Sui rally stalls amid $9.3 million weekly fund inflows and price swings in the broader market

- Sui's bullish momentum falters on Monday, reflecting possible profit-taking after rallying to $4.30.

- Digital asset inflows into Sui's products reached $9.3 million last week on renewed sentiment in the wider crypto market.

- Sui's DeFi TVL remains above $2 billion, signaling growing investor confidence in the layer-1 protocol.

Sui's (SUI) price faces headwinds around $3.71 on Monday, following a slightly bullish Sunday. The layer-1 blockchain token has, since the sentiment-driven rally to $4.30 on May 12, been confined below $4.00 despite consistency in digital asset inflows, which reached $9.3 million last week.

Sui struggles to sustain the uptrend despite consistent fund inflows

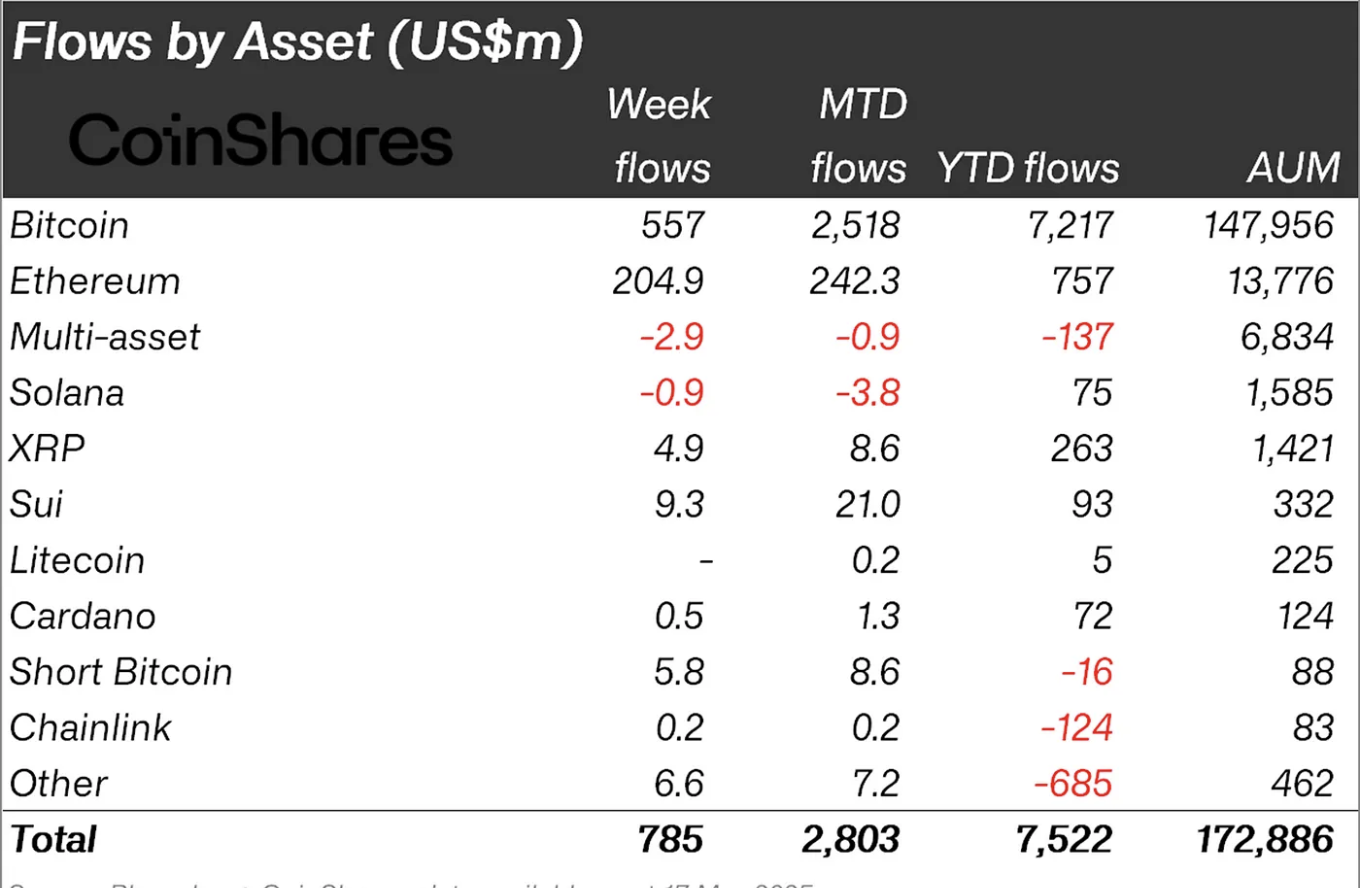

Sentiment around Sui remained elevated last week, with digital fund inflows in the ecosystem's financial products hitting $9.3 million, according to a CoinShares report. Sui boasts $332 million in assets under management (AUM), falling behind Ripple's (XRP) $1.42 billion and Solana's $1.6 billion.

Digital asset investment products recorded $785 million in total, marking the fifth consecutive week of inflows, with Bitcoin (BTC) accounting for the lion's share at approximately $557 million.

Digital asset inflows | Source: CoinShares

Ethereum (ETH) emerged as the standout performer, with over $205 million in inflows, buoyed by renewed investor optimism around the Pectra upgrade.

Sui's fund inflows steadied, mirroring renewed sentiment in the protocol's Decentralized Finance (DeFi) Total Value Locked (TVL), which remains slightly above $2 billion, according to DefiLlama data.

TVL is the sum of the value of all coins held in smart contracts of all the protocols on the chain. The chart below highlights the consistent increase in the TVL from around $1.78 billion on May 1.

A rising TVL is a bullish indicator, reflecting heightened confidence and renewed interest in the protocol. Investors lock assets in smart contracts when they trust the network's long-term value and anticipate substantial price growth.

Sui DeFi TVL | Source: DefiLlama

Meanwhile, Sui's stablecoin market capitalization soared 23.5% last week, reaching $1.09 billion, with USDC leading as the primary asset. This growth is mirrored by a staggering 10.47% surge in decentralized exchanges (DEXs) volume, hitting $4.14 billion weekly.

Looking ahead: How far can Sui's pullback go?

Sui's price is down over 6% on the day to $3.71 at the time of writing. Intraday declines hit $3.59 on Monday, reflecting broader swings between support and resistance in the crypto market.

The Relative Strength Index (RSI) has been trending sharply downward, nearing the 50 midline after hitting overbought levels at 75.53 on May 8. This consistent decline aligns with Sui's retreat from its peak of $4.30, suggesting sellers still hold a short-term advantage.

Beyond the immediate support at $3.50 previously tested in late April and in February, key monitoring levels lie at the descending trendline, as illustrated on the daily chart, the demand area at $3.26 near the 50-day Exponential Moving Average (EMA) and the 200-day EMA around $2.96.

SUI/USDT daily chart

Although the short-term trend appears bearish, Sui remains well above the 50-day EMA at $3.26, the 100-day EMA at $3.12, and the 200-day EMA at $2.96. The upward trajectory of these moving averages indicates that buyers maintain control over sellers, suggesting caution against overly bearish outlooks.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.