Crypto Today: Bitcoin, Ethereum, XRP weather geopolitical tensions, risk-off sentiment ahead of Fed rate decision

- Bitcoin consolidates below $105,000 amid escalating geopolitical tensions in the Middle East.

- Investors are turning their attention to the Fed's interest rate decision on Wednesday amid growing risk-off sentiment in the derivatives market.

- Institutional interest extends as BTC and ETH spot ETFs post positive inflows for the second consecutive day this week.

- Ethereum and XRP trade sideways above key support areas, signaling indecision ahead of the FOMC meeting.

The cryptocurrency market is broadly consolidating amid ongoing geopolitical tensions in the Middle East. Bitcoin (BTC) mirrors the lethargic sentiment, trading at around $104,572 at the time of writing on Wednesday. Leading altcoins, including Ethereum (ETH) and Ripple (XRP), are trading largely sideways ahead of the Federal Reserve (Fed) interest rate decision, anticipated during the American session.

Market overview: Crypto price action muted ahead of Fed interest rate decision

Cryptocurrencies experienced heightened volatility on Friday following Israel's initial strikes on Iran. Despite the macro headwinds, Bitcoin ticked up, briefly rising above $107,000 on Monday. However, risk-off sentiment has left traders undecided ahead of the Federal Open Market Committee (FOMC) meeting on Wednesday.

"The upcoming FOMC meeting on Wednesday stands as this week's focal macro event, with traders watching closely for the updated dot plot for clues on rate trajectories," a K33 Research report states.

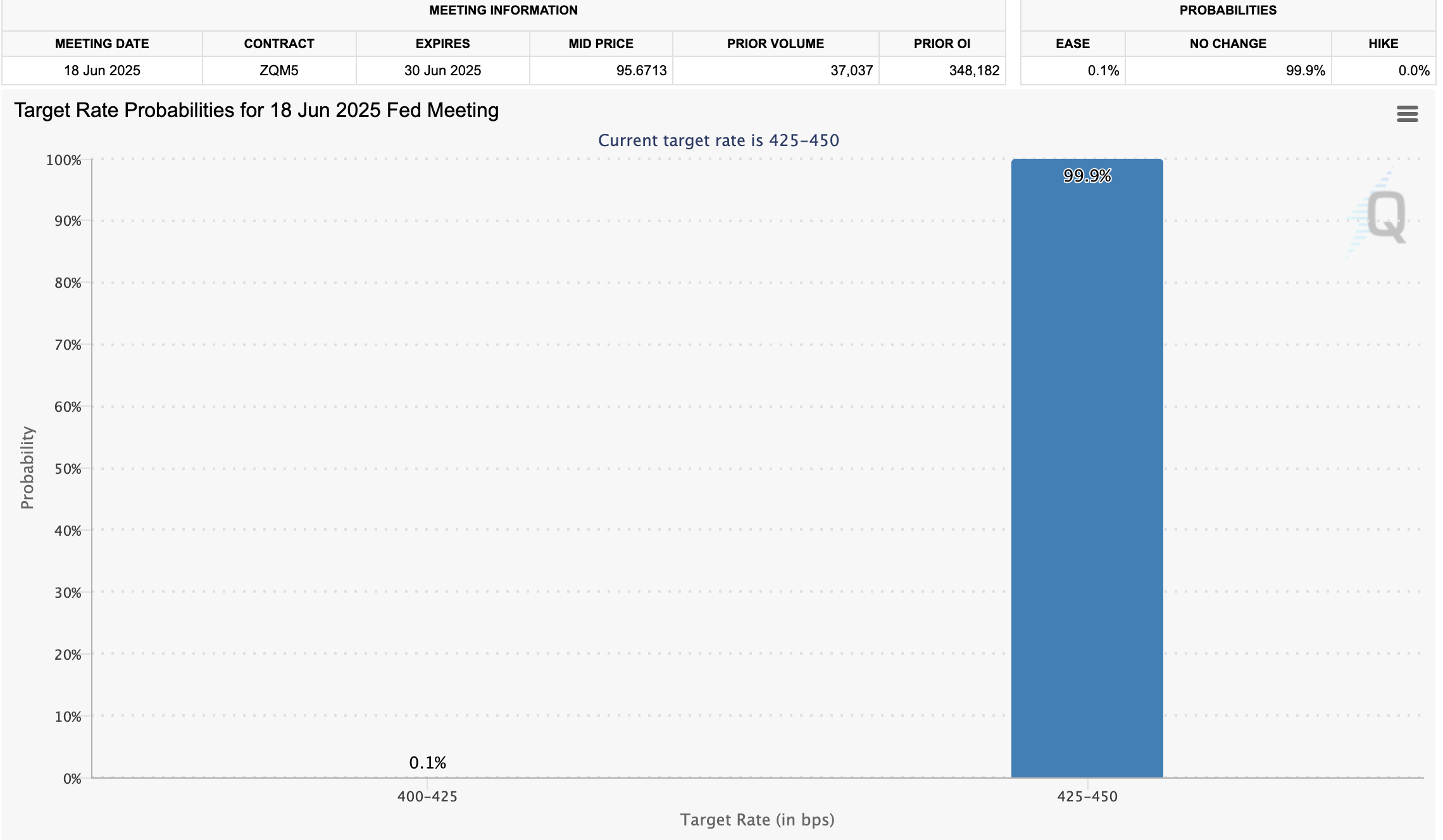

CME Group's FedWatch tool indicates that market participants anticipate the Fed to maintain interest rates in a range of 4.25% to 4.50%.

CME Group's FedWatch tool

Recent inflation data has pointed toward a potential dovish tilt by the central bank. However, analysts at K33 Research highlight that "potential fiscal expansion through a multi-trillion-dollar budget bill could nudge policymakers toward a more hawkish stance."

Data spotlight: Institutional demand steady despite geopolitical tensions

The conflict between Israel and Iran has no immediate signs of cooling, with strikes from each side continuing, currently on their sixth day. Oil prices have been surging, keeping markets on edge over a potential large-scale impact on the global economy.

In the crypto market, interest remains steady but limited compared to the run-up to Bitcoin's all-time highs of around $111,980, reached on May 22.

Bitcoin spot Exchange Traded Funds (ETFs), with $216 million in daily net inflow recorded on Tuesday, stand significantly below the $412 million posted on Monday. BlackRock's IBIT continued its lead over other US spot ETFs, with a net inflow of $639 million. None of the remaining ETF operators recorded net inflows on Tuesday, reflecting the persistent risk-off sentiment.

Bitcoin spot ETF stats | Source: SoSoValue

Interest in Ethereum-related financial products continued, albeit with a significant decline compared to the inflows witnessed last week. SoSoValue shows that ETH spot ETFs experienced net inflows of $11 million on Tuesday, a decrease from $21 million on Monday.

Ethereum spot ETF stats | Source: SoSoValue

Chart of the day: Could Bitcoin resume uptrend targeting $110,000?

Bitcoin's price sits above critical support provided by the 50-day Exponential Moving Average (EMA), currently holding at $103,058. However, attempts to make headway above $105,000 have failed to gain momentum, with the BTC price currently hovering at around $104,572 at the time of writing.

The Relative Strength Index (RSI) extends the slope from the overbought region below the 50 midline. This indicates a rising bearish influence. Traders will watch for movement toward the oversold region to ascertain the bearish momentum.

However, sideways movement and an RSI reversal above the midline could spark a surge in interest in Bitcoin, especially after the Fed announces its interest rate decision and Chairman Jerome Powell's remarks.

BTC/USDT daily chart

Crypto analyst and investor Michaël van de Poppe told his followers on X that it has become a norm for risk-off sentiment to take center stage before the FOMC meeting, followed by risk-on sentiment after the release.

Bitcoin's return above $105,000 and, more importantly, the resistance at $106,000 could ignite risk-on sentiment and even expand the bullish scope for gains past the critical hurdle at $110,000.

Altcoins update: Ethereum paring losses as XRP edges toward support

Ethereum's technical outlook remains largely bullish despite the correction witnessed on Friday. The largest smart contracts token holds above key levels, including the 200-day EMA support at around $2,475, the 50-day EMA at $2,434 and the 100-day EMA at $2,368.

The RSI on the daily chart shows signs of steadying at 48, slightly below the midline, suggesting indecision among traders. Investors can anticipate a breakout on either side, depending on sentiment following the Fed interest rate decision. However, key levels of interest include the seller congestion at $2,876, tested on June 11, and 100-day EMA support at around $2,368.

ETH/USDT & XRP/USDT daily charts

On the other hand, XRP's price is extending its losses for the second consecutive day, trading at $2.13 at the time of writing. A sell signal sustained by the Moving Average Convergence Divergence (MACD) indicator since Friday indicates a strong bearish bias.

Should the ongoing retracement persist, traders should monitor the 200-day EMA support at $2.09. XRP bounced off this key level last week, preventing losses from extending below $2.00.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.