XRPLedger AMM amendment passed with majority votes, XRP holders will earn passive income on this condition

- XRP holders will not receive income for holding the altcoin, they need to provide liquidity to the AMM for earning rewards.

- XRP holders that interact with the Automated Market Maker and provide their holdings to swappers, qualify for passive income.

- XRP price is $0.62 on Sunday, the altcoin sustained above the psychologically important level of $0.60.

Automated Market Maker (AMM) is set to debut on the XRPLedger and XRP holders will have the opportunity to provide liquidity to the AMM and earn passive income. Validators provided a clear picture of how XRP holders can earn through the AMM, and explain that simply holding the altcoin does not qualify traders for rewards or additional income.

Also read: XRP price drops alongside mass profit taking by Ripple holders

XRP holders that provide liquidity to AMMs can earn passive income

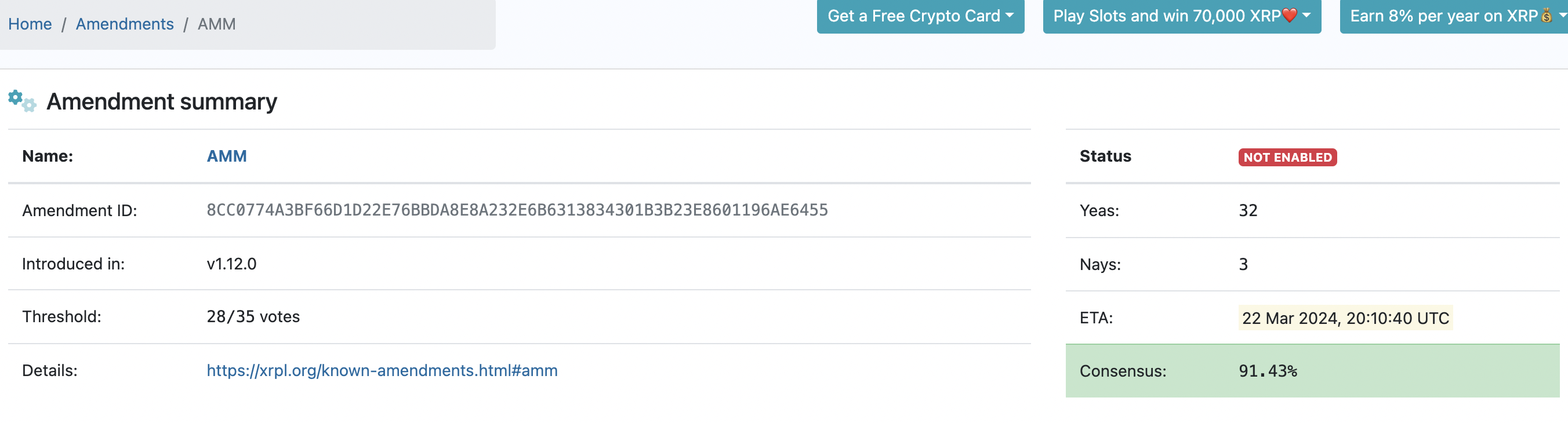

As the XRPLedger sees approval of the AMM amendment, social media platforms like X are flooded with posts claiming that XRP holders can earn passive income without ever selling their holdings. The amendment was passed with 91.43% consensus and AMMs have not been activated on the Ledger, at the time of writing.

AMMs will likely arrive on the XRPLedger by March 22, 20:10 UTC, according to information from XRPscan.

XRPLedger Amendment for AMMs passed

An XRPLedger Validator on X explained that AMMs do not provide passive income for holding XRP.

XRP holders need to provide liquidity to and interact with the Automated Market Maker, these XRP tokens are then bought and sold by swappers and the liquidity providers earn passive income.

At the time of writing, XRP price is $0.62. Despite the recent correction in the altcoin’s price, it sustained above the psychologically important level of $0.60. XRP price is in an uptrend and $0.6293 and $0.6500 are two key resistances in the altcoin’s path to rally towards its 2024 peak of $0.6685.

XRP/USDT 1-day chart