Bitcoin Price Forecast: BTC flashes early signs of weakness as profit-taking activity hits three-month high

- Bitcoin price consolidates around $109,000 on Wednesday, following a mild correction the previous day.

- On-chain data shows that BTC’s profit-taking activity has reached a three-month high, signaling growing selling pressure.

- The FOMC Minutes on Wednesday could act as a catalyst to bring volatility to risky assets, such as BTC.

Bitcoin (BTC) consolidates around $109,000 on Wednesday, following a mild correction the previous day. BTC’s on-chain data suggests weakness and indicates a potential correction, as profit-taking activity has reached a three-month high. Moreover, the Federal Open Market Committee (FOMC) Minutes from the May meeting, due to be released later on Wednesday, could trigger volatility in the largest cryptocurrency by market capitalization.

Bitcoin holders' book profits activity hits three-month high

Santiments’ Network Realized Profit/Loss (NPL) metric indicates that BTC holders are booking some profits after the cryptocurrency saw a slight recovery on Monday, following Donald Trump’s tariff delay on the European Union.

As shown in the graph below, the NPL experienced a significant spike on Tuesday, marking the highest profit booking activity since February 5. The spike indicates that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[14-1748433895610.25.21, 28 May, 2025].png)

BTC NPL chart. Source: Santiment

The short-term profit booking activity comes ahead of the highly anticipated FOMC Minutes on Wednesday, which could inject fresh volatility into the market.

Haresh Menghani, an analyst at FXStreet, reports that traders now look forward to the release of FOMC meeting minutes for cues about the future interest rate path.

The analyst continued that the investors, however, remain on edge amid the traded uncertainty, deep-rooted US-China trade tensions, concerns about the worsening US fiscal condition, and persistent geopolitical risks.

If the US Federal Reserve (Fed) takes a dovish stance regarding interest rates, it could bring a risk-on sentiment to the market, which could further support price rallies for riskier assets, such as Bitcoin. However, a hawkish stance will fuel the downward pressure on cryptocurrency.

Bitcoin could experience high volatility and liquidation

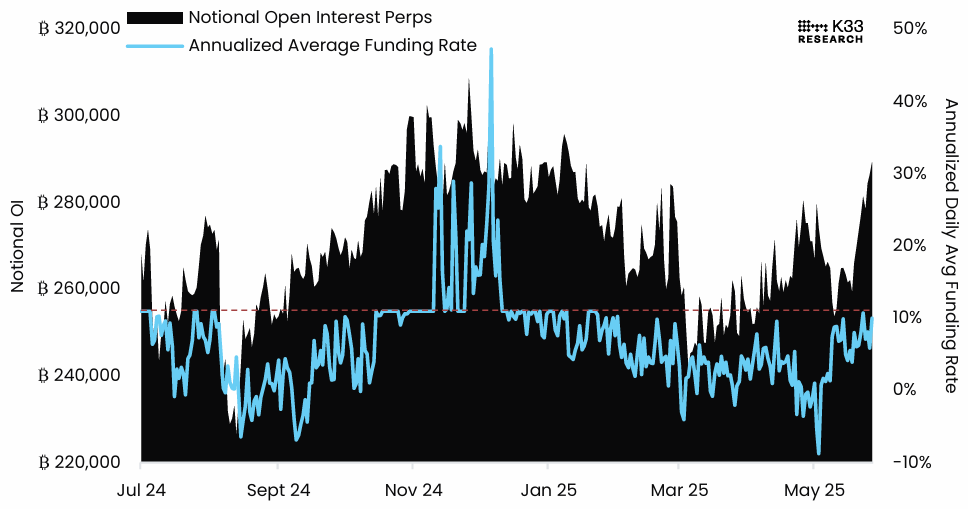

A K33 Research report on Tuesday highlights that the increased leverage and Open Interest (OI) in Bitcoin perpetual futures signal a potentially volatile phase ahead, but with no clear directional bias yet.

The report explains that OI in BTC perpetual has surged significantly after BTC broke its new all-time high (ATH) last week, as shown in the chart below. This rise in OI suggests renewed leverage in the market as traders are taking larger positions, likely anticipating further big moves.

“While long liquidations are the norm, the current funding rate structure offers an ambiguous picture, pointing toward heightened likelihood of squeezes in either direction,” says K33’s analyst.

BTC Notional Open Interest vs. Daily Annualized Funding Rates Chart. Source: K33 Research

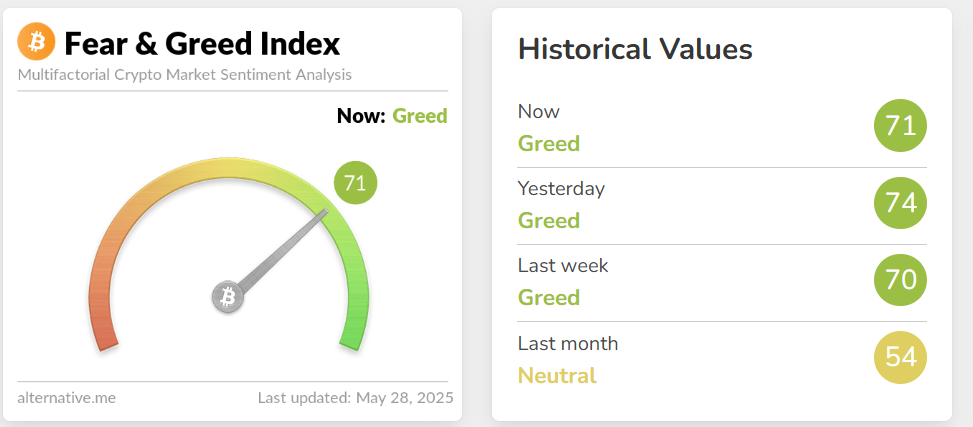

The alternative.me Fear and Greed Index, a metric that measures the overall sentiment of the cryptocurrency market, read 71 on Wednesday, indicating high "greed" among investors. Still, it is decreasing from 74 the previous day.

The metric has not reached "extreme greed" levels, which generally indicates a bullish sentiment, but also serves as a warning sign that the market could be overheated and due for a short-term reversal, as the Fear of Missing Out (FOMO) arises among retail investors, which could signal a local top for BTC.

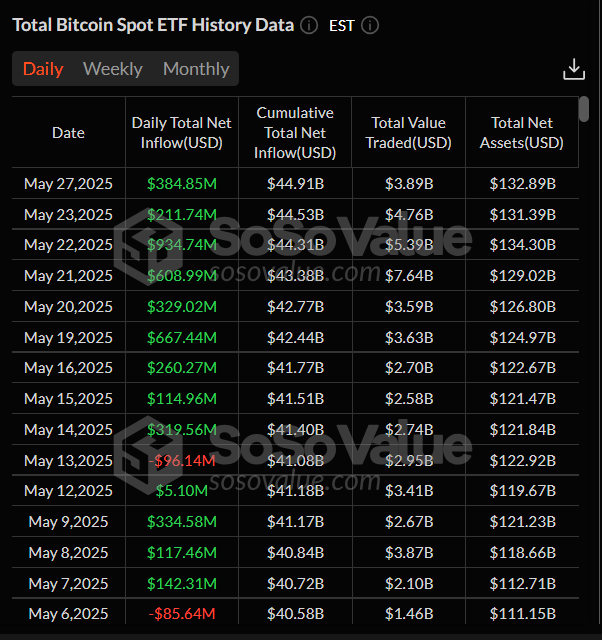

Despite rising greed and leverage overheating conditions, institutional demand for Bitcoin remains strong. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $384.85 million on Tuesday, continuing its streak of inflow since mid-May. If this institutional inflow continues or intensifies, it could serve as a buffer if BTC experiences a short-term pullback.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC shows weakness in momentum indicators

Bitcoin price reached a new all-time high (ATH) of $111,980 on Thursday and declined by 3.92% on Friday. However, it found support around the $106,406 daily level on Saturday and recovered in the next three days. BTC faced a mild correction on Tuesday. At the time of writing, it trades at around $109,000.

Bitcoin momentum indicators are flashing early warning signs of potential exhaustion. The Relative Strength Index (RSI) on the daily chart reads 64, pointing downward after being rejected from its overbought level of 70, indicating fading bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator also showed a bearish crossover on Sunday, giving a sell signal and suggesting a downward trend.

If BTC faces a pullback, it could extend the correction to retest its daily support level at $106,406. A successful close below this level could extend the decline to revisit its psychologically important level of $100,000.

BTC/USDT daily chart

However, if BTC continues to recover and closes above its all-time high, it could extend the rally toward the key psychological level of $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.