Ethereum, XRP and Solana lead crypto market rally: Is altcoin season here?

- The cryptocurrency market maintained a bullish outlook over the past week, led by major altcoins Ethereum, XRP, and Solana.

- Bitcoin dominance has declined by 6.9% from its current cycle high of 66%, signaling capital rotation toward altcoins.

- The GENIUS Act could accelerate growth in altcoin blockchains that host stablecoins.

The cryptocurrency market is showing early signs of an altcoin season, following a sustained uptrend in top altcoins, including Ethereum (ETH), XRP, and Solana (SOL), over the past week, while Bitcoin (BTC) remained range-bound.

Altcoins get set for altseason as Bitcoin momentum drops

The crypto market maintained its bullish outlook over the past week, led by gains of over 20% across major altcoins, including Ethereum, Solana, and XRP, while Bitcoin saw a mild decline of 2%.

The rally led to a drop in Bitcoin's Dominance over the past week to 59%, a slight decline from its 66% cycle high. The decline suggests that investors may be rotating capital from Bitcoin into top altcoins, suggesting early signs of an altcoin rally.

"Historically, such sustained declines in Bitcoin dominance, especially without a sharp BTC correction, often signal the beginning of altcoin-led phases within broader bull markets," wrote Bitfinex analysts in a note to investors on Monday.

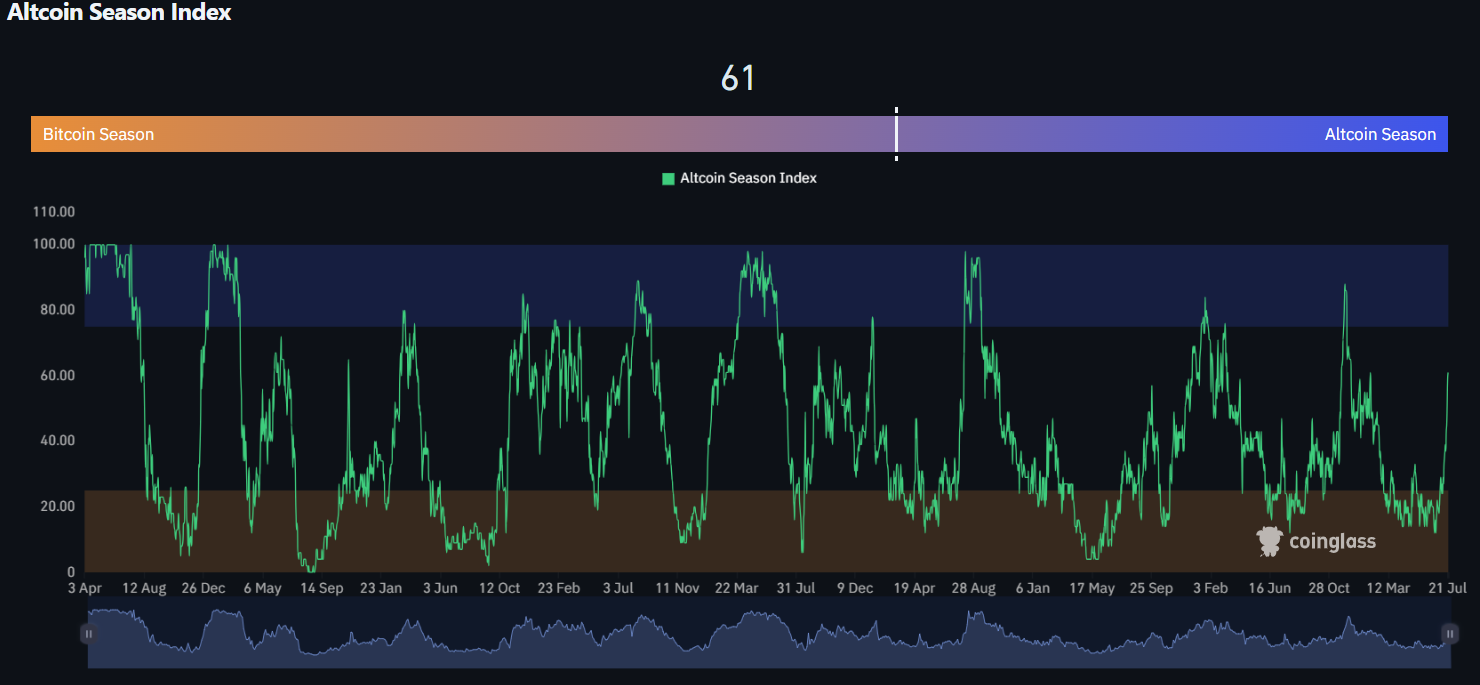

The drop in Bitcoin's dominance followed a rise in the altseason index, which went above 50 for the first time since December.

Altcoin Season Index. Source: Coinglass

The recent surge in altcoins comes amid record inflows into US spot ETH exchange-traded funds (ETFs) and progress in crypto regulation.

Ethereum ETFs saw a record inflow of $2.18 billion last week, beating their previous record of $908 million, according to SoSoValue data. Ethereum's futures Open Interest (OI) also spiked from around $40 billion to more than $57 billion in just a week, indicating a rise in optimism among futures traders, per Coinglass data.

Open Interest refers to the total value of unsettled contracts in a derivatives market.

The strong inflows and OI growth reflect positive momentum surrounding President Trump's signing of the GENIUS bill on Friday, following a successful Crypto Week at the House of Representatives. The new crypto law could benefit native tokens of Layer-1 networks that host stablecoins, according to QCP analysts in a note to investors on Monday.

Alongside progress in crypto regulation, the momentum across top altcoins was further supported by their increased allocation in the corporate treasuries of public companies.

"These Treasuries are looking to ETH and other L1s such as SOL, XRP, and ADA to become what BTC is to the likes of Strategy and Metaplanet," added QCP analysts.

The analysts noted that if the current trend with altcoins persists and is supported by the potential approval of staking within Ethereum ETFs by the Securities & Exchange Commission (SEC), then an alt season may "already be in motion."