XRP Down 3% After SEC Settlement Stalls, But Social Media Turns Bullish

A federal judge has rejected Ripple and the SEC’s proposed $50 million settlement, but social media sentiment around XRP has turned bullish anyway.

Ripple-SEC Settlement Stalled After Court Rejection

The Ripple-SEC case seemed to be moving forward after both parties agreed on a reduced $50 million settlement, but the joint motion for an indicative ruling has now been rejected in court.

According to the filing shared by defense lawyer James K. Filian in an X post, the two haven’t “come close” to showing exceptional circumstances outweighing public interest or the administration of justice that would justify modifying the judgment. This means that the original fine of $125 million still stands for Ripple.

Following the news, XRP has taken a bearish hit to its price, as the below chart displays.

The asset was trading around $2.15 at the time the news broke out, but it has since fallen below $2.09, implying a decrease of around 3%. Naturally, this reaction is quite mild by the cryptocurrency sector’s standards, but could still suggest some panic selling.

Sentiment among the retail crowd, however, has seen a surprising jump, as per social media data.

XRP Sentiment On Social Media Has Seen A Bullish Jump

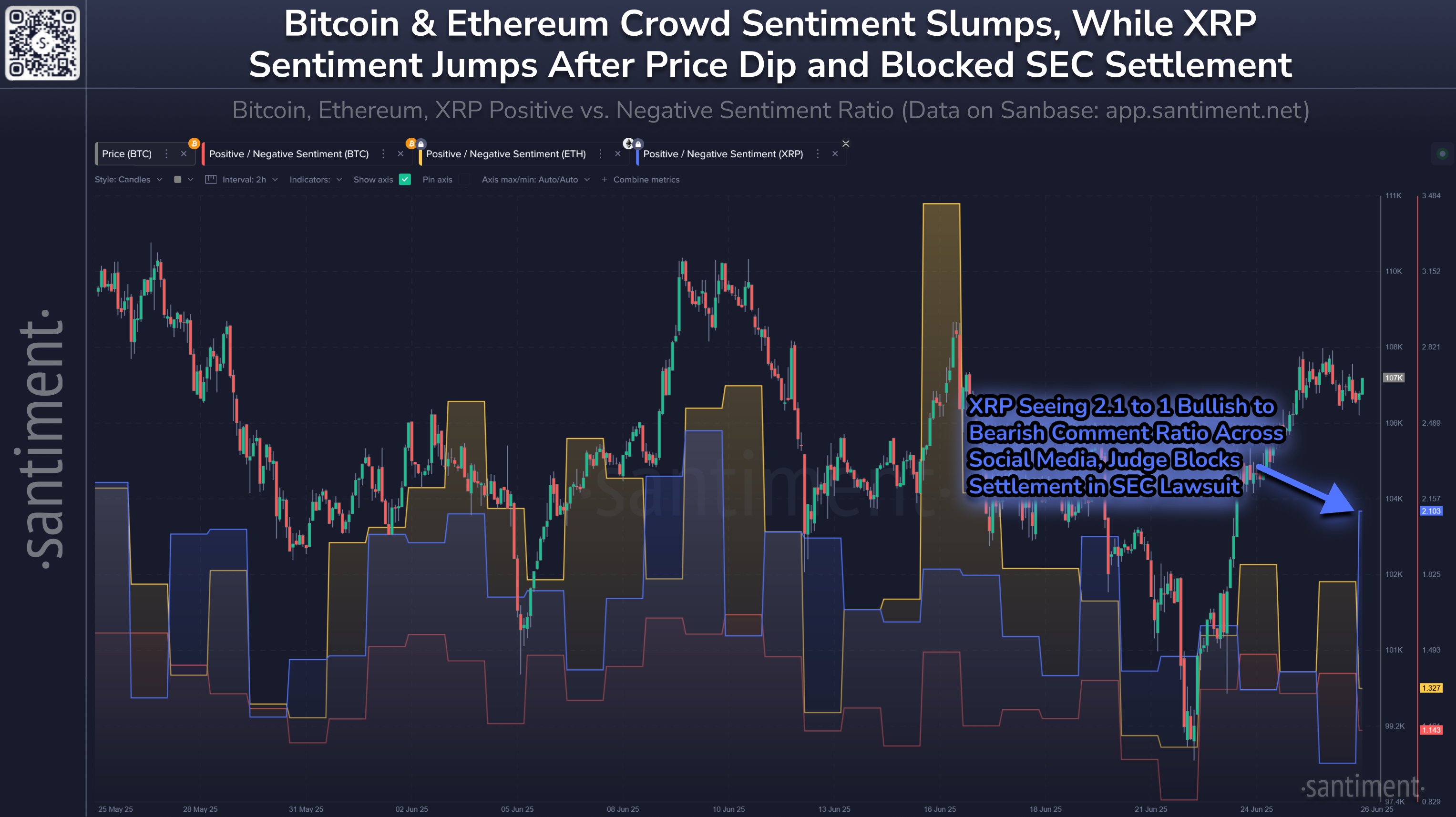

In a new post on X, the analytics firm Santiment has talked about how the social media users have responded to news of the Ripple-SEC case stalling. The indicator shared by Santiment is the “Positive/Negative Sentiment,” gauging the ratio between positive and negative comments involving a given coin on the major social media platforms.

The indicator separates between positive and negative posts/threads/messages on the platforms using a machine-learning model and determines how the counts of the two compare.

Here is a chart that shows the latest trend in the metric for Bitcoin, Ethereum, and XRP:

As displayed in the above graph, the Positive/Negative Sentiment is currently above the 1 mark for all three of these cryptocurrencies, indicating that posts pertaining to bullish sentiment outweigh the bearish ones.

For Bitcoin and Ethereum, however, the positive comments only have a slight advantage, meaning that while optimism does exist among the crowd, it’s quite mild.

From the chart, it’s visible that XRP has diverged from these assets with a sharp spike, which has taken its Positive/Negative Sentiment to a value of 2.1. This is the highest level for the cryptocurrency in 17 days and corresponds to there being more than double as many bullish calls as bearish ones.

Often, retail sentiment acts as a contrarian signal, with extreme values in either direction leading to some sort of reversal in the price. As such, while this development in crowd mentality could potentially imply investors aren’t worried about the news, the indicator could still be to keep an eye on.