SKY Leads Market Gains Following Launch of USDS Staking Rewards

SKY (formerly known as MKR) is today’s top market gainer, with a price surge exceeding 10%. This rally follows the recent announcement that staking rewards are now live for SKY holders using the USDS stablecoin.

With strengthening bullish pressure, the altcoin appears poised to maintain its uptrend.

SKY Climbs as Bulls Regain Control

The rollout of the new staking incentives has sparked renewed interest and buying pressure in SKY. As of this writing, the altcoin trades at $0.0744, climbing by 13% over the past day.

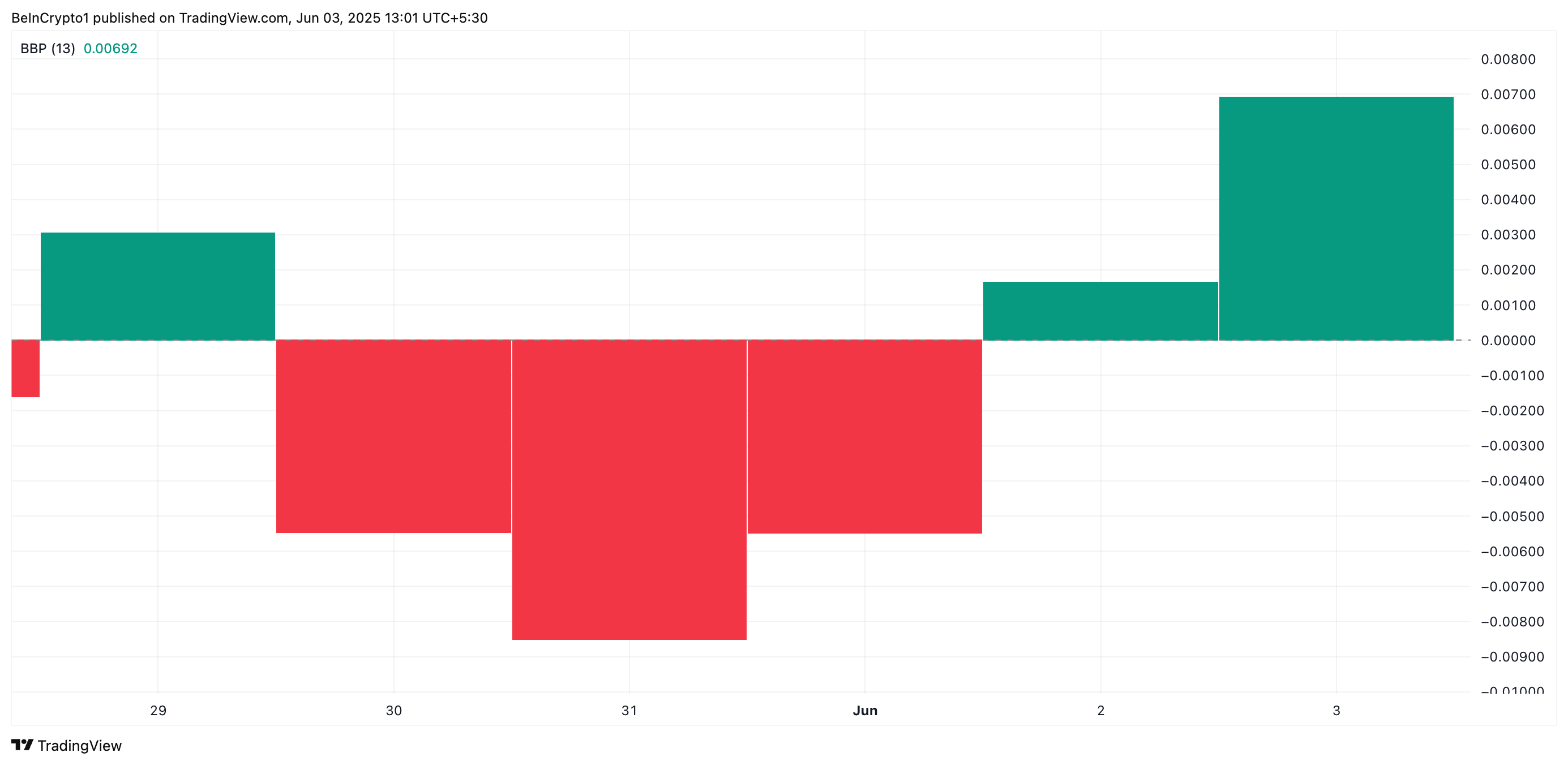

On the daily chart, readings from the token’s Elder-Ray Index confirm the SKY demand spike. The indicator has posted a slightly taller green histogram bar compared to the previous session, signaling increasing buying power among market participants. As of this writing, SKY’s Elder-Ray Index is 0.0069.

SKY Elder-Ray Index. Source: TradingView

SKY Elder-Ray Index. Source: TradingView

The indicator gauges the strength of bulls and bears in the market. When it prints green histogram bars, it indicates strong buyer dominance and rising upward momentum. This hints at the possibility of SKY’s sustained rally.

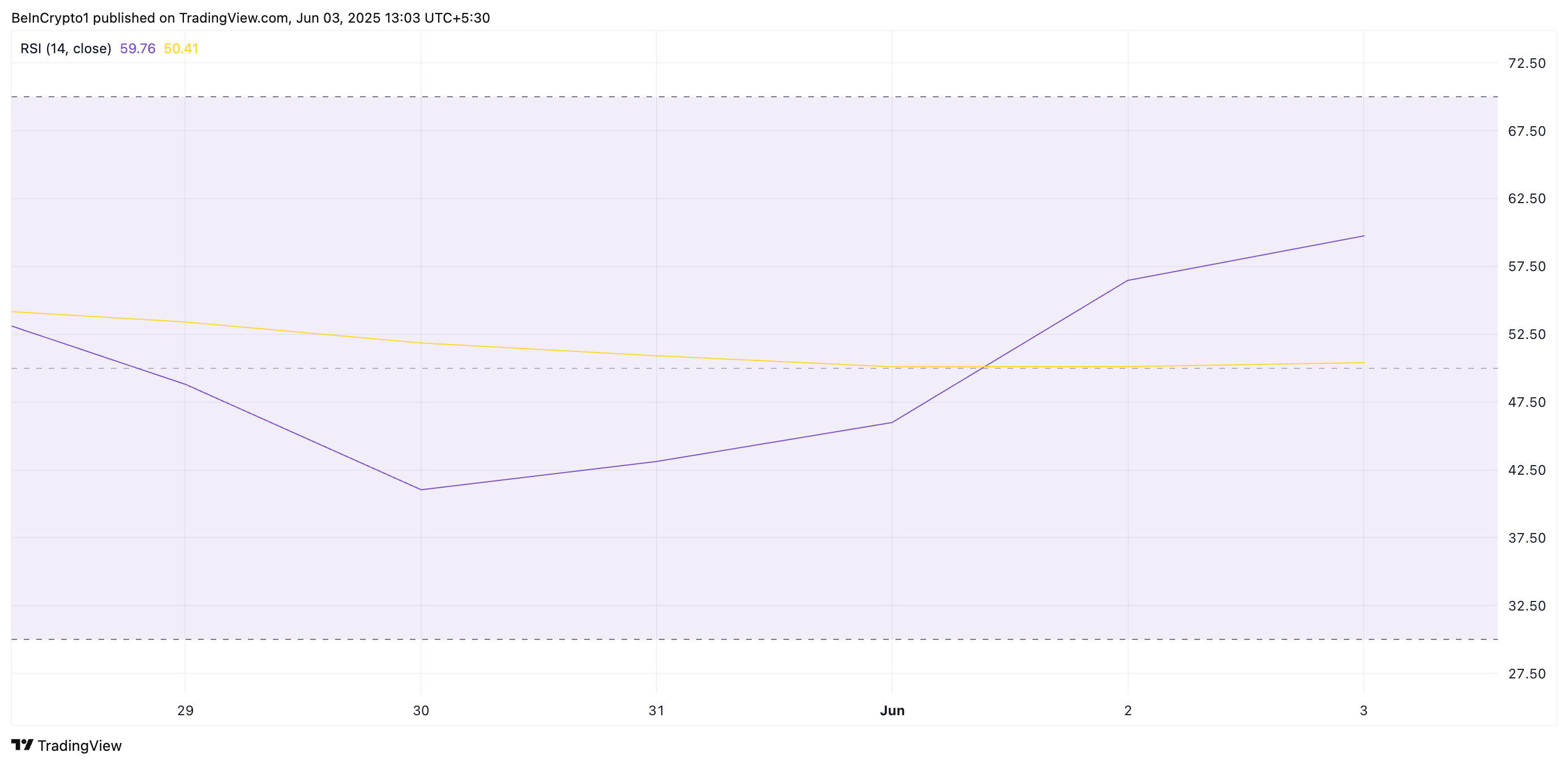

Moreover, the altcoin’s rising Relative Strength Index (RSI) highlights the demand backing the token’s rally. This key momentum indicator stands at 59.76, reflecting the surging buying pressure.

SKY RSI. Source: TradingView

SKY RSI. Source: TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 59.76 and climbing, SKY’s RSI signals a steady rise in token accumulation, a trend that could support its continued price growth.

SKY Clears Short-Term Resistance With Double-Digit Gain

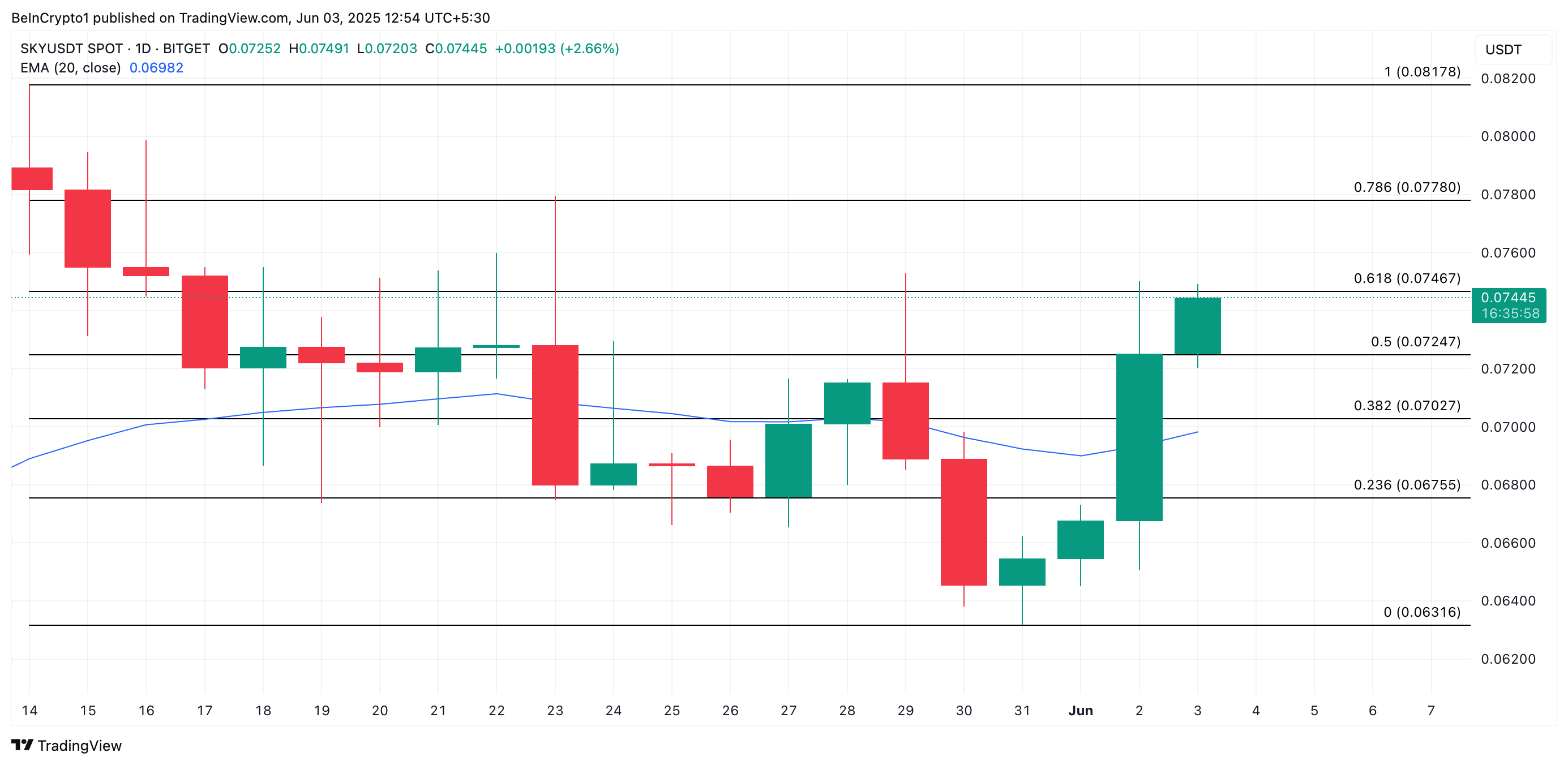

SKY’s double-digit rally has pushed its price above the 20-day exponential moving average (EMA). This key moving average now forms dynamic support below the token’s price at $0.0698.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When price trades above the 20-day EMA, it signals short-term bullish momentum and suggests buyers are in control.

If this continues, SKY could break above $0.0746 and extend its rally to trade at $0.0778.

SKY Price Analysis. Source: TradingView

SKY Price Analysis. Source: TradingView

However, if profit-taking resumes, the SKY token price could fall to $0.0724.