Arizona state approves first ever US Bitcoin reserve, set to invest 10% of $31.5B state assets

- Arizona state lawmakers have passed a bill allowing the state to invest up to 10% of public funds in digital assets, including Bitcoin.

- The legislation also establishes a Digital Assets Strategic Reserve Fund, utilizing seized crypto assets and future appropriations.

- The Senate bills 1025 and 1373 now await final confirmation from state Governor Katie Hobbs.

The state of Arizona took a major step toward public Bitcoin adoption in the US as lawmakers passed two bills enabling direct investment of public funds in digital assets.

Arizona lawmakers approve bills to Invest state assets in Bitcoin and NFTs

Arizona has moved a step closer to becoming the first U.S. state to establish a Bitcoin reserve. Lawmakers in the House of Representatives on Monday approved Senate Bill 1025 and Senate Bill 1373, clearing the way for a potential 10% allocation of treasury and pension funds into Bitcoin and other digital assets.

The legislation, now awaiting Governor Katie Hobbs' signature, would authorize Arizona’s treasurer to invest up to 10% of state-managed assets in digital currencies.

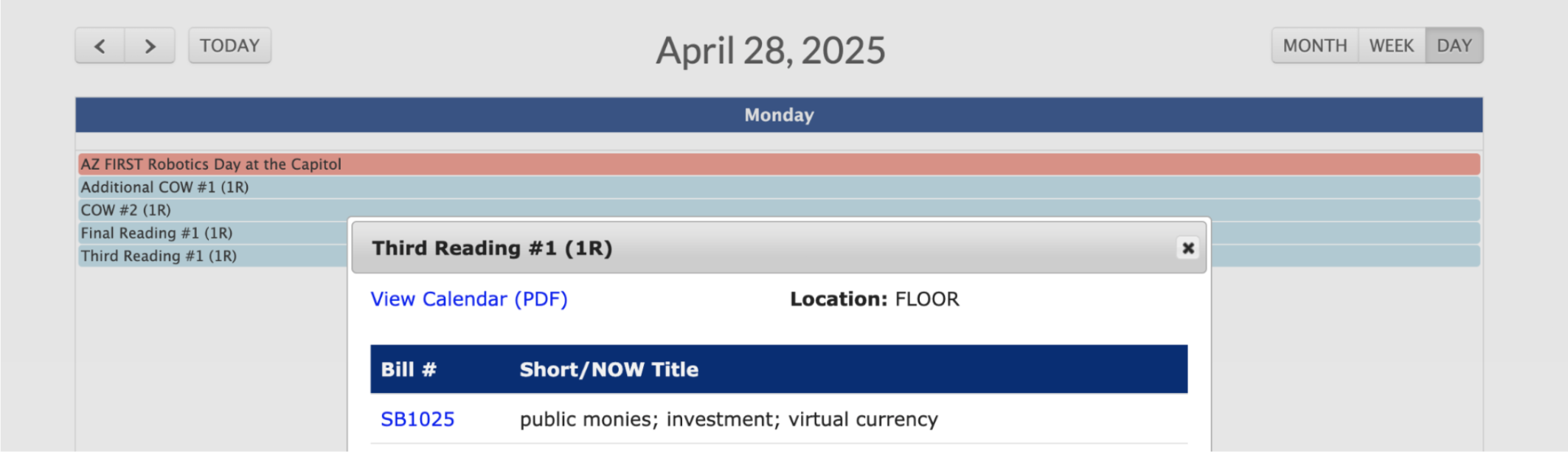

Arizona state approves SB 1025 crypto reserve bill, April 28 | Azleg.gov

Additionally, the bills established a Digital Assets Strategic Reserve Fund to hold seized crypto assets and future appropriations, with mandates for on-chain auditability and standardized risk controls.

Arizona’s initiative mirrors ongoing legislative momentum in states like Texas, Florida, and New Hampshire, as local governments explore Bitcoin-backed reserve strategies to attract blockchain innovation and diversify public asset portfolios.

If enacted, Arizona would become the first U.S. state to formally hold Bitcoin in its treasury.

What's Next? Markets await Governor Hobbs’ confirmation

Given Arizona’s potential to set a national precedent for Bitcoin’s integration into public finance frameworks.

Following the vote, Bitcoin traded near $95,000, after a rapid 25% recovery from the monthly time frame lows recorded earlier in April.

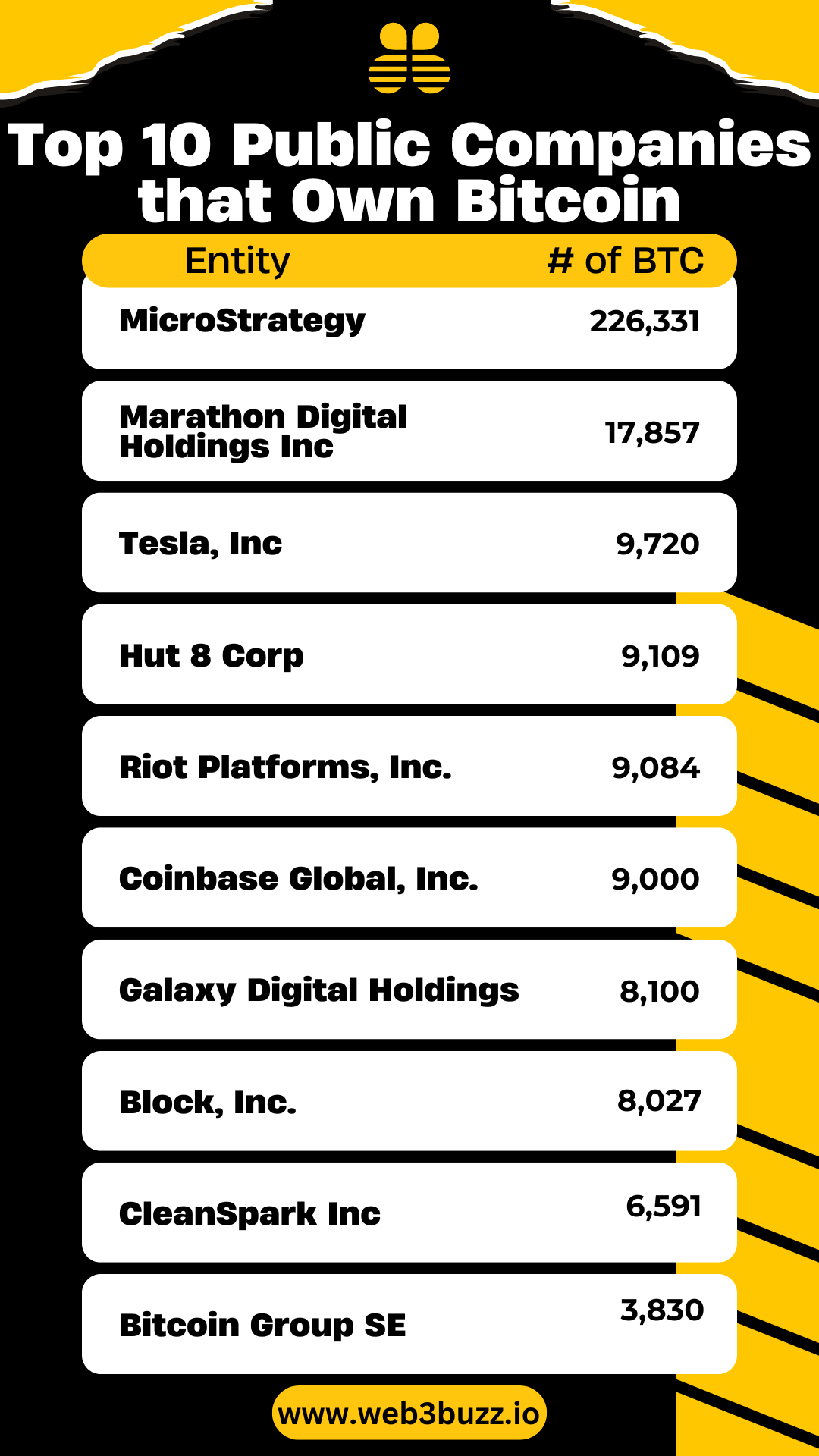

Corporate Bitcoin Holders as of April 2025

Renewed institutional appetite for Bitcoin, alongside moves by states like Arizona to validate Bitcoin as a sovereign reserve asset, continues to bolster market momentum.

Notably, Governor Hobbs, recently eased a veto threat linked to disability funding disputes after reaching a bipartisan agreement on April 24. However, the Governor has not yet signaled her position on the Bitcoin bills.

A signature would immediately authorize the allocation process, while a veto could override the bill and put all budgetary allocations on pause.

Looking ahead: How much can Arizona invest in Bitcoin?

Arizona’s total public assets under management are substantial. As of 2023, the Arizona State Treasury oversaw more than $31.4 billion in assets, according to official data.

A 10% allocation, as permitted under Senate Bill 1025, would authorize up to $3.14 billion to be invested in digital assets, including Bitcoin and NFTs.

The legislation identifies Bitcoin and select "non-fungible blockchain-based assets" as eligible investments, emphasizing the need for high-liquidity, high-security instruments.

The bills further mandate that investments must comply with standard fiduciary risk management protocols, ensuring that public funds remain protected against volatility and custodial risks.

If fully deployed, a $3.14 billion Bitcoin reserve would acquire about 31,000 BTC. This would immediately make Arizona the second-largest institutional Bitcoin holder among U.S. public entities, exceeding the holdings of major corporate holders like Tesla and Marathon Digital, the largest Bitcoin mining firm.

Looking ahead, this development could set a precedent for other states and sovereign governments outside the US seeking modern means to bolster public reserves.