Raydium and Pump.fun clash in the race for Solana DEX supremacy

- Rayduim’s LaunchLab is returning to the meme coin space, aiming to reclaim market share from Pump.fun.

- LaunchLab is gaining traction, capturing up to 24% of daily new meme coin launches compared to Pump.

- The winner of the battle between the platforms will likely deliver the next breakout token.

The debut of LaunchLab in April, Raydium’s meme coin launchpad, is leading to a comeback in the meme coin space as the platform aims to get market share from Pump.fun.

A K33 Research report states that LaunchLab is gaining traction in the Solana decentralized exchange (DEX), capturing up to 24% of daily new meme coin launches compared to Pump. However, the winner of the battle between the platforms will depend on incentives, user growth, and meme virality, with the victor likely to be the one that delivers the next breakout token.

LaunchLab’s comeback: From a slow start to gaining ground

A K33 report highlights that Raydium’s LaunchLab is making a comeback in the meme coin space, aiming to reclaim market share from Pump.fun. Following the LIBRA scandal, promoted by Argentina’s President Javier Milei in February – which resulted in billions of dollars being wiped out – many declared the end of the meme coin era. However, meme coins have made a comeback since the marketwide lows in April, with tokens like Fartcoin (FARTCOIN) surging by 440%.

Meme coins accounted for 47% of Solana’s DEX volume in March, according to David Zimmerman, Senior Analyst at K33 Research.

As retail speculation returns, the competition between Raydium and Pump.fun has heated up. With the launch of LaunchLab earlier this month, Raydium is gaining trading volume, revenue, and relevance in a sector currently dominated by Pump.

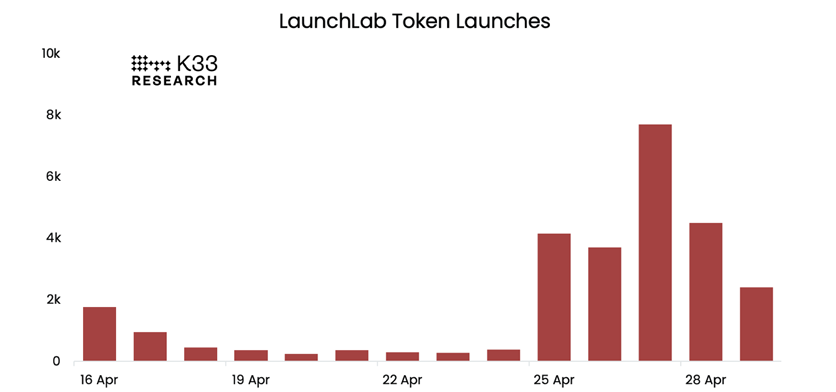

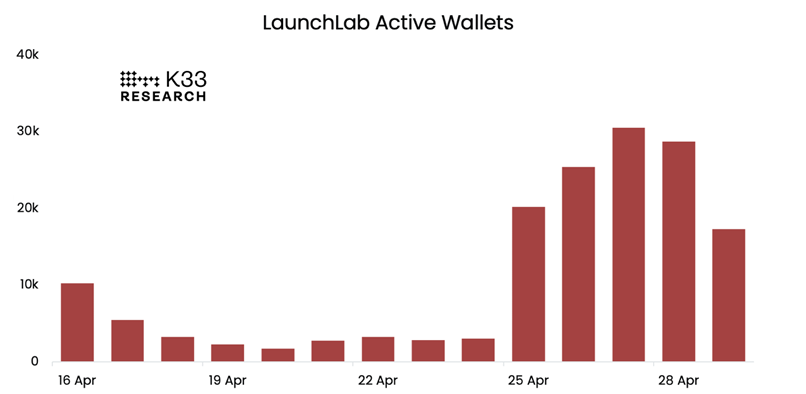

LaunchLab went live two weeks ago, and it struggled initially. However, token launches have recently experienced a significant surge, as shown in the graph below. The platform has also seen a sharp increase in daily active wallets, peaking this week at 30,530 after a drop following the first few days of the protocol’s debut.

LaunchLab token launches chart. Source: K33 Research

LaunchLab active wallets chart. Source: K33 Research

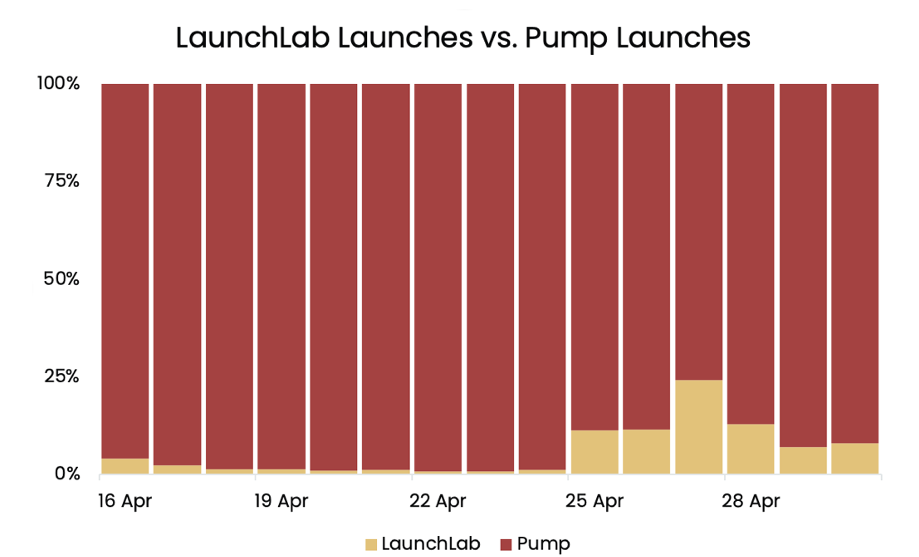

Within its first two weeks, “LaunchLab has managed to capture up to 24% of daily new memecoin launches when compared to Pump. While Pump remains very dominant, this early momentum is notable,” says Zimmerman.

The analyst noted that LaunchLab is not the first challenger for Pump’s crown. Tron’s memecoin launchpad, SunPump, had some early success and peaked at 51% of daily new memecoin launches in August last year. However, currently, SunPump has faded almost entirely into insignificance.

Whether LaunchLab is destined for the same fate remains to be seen, but being intrinsically tied to Solana’s leading DEX gives it a distinct edge over previous Pump challengers.

LaunchLab launches vs. Pump launches chart. Source: K33 Research

Challenges and competition for LaunchLab

Despite a promising start, LauchLab faces a key challenge: breaking Pump.fun’s cultural stranglehold. Its reputation for simplicity, meme virality, and fast action has created a loyal user base.

Meanwhile, Raydium offers superior economics and flexibility, its automatic integration into Raydium’s automated market maker (AMM) pools – which enjoy significant Solana-wide trading volume – is an advantage that PumpSwap cannot easily match.

The next phase of this competition may hinge on incentives. Pump.fun is reportedly exploring revenue sharing and a native token airdrop, moves that could boost user retention. Raydium, meanwhile, leads in liquidity depth, giving LaunchLab tokens a trading advantage on-chain. The team has also hinted at upcoming enhancements to tokenomic design and marketplace integrations.

Which platform will deliver the next viral meme coin?

The report concluded that Pump.fun still wears the cultural crown in Solana’s memecoin space, but LaunchLab is quickly gaining credibility with its creator-friendly framework and rising user engagement.

“Ultimately, the real winner will be the platform that can give on-chain traders what they want – big runners,” says the analyst.

The next FARTCOIN-sized success will likely propel traders toward that launchpad platform, chasing raw virality, provided Bitcoin (BTC) can maintain a strong position above $90,000.