Crypto Whales Continue to Buy TRUMP Despite Political Controversy

Despite political controversies surrounding the Trump Gala Dinner event, the crypto market has recently witnessed a significant accumulation wave of the TRUMP token, a meme coin associated with the Trump family.

These activities reflect strong interest from major investors, often called “whales,” and highlight the TRUMP token’s growth potential amidst a volatile market.

Whales’ accumulation to secure VIP tickets

The accumulation trend for the TRUMP token gained momentum as large investors consistently executed noteworthy transactions.

On April 28, 2025, a whale withdrew 190,987 TRUMP tokens from Binance, increasing its total holdings to 1.389 million tokens, equivalent to $20.59 million. This investor, known by the alias “MeCo,” currently holds the second position among the top holders vying for a spot at the Trump Gala Dinner, trailing only Justin Sun.

On the same day, another whale bolstered its holdings by adding 92,460 TRUMP tokens, belonging to the top 125 holders.

Before that, on April 27, a savvy trader swapped 1.18 million Fartcoins for 78,671 TRUMP tokens. Moving to April 26, a prominent whale reinvested early profits and additional funds, purchasing $5.73 million worth of TRUMP tokens.

Also on that day, a whale withdrew 413,530 TRUMP tokens from a CEX platform.

These transactions reveal a clear trend: major investors are accumulating TRUMP tokens to secure their spots at the Trump Gala Dinner, an exclusive event reserved for top token holders.

Challenges starting

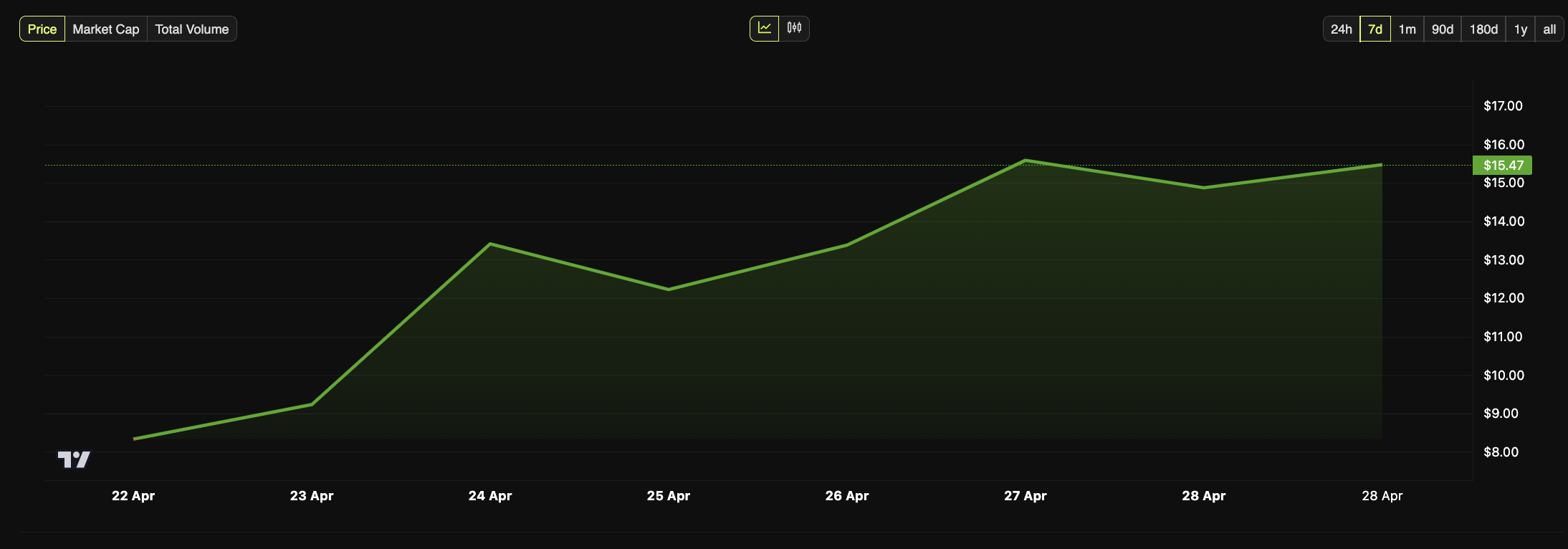

Despite these activities, TRUMP has shown positive performance signals in the market. According to data from BeInCrypto, the price of TRUMP surged by 84% over the past seven days, outpacing many other cryptocurrencies.

TRUMP price. Source: BeInCrypto

TRUMP price. Source: BeInCrypto

The spot trading volume of TRUMP on Binance also skyrocketed by 202% within nine days. However, despite these positive indicators, the Trump Gala Dinner has sparked intense political controversy.

On April 25, 2025, two US Senators, Adam Schiff and Elizabeth Warren, sent a letter to the U.S. Office of Government Ethics. They called for an investigation into the event because they believed it violated federal ethics regulations.

The Senators expressed concerns that the event could constitute a “pay-to-play” scheme. Investors pay for political access, as Trump promised a private dinner on May 22, 2025, for the top.

Following this announcement, the TRUMP token’s value surged over $100 million. This raised suspicions that the Trump family might leverage their political influence for profit.

Schiff and Warren also questioned whether Trump or his family had received guidance on profiting from digital assets during his tenure. And what safeguards exist to prevent the purchase of political access through TRUMP token investments?

This controversy has sparked broader questions about the intersection of cryptocurrency and politics, particularly as more public figures engage with the crypto market.

Furthermore, as previously reported by BeInCrypto, there is speculation that Trump might use the Trump Gala Dinner to promote a new NFT project.

In summary, the accumulation wave of TRUMP tokens to attend the Trump Gala Dinner shows this meme coin’s strong financial appeal due to its social and political significance. Positive price and trading volume data reinforce investor confidence in TRUMP’s growth potential.

However, the political controversies surrounding the event also introduce significant risks. Investors should remain vigilant, closely monitoring market developments and related legal factors.