Bitcoin whale James Wynn pushes 40x long position to $1.07 billion

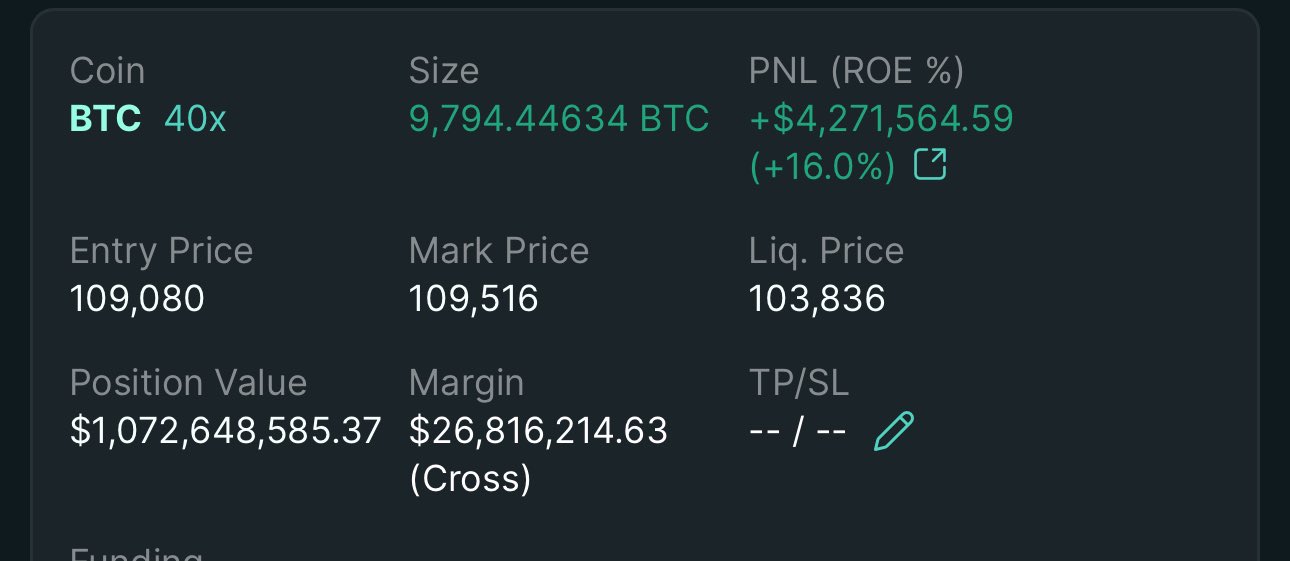

James Wynn, a pseudonymous crypto trader known for swinging massive positions on-chain, has expanded his Bitcoin long bet to $1.07 billion using 40x leverage on Hyperliquid, the decentralized derivatives platform.

The final scale-up was shared by James via X on Friday, with a screenshot that showed the total exposure was pegged at 974.44634 BTC, entered at around $109,000 per coin. The size of the position in satoshis (1,073,912,068.95) is a figure few traders would ever dare touch.

James started with an $830 million long opening on May 21, timed with Bitcoin’s price breaching $109,000. At the time, optimism in the market was being fueled by growing institutional participation and clearer rules from the US government and regulators.

But James’ play came during a moment when most large traders were taking short positions, expecting a pullback, and he went the opposite direction.

Bitcoin whale trims holdings, then reloads to over $1.1 billion

Ninety minutes into that original $830 million position, James took profit by cutting 3,688 BTC, worth about $400 million, from the exposure. That reduced the position to $430 million. EmberCN, a blockchain analytics firm, said this was likely an early gain lock rather than a shift in outlook.

By the morning of May 22, James returned heavier, as he had raised his position to $1.1 billion, maintaining the same 40x leverage. At that time, Bitcoin had crossed $110,000, and James’s trade was sitting on $39 million in unrealized gains, per wallet data tracked by Lookonchain.

Later that day, James again reduced exposure, selling off 540 BTC valued near $60 million. He booked a $1.5 million profit and repeated his previous day’s pattern of partial exits after strong price actions.

Lookonchain reported that three previous trims by James had all preceded pullbacks in Bitcoin, causing traders to monitor his wallet for the next move. Some were speculating that James’ exits might be playing into short-term volatility across the market.

Meanwhile, amid this, data from Glassnode shows that over 420,000 Bitcoins have a cost basis near $94K, forming one of the strongest support zones of the current cycle. The Fear & Greed Index has also hit 78 at extreme greed in its highest level since January.

James originally became known for flipping meme tokens with shocking results. His wallet, identified as 0x507, was first flagged after massive wins trading PEPE, the frog-themed memecoin. He bought 2.83 trillion PEPE for just $8,524, and by June 2024, that bag was worth $44.4 million.

In June 2024, James deposited 491 billion PEPE, worth $7.54 million, into Binance, triggering speculation that he was offloading. But he didn’t sound bearish.

In a post on X after the deposit, James said PEPE was “still severely undervalued,” and added that the “PEPE takeover just began.” He also claimed, “everyone who bought PEPE was in profit unless they sold it,” pushing back against doubts in the memecoin’s value.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites