Ethena partners with TON Foundation to bring USDe into Telegram ecosystem

- Ethena Labs announced a partnership with TON to make USDe stablecoin accessible to Telegram users through custodial and non-custodial wallets.

- Ethena’s synthetic dollar is now live on 20+ chains, powered by LayerZero's OFT standard for cross-chain operability.

- ENA and TON rose following the integration announcement

Ethena Labs integrates USDe into Telegram via TON, unlocking stablecoin access, payments, and yield for one billion global users.

Ethena Labs rings USDe to Telegram’s one billion users

The Ethereum-based synthetic dollar protocol, Ethena Labs, has decided to integrate its USDe stablecoin into the Telegram ecosystem.

The announcement, made on Thursday, brings the globally accessible digital dollar to Telegram’s massive user base, marking a pivotal moment in stablecoin adoption across mainstream messaging platforms.

According to Ethena’s official statement, the partnership with TON Foundation focuses on three primary product lines: support for USDe in non-custodial TON wallets like TON Space, integration into Telegram's custodial wallet, and adoption within TON’s DeFi ecosystem.

This allows users to send, save, and pay with USDe directly within Telegram, streamlining access to stable digital dollars for over a billion users.

The product also offers options for users to stake their USDe stablecoin for annual returns up to 10%.

USDe is a synthetic dollar powered by LayerZero’s OFT (Omnichain Fungible Token) standard, offering seamless operability across multiple chains.

With the latest TON integration, USDe is now live on more than 20 chains, securing its place as one of the most accessible yield-bearing stablecoins in the crypto market.

TON and ENA rally on partnership news

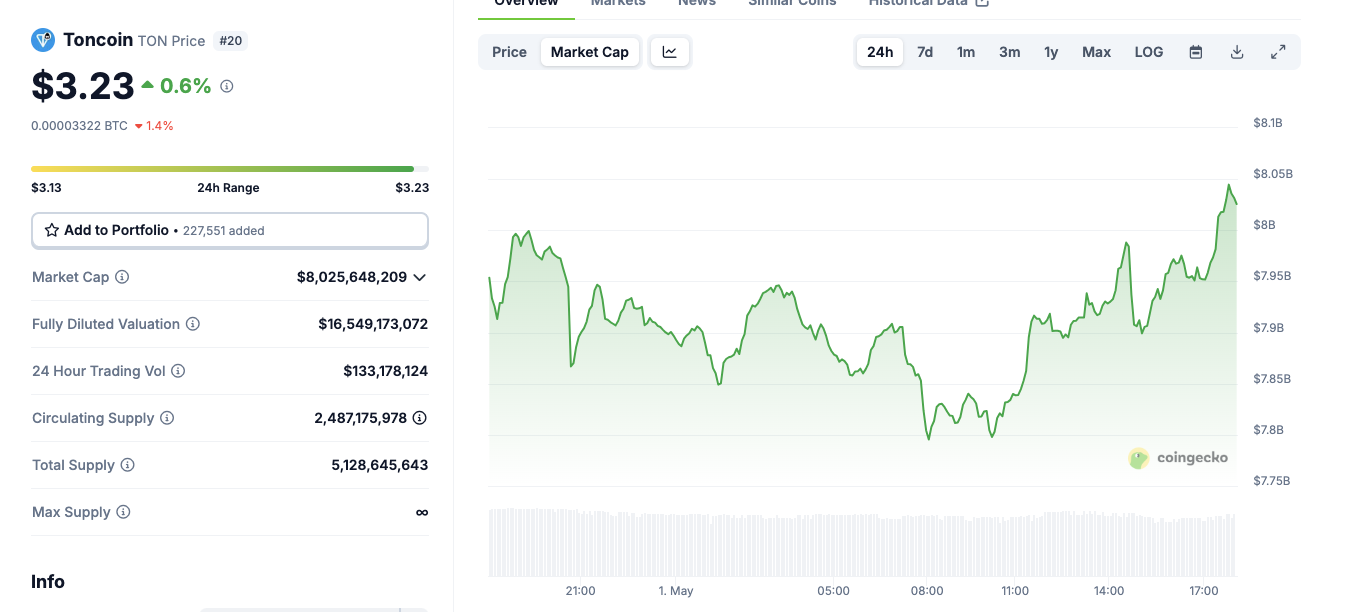

Following the integration announcement, Toncoin (TON) rose 1.90% in the day, trading around $3.22 at the time of writing.

Toncoin (TON) price action | Source: Coingecko

With Telegram’s one billion active users and TON’s growing role in enabling Web3 features on the app, USDe’s integration could transform how global users interact with crypto.

As Ethena Labs enables savings, lending, and payments through USDe, the TON blockchain could see significant upticks in DeFi adoption, driving user stickiness and utility for Toncoin.

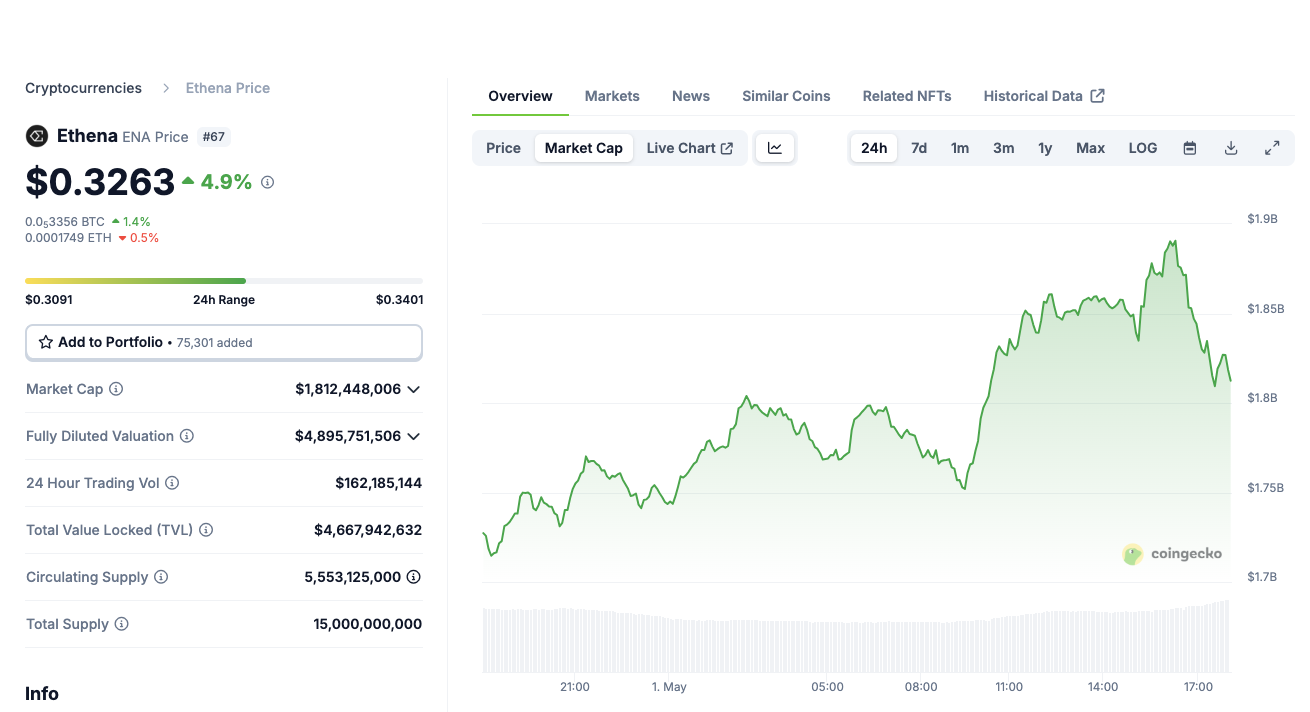

Ethena (ENA) Price Action | Source: Coingecko

Meanwhile, ENA, the native token of Ethena, has also responded positively.

It posted a 3.5% daily gain following the announcement, trading at $0.033, up from a 24-hour low of $0.3036.

Though still facing bearish pressures over the 3-month horizon, the short-term rally suggests investor confidence in Ethena’s latest announcement

Market outlook: How will Ethena’s USDe integration impact Toncoin

Ethena Labs’ decision to partner with TON and Telegram could prove transformative. By meeting users where they already are, the protocol bypasses crypto’s typical user acquisition hurdles.

The embedded Telegram wallet now acts as a ready-to-go on-ramp for stablecoin utility, potentially opening the doors to billions in fresh inflows.

If adoption grows, Toncoin could benefit from increased transaction volumes, higher DeFi activity, and wider developer engagement.

While the market’s reaction remains cautious for now, the foundations for long-term growth appear firmly in place.