Can Immutable (IMX) Break a 3-Month Barrier to Bring $84 Million Profits?

Immutable X (IMX) has shown positive momentum in the past month, pushing the altcoin to a critical juncture in its price action. Currently trading at $0.72, IMX is attempting to break past a long-standing resistance level.

However, it faces challenges as a significant portion of the token’s supply, about 117 million IMX worth over $84 million, remains unprofitable and could potentially cause further price resistance.

Immutable Investors Await Profits

About 117 million IMX tokens, valued at over $84 million, are currently awaiting profitability, sitting between the price range of $0.81 and $0.84. This sizable supply zone has created a resistance level that Immutable X has struggled to breach for the past three months.

As a result, the chances of selling at this point are high, with many holders likely to liquidate their positions as the price approaches this zone.

This selling pressure could prevent IMX from sustaining upward movement unless stronger support from long-term holders and new buyers emerges. The resistance at this price range could also lead to the formation of price consolidation.

IMX IOMAP. Source: IntoTheBlock

IMX IOMAP. Source: IntoTheBlock

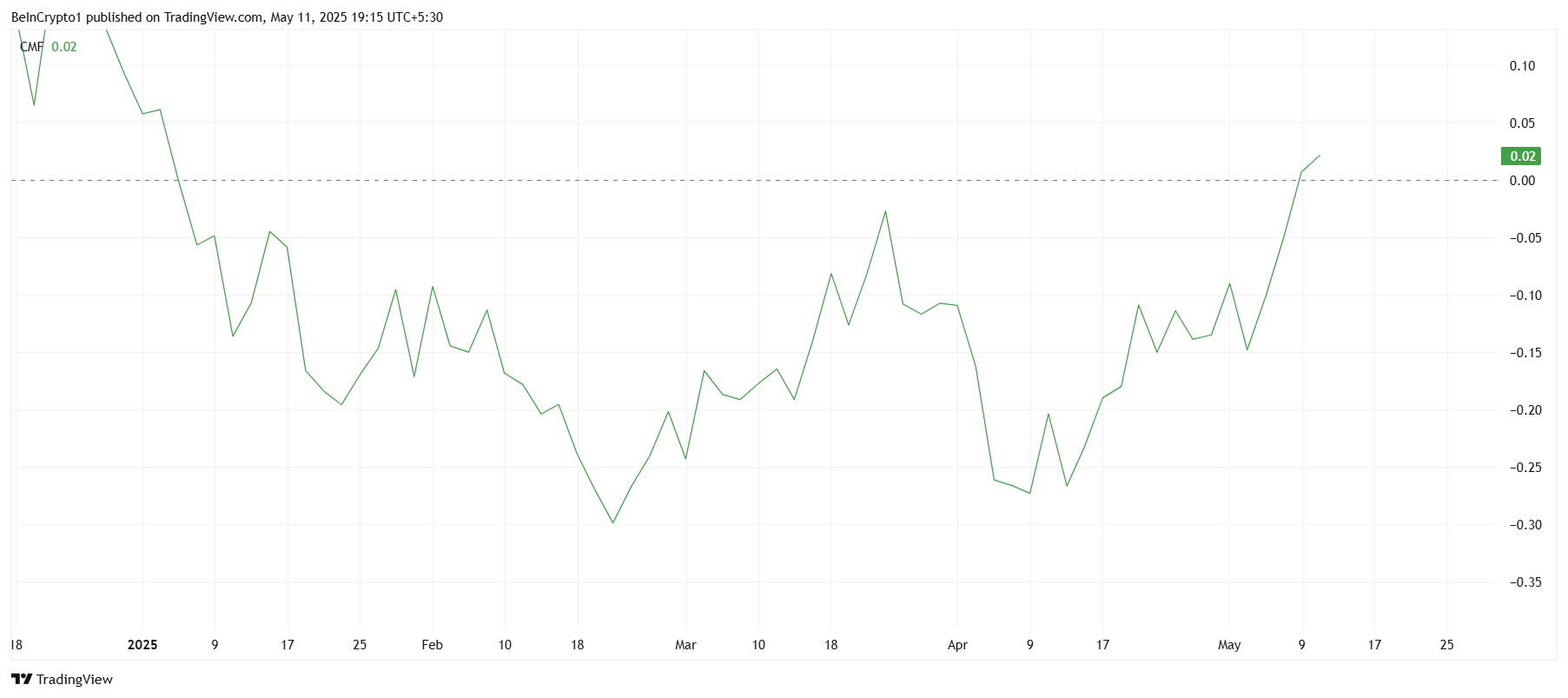

Looking at the broader market momentum, IMX is showing positive signs. The Chaikin Money Flow (CMF) has recently breached above the zero line for the first time since the beginning of 2025.

This indicates that IMX is experiencing its strongest inflows of the year, which could help maintain the altcoin’s rally.

Meanwhile, the surge in inflows could help push IMX past its current resistance levels, especially if market sentiment remains favorable. The positive movement in the CMF suggests that the rally is backed by strong demand, which could fuel further price increases.

With sustained capital inflows, IMX may find the necessary support to break through the $0.81 barrier and continue its upward momentum.

IMX CMF. Source: TradingView

IMX CMF. Source: TradingView

IMX Price Aims At Breakout

IMX has gained 37% over the past week, trading at $0.72 at the time of writing. Holding above the $0.72 support level, the altcoin faces the critical resistance zone of $0.81, which it has been unable to breach since mid-February. If IMX can break this resistance, it could signal the start of a new upward movement.

However, the significant supply zone between $0.81 and $0.84 poses a risk of continued price consolidation under $0.81.

If the resistance proves too strong, IMX could fall through the $0.72 support level and drop to $0.60. This would invalidate the bullish thesis, suggesting a potential reversal in market sentiment.

IMX Price Analysis. Source: TradingView

IMX Price Analysis. Source: TradingView

On the other hand, if investor sentiment remains bullish and the broader market cues continue to support the rally, IMX could breach the $0.81 resistance.

A successful push past $0.88 would make the 117 million IMX tokens profitable, reinforcing the altcoin’s growth potential. This would invalidate the bearish outlook and likely spur further positive momentum.