Bitcoin Miners Face Worst Payout In A Year As Revenue Crashes To $34 Million

On-chain data suggests the Bitcoin miners have recently been the most underpaid in around a year, as daily revenue hits a $34 million low.

Bitcoin Miner Revenue Has Observed A Plummet

According to data from the on-chain analytics firm CryptoQuant, the margins of the Bitcoin miners have recently taken a notable hit. Miners earn their revenue through two sources: block subsidy and transaction fees.

The first component, the block subsidy, refers to the reward that these chain validators receive as compensation for adding a block to the chain. The network gives out this reward as a fixed BTC-denominated amount.

Due to the existence of a feature known as the difficulty, miners are only able to add blocks at a more or less fixed rate of time, which adds another constraint to the block subsidy.

If speed and amount are fixed, that leaves only one variable related to this reward: the Bitcoin spot price. Changes in the price directly affect miners’ income from the block subsidy.

The other component of miner revenue, the transaction fees, is connected to the level of activity that BTC is observing. Investors attach these fees to their transfers as a small payment for the validators. In times when the network isn’t handling any notable traffic, senders have little incentive to pay any significant amounts, as chances are that their transfers will go through quickly anyway.

When there is congestion present, however, transactions can get stuck in the mempool for a while. During such periods, investors who want their moves to go through fast have no choice but to outcompete the other users in transfer fees. As such, the total transaction fees being received by the miners tend to spike during times of high activity.

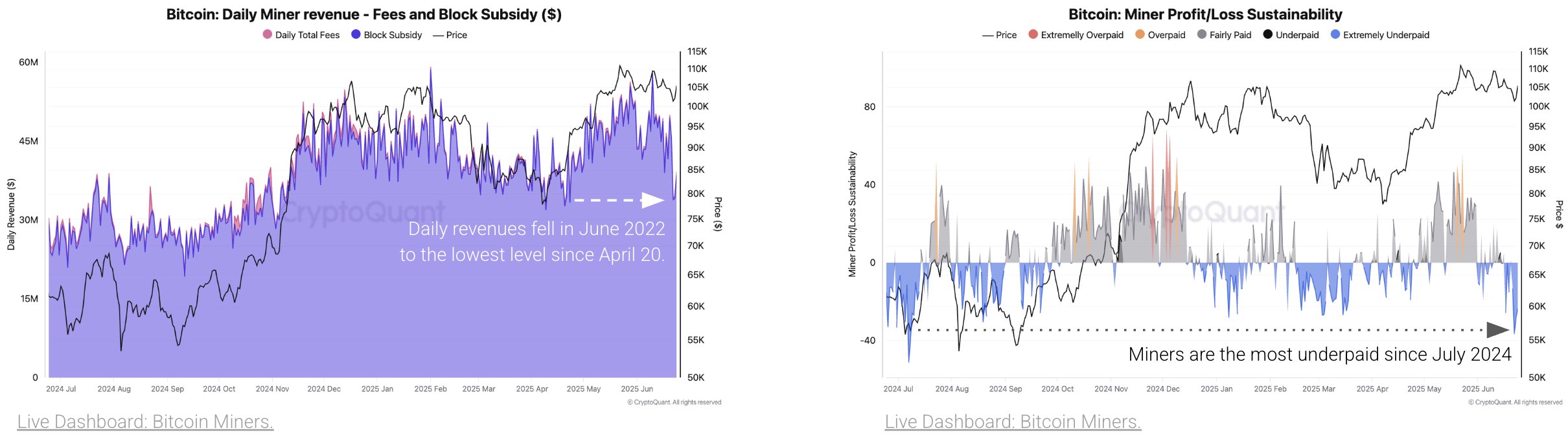

Now, here is the chart shared by CryptoQuant that shows the trend in the two components of Bitcoin miner revenue over the past year:

As displayed in the left graph, the combined daily revenue of the Bitcoin miners has recently gone through a plunge. “Falling fees and Bitcoin’s price drop are crushing margins,” notes the analytics firm.

During the price low earlier, the metric reached a low of $34 million, which is the lowest that its value has been since April 10th. This comparison, however, doesn’t accurately portray how bad the current situation is for the miners.

The chart on the right shows the data of the Miner Profit/Loss Sustainability, a model that compares the miners’ revenue against the difficulty to determine how fairly paid the group is. From the indicator’s trend, it’s apparent that the recent low in mining revenue corresponded to miners being the most underpaid since July 2024.

BTC Price

At the time of writing, Bitcoin is floating around $107,000, up over 2% in the last seven days.