What to Expect from XRP in May 2025

XRP is up 7% over the last week of April, but May 2025 could bring even bigger moves as major catalysts line up. Key metrics like NUPL and active addresses show a market at a crossroads, with strong optimism and warning signs.

Hype around ETF approvals has stirred volatility, and real institutional inflows could decide XRP’s next major trend. Traders should prepare for a month where both sharp rallies and deep corrections remain firmly on the table.

XRP NUPL Signals Rising Confidence, but ETF Rumors Stir Volatility

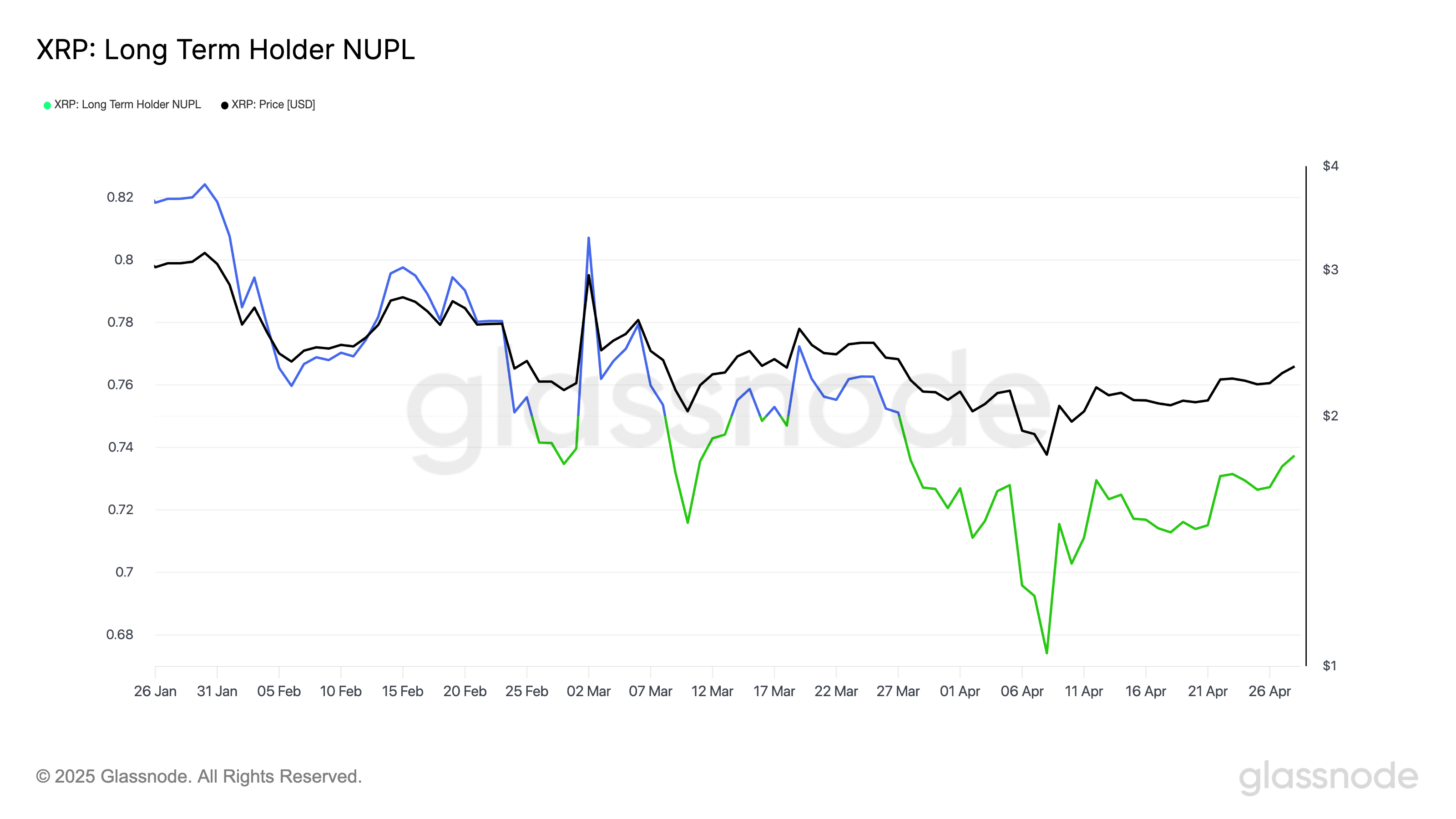

XRP Long-Term Holders Net Unrealized Profit/Loss (NUPL) is currently at 0.73. This places it firmly in the “Belief – Denial” stage of the market cycle. The indicator measures the average unrealized profit among long-term holders.

It has been stuck in this zone since March 27, over a month ago. In general, NUPL values above 0.75 indicate “Euphoria—greed.”

Readings between 0.5 and 0.75 show belief that prices can rise, but there is also the risk of denial if momentum weakens.

The current value has risen from 0.68 three weeks ago to 0.73 today. Long-term XRP holders are seeing larger paper gains. Still, the market could soon face a critical moment where either continuation or a correction emerges.

XRP Long-term Holders NUPL. SourceGlassnode.

XRP Long-term Holders NUPL. SourceGlassnode.

Rumors about an SEC-approved spot XRP ETF have recently caused confusion, adding more fuel to market volatility. In reality, only ProShares’ leveraged and short XRP Futures ETFs were approved to begin trading on April 30. A true spot ETF has not been approved.

Although the futures approval is seen as a positive step for XRP’s long-term legitimacy, spreading false information has damaged investor confidence. It has also created unnecessary instability.

Despite that, analysts have suggested XRP market cap could surpass Ethereum’s. Rumours around a XRP and SWIFT partnership have also risen in the last month.

Some experts predict that a future spot ETF could eventually drive up to $100 billion in capital inflows into XRP. However, until that happens, volatility driven by rumors and miscommunication remains a major risk for the token.

XRP User Engagement Slows as Active Addresses Stay Below 200,000

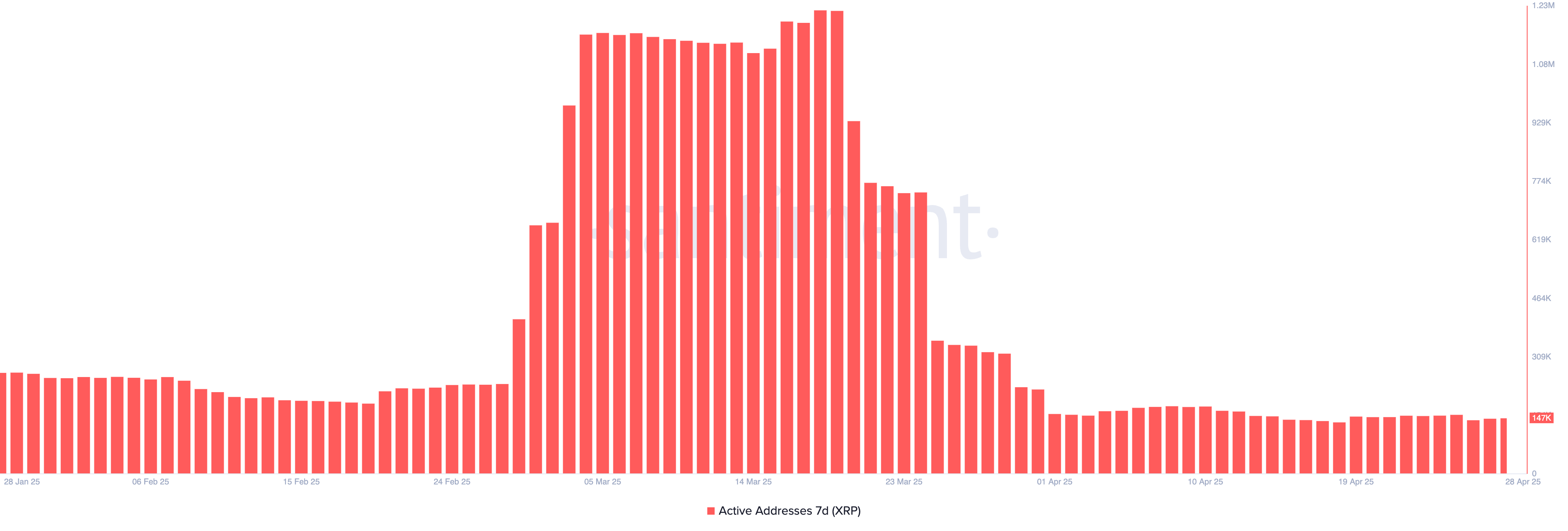

XRP’s 7-day active addresses have dropped significantly, currently at 147,000, compared to their all-time high of 1.22 million, which reached March 19.

This steep decline reflects a broader cooldown in network activity after the massive surge seen earlier this year.

Monitoring active addresses is crucial because it offers real-time insight into user engagement, transaction volume, and overall ecosystem health—lower address activity often signals waning interest, reduced transaction flow, and a softer foundation for sustained price growth.

XRP 7-Day Active Addresses. SourceSantiment.

XRP 7-Day Active Addresses. SourceSantiment.

Since April 1, XRP’s 7-day active address count has consistently stayed below 200,000, reinforcing that user activity has yet to recover fully.

While the drop does not necessarily mean a major price collapse is imminent, it highlights a critical point: strong rallies are often backed by growing network participation.

Without a meaningful pickup in active addresses, XRP could struggle to maintain momentum or ignite a new bullish phase soon.

XRP ETF Approval Could Trigger 49% Rally, But Downside Risks Remain

The final approval of a Spot XRP ETF could become a major catalyst for the token’s price. It would potentially unlock significant institutional inflows. Recently, the world’s first XRP ETF began trading in Brazil.

Experts predict that, if real demand follows the approval like it did with Bitcoin, XRP price could rally sharply. The next major upside target is $3.40, representing a 49% increase from current levels.

This move would be driven by fresh inflows, greater mainstream acceptance, and a tightening supply as more investors gain direct exposure through regulated channels.

XRP Price Analysis. Source: TradingView.

XRP Price Analysis. Source: TradingView.

On the downside, if momentum fails to recover and a strong downtrend takes hold, it could face a sharp correction. A break below the psychological $2.00 level would expose the token to deeper losses, with the next major support around $1.61.

Such a move would imply a 29% drop from current prices, reflecting a scenario where optimism around ETFs fades and selling pressure takes over.

In this case, XRP could remain stuck in a broader consolidation or bearish phase until stronger catalysts appear.