Will PI Coin Slip Toward Its All-Time Low This Week? What the Charts Reveal

Readings from the PI/USD daily chart show that the altcoin briefly consolidated between July 1 and 4, facing resistance at $0.50 and support at $0.47.

However, bearish forces gained strength on Friday, pushing the token below its short-lived support range. Since then, PI has trended downward, increasing the likelihood of a retest of its all-time low at $0.40.

PI Sell-Off Deepens as Bullish Momentum Weakens

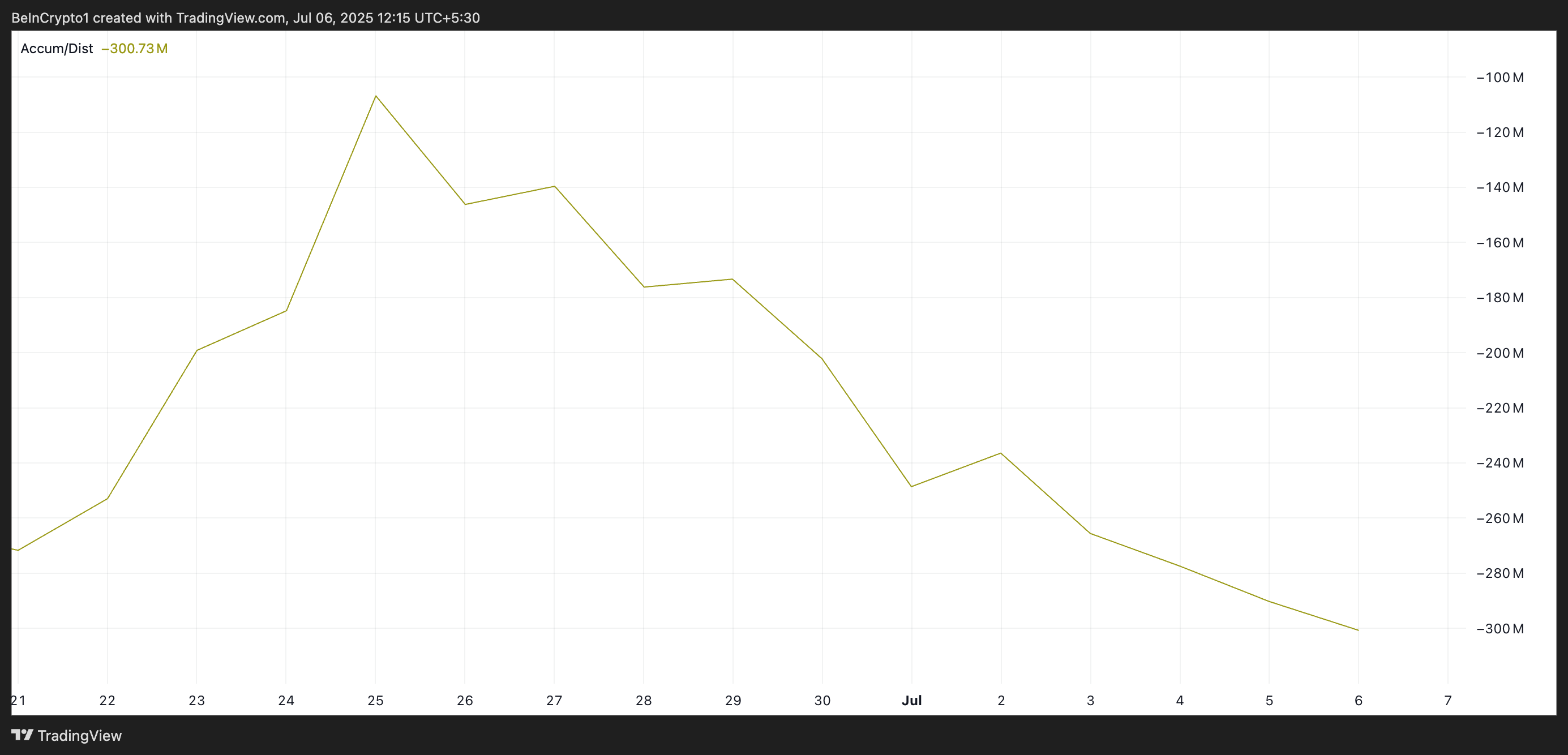

PI’s Accumulation/Distribution (A/D) Line has taken a dive over the past two weeks, signaling a significant drop in buying volume and waning investor confidence. As of this writing, the metric is at -300.73 million, falling 82% since June 25.

PI A/D Line. Source: TradingView

PI A/D Line. Source: TradingView

The A/D line measures an asset’s buying and selling pressure by analyzing its price movements and trading volume. When it climbs, it indicates strong accumulation, meaning buyers are driving demand and pushing prices higher.

On the other hand, as seen with PI, a falling A/D Line suggests that selling pressure outweighs buying interest. It indicates that traders are offloading PI rather than accumulating it, a sign of weakening confidence in the token’s short-term recovery prospects.

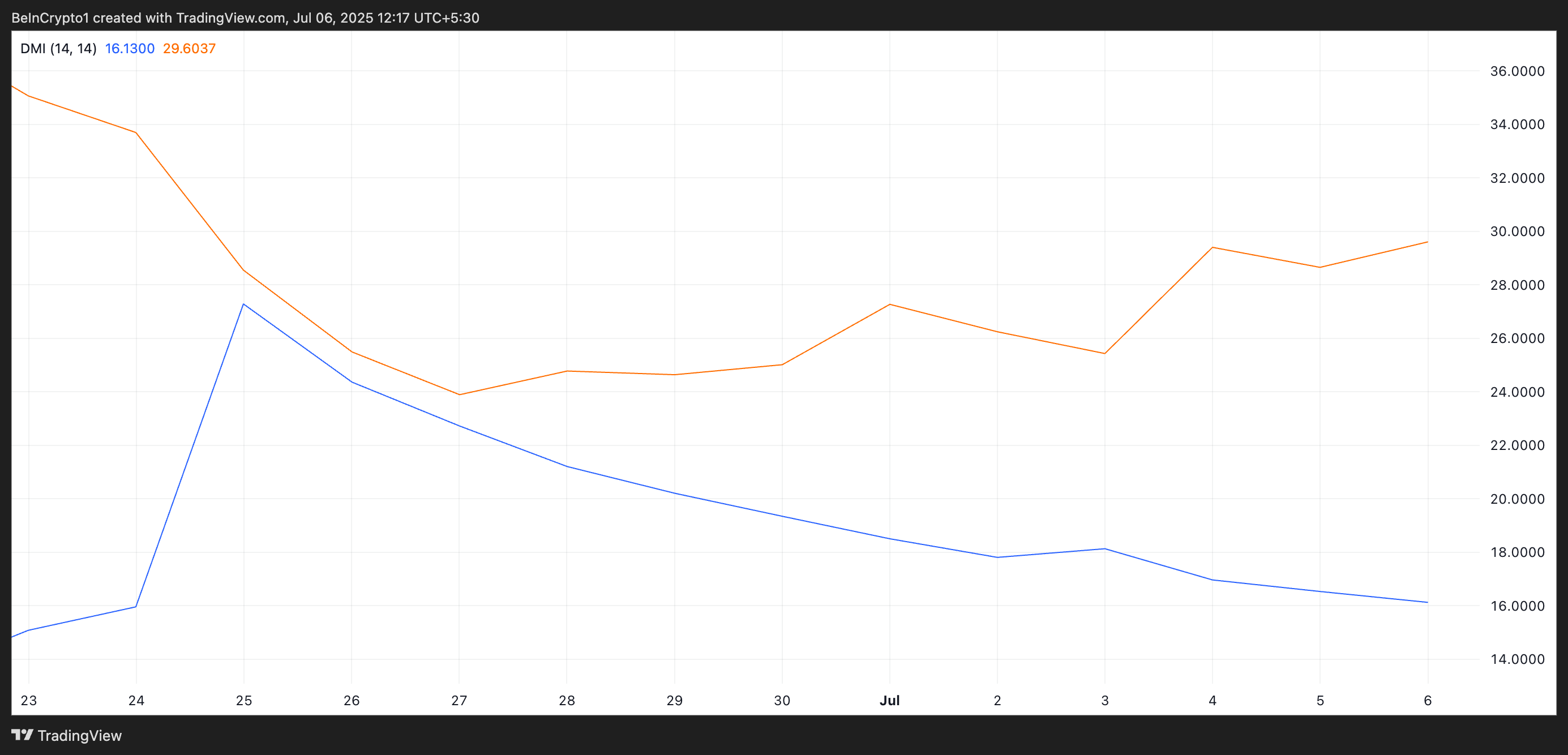

Furthermore, the setup of PI’s Directional Movement Index (DMI) aligns with this bearish narrative. The token’s positive directional index (+DI, blue) currently rests below the negative directional index (-DI, orange), showing a strengthening negative trend.

PI DMI. Source: TradingView

PI DMI. Source: TradingView

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which means downward price movement.

The market trend is bullish when the +DI rests above the -DI. This means that buy-side pressure is dominant, and the asset is in an uptrend.

Conversely, when the +DI lies under the -DI, the downward price movement is strong. This is a bearish sign, indicating that PI sellers have more control over the market than buyers.

Sellers Dominate PI Market, but Buyers Could Flip the Script

At press time, PI trades at $0.44, with its next major support level at its all-time low of $0.40. With sellers remaining firmly in control and building bearish momentum, a revisit to this price low is possible.

PI Price Analysis. Source: TradingView

PI Price Analysis. Source: TradingView

However, a resurgence in buyer demand could invalidate this bearish outlook. In that scenario, the PI coin price could rebound, break above the new resistance at $0.47, and climb toward $0.50.