PEPE price rallies 26% on Monday, likely driven by whale accumulation

- PEPE price yielded double-digit daily gains for holders as the meme coin climbed to a high of $0.00000755 on Monday.

- Large wallet investors are accumulating PEPE on Binance, two whales bought over 840 billion PEPE today.

- PEPE’s on-chain metrics support the meme coin’s price rally, active addresses and network growth hit a six-month peak.

PEPE, one of the largest meme coins in the crypto ecosystem, observed double-digit gains on Monday. The meme coin rallied to a high of $0.00000755 hours ago and the frog-themed cryptocurrency is being accumulated by whales.

Also read: XRP price could soon be independent of Ripple, altcoin hits a new 2024 high of $0.65

PEPE sees massive spike in price as whales scoop up billions of meme coin tokens

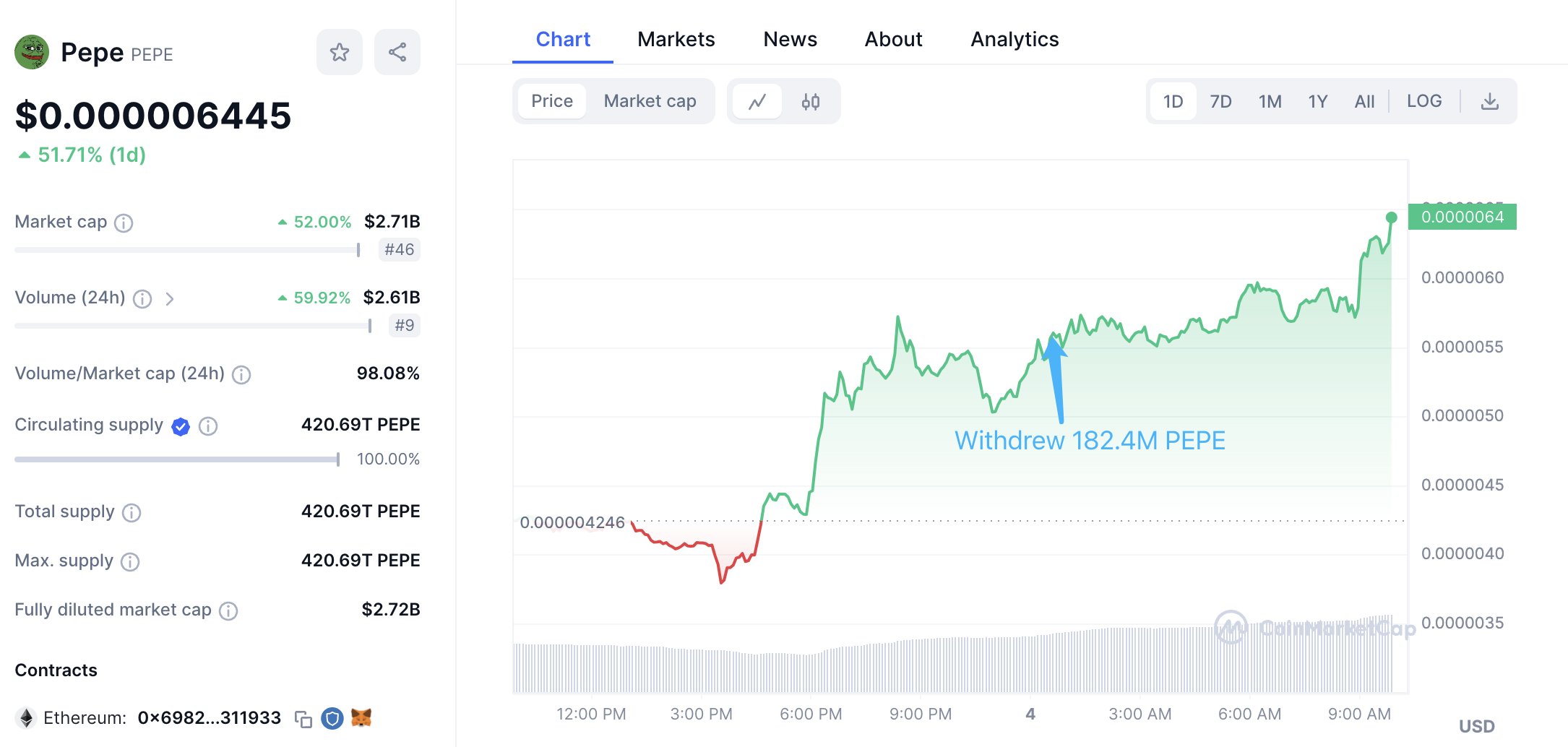

Data from crypto intelligence tracker Lookonchain reveals that large wallet addresses have recently accumulated PEPE in large volumes. A whale withdrew 184.4 billion PEPE tokens worth $1.02 million at the time, from Binance, early on Monday. The entity is sitting on an unrealized gain of $155,000.

PEPE whale withdrew assets from Binance. Source: Lookonchain

Lookonchain noted similar actions of other whales. One whale wallet bought 840.86 billion PEPE tokens from Binance, worth nearly $5 million, while another wallet spent $2 million in stablecoins to buy 340.86 billion PEPE tokens on the exchange platform.

Whale accumulation has likely influenced PEPE’s recent gains. On-chain metrics support the meme coin’s price rally. PEPE’s Active Addresses and Network Growth metrics are flashing positive signs for a sustained price rally in the meme coin.

%20[14.15.44,%2004%20Mar,%202024]-638451462862013128.png)

PEPE Active Addresses. Source: Santiment

%20[14.15.52,%2004%20Mar,%202024]-638451463214966412.png)

PEPE Network Growth. Source: Santiment

PEPE price has rallied despite massive profit-taking by large wallet investors. The Network Realized Profit/ Loss metric that tracks the net profits or losses realized by an asset’s holders identified that PEPE holders have booked $37.06 million in gains on March 3 and $34.09 million on March 4, at the time of writing.

%20[14.15.56,%2004%20Mar,%202024]-638451463509062616.png)

PEPE Network Realized Profit/Loss. Source: Santiment

At the time of writing, PEPE price is $0.00000741, the meme coin has yielded over 430% weekly gains for holders.