Bitcoin’s All-Time High Spurs Global Corporate Adoption Across Sectors

As Bitcoin continues to break records and reach its all-time high (ATH), a new wave of investment is emerging. This time, it’s not just from investment funds or individual investors. Traditional companies across various sectors are also jumping in.

From education, healthcare, and housing construction to cybersecurity, businesses large and small around the world are racing to accumulate Bitcoin. They view it as a strategic asset reserve, marking a major shift in companies’ perception of cryptocurrencies.

Bitcoin Accumulation Across Industries in May

Genius Group, a publicly listed education company, recently announced a 40% increase in its Bitcoin reserves. This move reinforces its long-term commitment to digital assets. Meanwhile, Basel Medical Group, a Singapore-based healthcare company, shocked the market by announcing a $1 billion Bitcoin purchase.

These moves show that Bitcoin is no longer exclusive to tech or investment firms. It’s now reaching into traditionally unrelated sectors.

In Europe, H100 Group became the first publicly traded company in Sweden to adopt a Bitcoin reserve strategy. It made an initial investment of 5 million NOK to purchase 4.39 BTC. Similarly, Blockchain Group—Europe’s first company to hold Bitcoin reserves—recently added 227 BTC to its treasury, bringing its total holdings to 847 BTC. This solidifies its pioneering role in the region.

“Europe stacking sats at the corporate level,” Nic, CEO & Co-founder of Coin Bureau, commented on the news.

These actions highlight the growing acceptance of Bitcoin as a strategic asset, especially as its value reaches new heights.

Manufacturing and Retail Companies Join the Movement

Manufacturing and cybersecurity companies are also getting involved. BOXABL, a modular home manufacturer, has declared Bitcoin a reserve asset. This move signals the construction industry’s shift toward digital finance. At the same time, JZXN, a publicly listed US electric car retailer, has approved a plan to purchase 1,000 BTC within the next year.

The participation of companies from seemingly unrelated industries, like automotive and housing, shows that Bitcoin is becoming a popular choice for corporate portfolio diversification.

Several Web3-related companies also moved to build Bitcoin reserves in May after it reached a new ATH. SecureTech, a cybersecurity firm, announced its reserve strategy. Roxom Global raised $17.9 million to fund its Bitcoin reserve and expand its media network.

These efforts reflect a strong ambition to combine digital assets with innovative business models.

Bitcoin Becomes a Macro Asset with a Limited Supply

Recent reports from BeInCrypto suggest that retail investors were largely absent during this latest rally. However, the flood of company Bitcoin acquisition announcements indicates a wave of institutional FOMO (fear of missing out).

Strategy is one of the companies leading this trend. As Bitcoin hit new highs, the value of its BTC holdings surged to $64 billion. But they haven’t stopped. The company recently announced plans to raise another $2.1 billion to continue its Bitcoin-buying strategy.

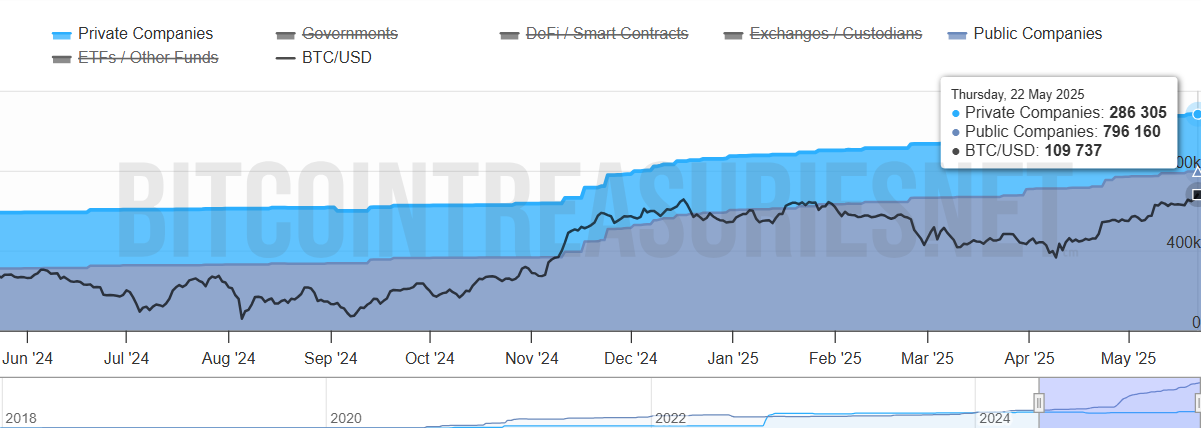

Total Bitcoin Accumulated by Companies. Source: Bitcoin Treasuries

Total Bitcoin Accumulated by Companies. Source: Bitcoin Treasuries

Data from Bitcoin Treasuries shows that private and public companies now hold over 1 million BTC—more than 5.4% of the circulating supply. Meanwhile, Bitcoin’s supply remains fixed, and the number of companies accumulating it continues to grow each month.

“Bitcoin breaking through $110,000 reflects the new reality: it’s no longer a fringe asset—it’s a macro instrument, ETF inflows, sovereign interest, and structurally limited supply are driving institutional demand at scale. For funds sitting on cash in a low-yield world, Bitcoin is starting to look less like a risk and more like a benchmark.” said Mike Cahill, CEO of Douro Labs, in an interview with BeInCrypto.

This trend proves that Bitcoin is gaining institutional trust in 2025. It’s no longer dismissed as a financial bubble. Instead, it’s being recognized as a strategic asset of the future.