2044.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.