Strategy raises $21B to buy more Bitcoin despite $4.7B loss in Q1 2025

- On Thursday Michael Saylor-led Strategy published its financial report for Q1 2025.

- Holding 551,000 BTC at press time, the firm closed Q1 2025 with a $4.2 billion loss.

- The firm announced a new $21 billion common stock offering to fund more BTC purchases.

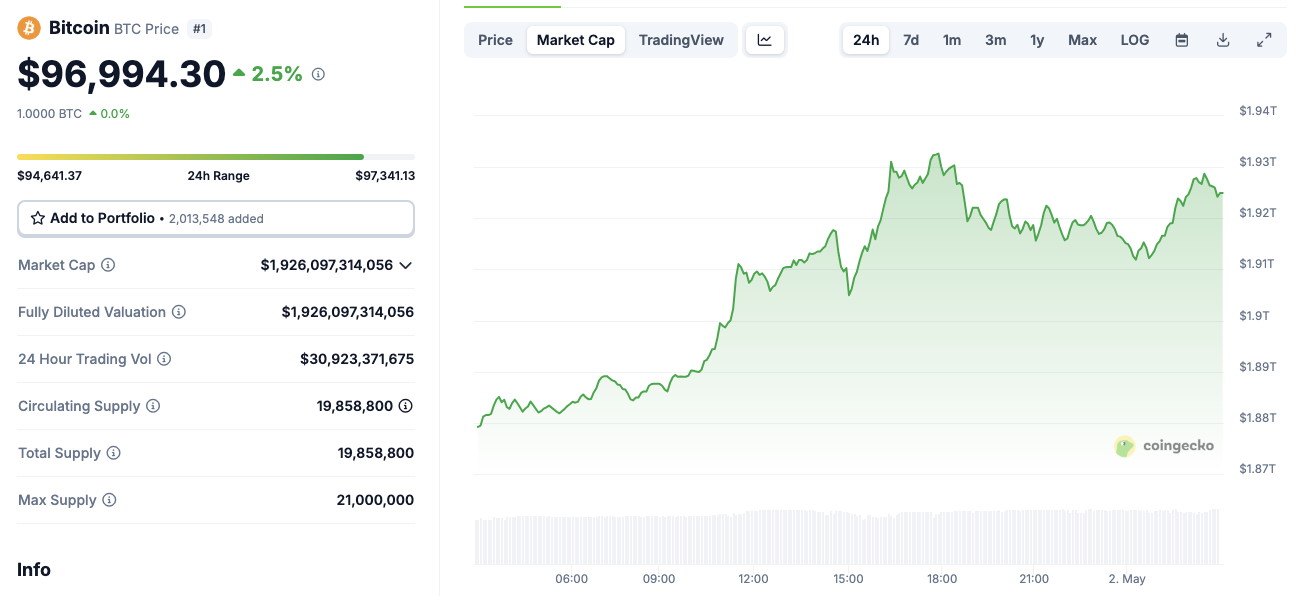

Bitcoin price crosses $97,340 on Friday as a Q1 report published by Michael Saylor-led Strategy signals rising institutional demand, brushing off altcoin ETF filing delays.

Bitcoin Hits 70-Day peak as Michael Saylor launches another $21B Plan

Bitcoin extended its recent rally on Thursday, bouncing by more than 3% to hit a 70-day peak of $97,310 amid rising institutional inflows and bullish sentiment from recent altcoin ETF filing.

SUI spot ETF filing by 21 Shares improved market sentiment after the US SEC’s decision earlier in the week to delay verdicts on seven altcoin ETFs.

Bitcoin price action (BTCUSD) | Source: Coingecko

The fresh ETF filing helped soothe fears of broader regulatory pushback, reinforcing optimism about bitcoin ETF approval verdicts later in 2025. With demand still on the rise, BTC is currently trading at $96,960 at press time, up 2.5% over 24 hours and 3.4% on the seven-day timeframe.

However, the single most significant catalyst on the day came from Michael Saylor’s Strategy, whose bold $21 billion move sent bullish shockwaves across BTC markets on Thursday.

Strategy Raises $21B to Buy More Bitcoin Despite $5.8B gains in Q1 2025

Michael Saylor’s Strategy made headlines again Thursday after publishing its Q1 2025 financial reports. After closing the quarter with a $5.8 billion gain, the company unveiled a fresh $21 billion at-the-market (ATM) stock equity offering to ramp up its Bitcoin purchases.

After its latest purchase on Monday, the firm now currently holds 553,555 BTC, the largest corporate Bitcoin holding globally. As of April 28, BTC was trading above $97,000, pushing Strategy’s holdings well into profitable territory despite recent market volatility from Trump’s trade tariff announcements.

Microstrategy total Bitcoin holdings as of May 2 2025 | SaylorTracker

Strategy's Q1 report outlines a 13.7% BTC yield year-to-date and a $5.8 billion BTC dollar gain, meeting 58% of its annual target within the first four months. Accordingly, the company has raised its 2025 BTC Yield target from 15% to 25%, and its BTC dollar gain projection from $10 billion to $15 billion.

“We successfully executed our record $21 billion ATM, adding 301,335 BTC while achieving a 50% surge in our share price,” said CEO Phong Le. He emphasized Strategy’s role in shaping the emerging Bitcoin Treasury Standard, now adopted by over 70 public companies worldwide.

Notably, Strategy also adopted fair value accounting for its BTC holdings this quarter, contributing to a $12.7 billion uplift in retained earnings. Despite the Q1 markdown from BTC’s end-quarter price of $82,445, the company remains structurally bullish and fundamentally aggressive in its strategy to accumulate more BTC regardless of short-term volatility.

Market Impact: What’s ahead for BTC in Q2 2025

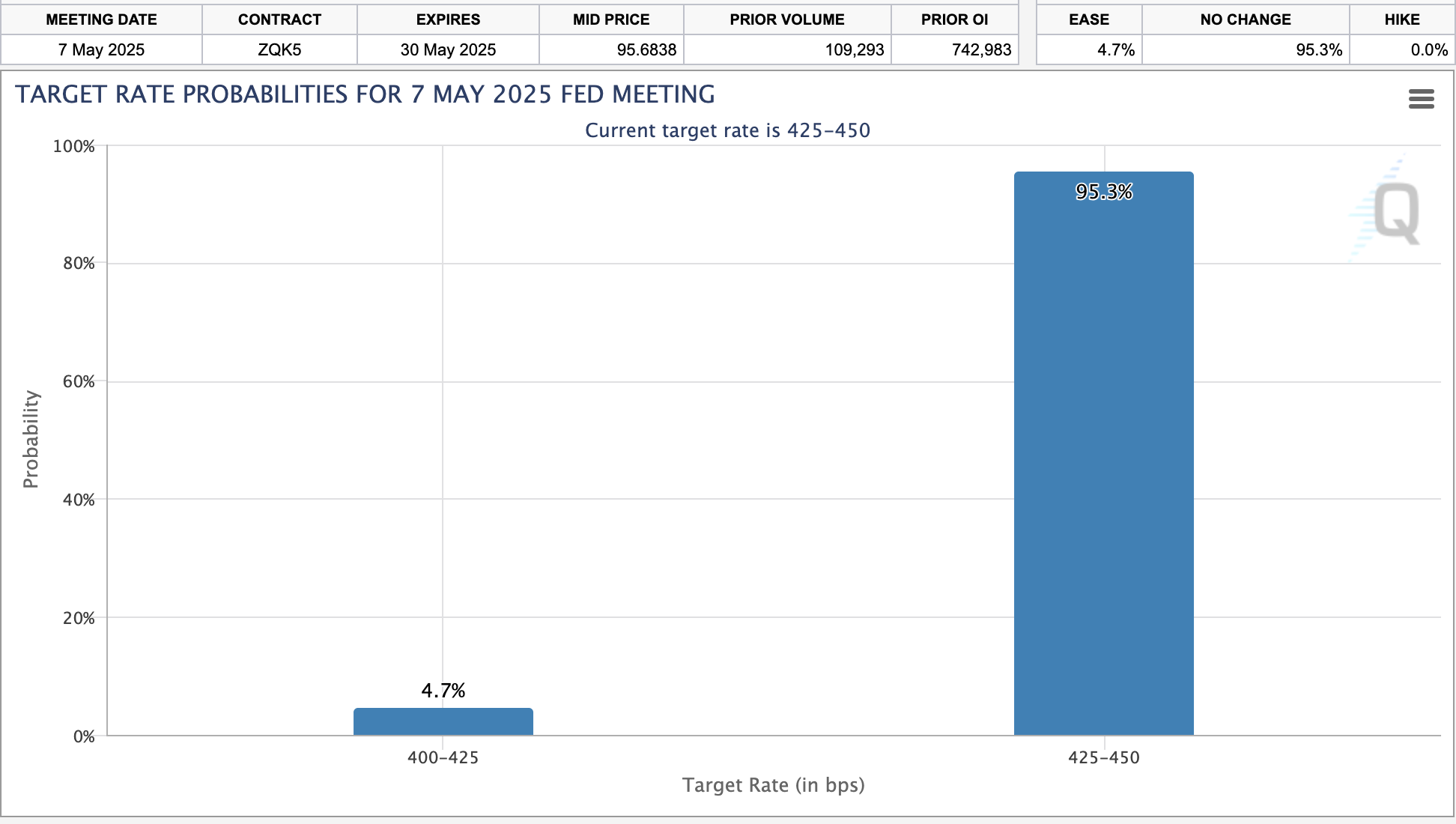

Looking forward, macroeconomic tailwinds could further amplify Bitcoin’s bullish momentum. With the U.S. labor market weakening and inflation remaining persistent, expectations for a Federal Reserve rate cut in Q2 have intensified.

Market watchers price in an 87% chance of Fed rate pause, May 2025 | Source: CMEGroup/Fedwatch Tool

Michael Saylor’s renewed $21B buy plan aligns with the recent ETF inflow spree, reflecting strong institutional conviction in BTC’s long-term potential. Analysts now view corporate and ETF-driven accumulation as critical support pillars that may offset macro uncertainty in Q2.

More so, the Arizona state legislature recently passed a bill establishing the first official cryptocurrency reserves earlier this week.

As more firms, and sovereign states mirror Strategy’s BTC treasury blueprint, Bitcoin is increasingly viewed as a balance sheet asset and hedge against monetary dilution. If current momentum holds, BTC price may enter the price discovery phase above $110,000 as Q2 2025 unfolds.