Arthur Hayes says Treasury buybacks are about to launch Bitcoin past $110K toward $200K

Arthur Arthur believes Bitcoin will smash past $110,000 and climb toward $200,000, powered by a silent force hiding in plain sight—US Treasury bond buybacks.

The former BitMEX CEO dropped the entire theory in his new essay “Ski Cut,” where he explained how a liquidity trick buried inside the bond market is going to melt faces.

Arthur explained the Treasury Department started the buyback program years ago. Now it’s back, bigger, and more aggressive. The setup is simple. The Treasury sells a new bond. Then it takes that cash and buys old, inactive bonds—so-called off-the-run bonds—which barely trade.

When that happens, prices of those dusty bonds go up because the Treasury becomes the only buyer that matters. That price jump helps RV funds—hedge funds running relative value strategies—lock in fast profits. They unload the overpriced bonds, shut down their short futures positions, and grab the gains.

Bessent needs leverage junkies to buy more bonds

The US bond market is currently being greased by this buyback loop. And Arthur believes Treasury Secretary Scott Bessent knows exactly what he’s doing, so he can push as many buybacks as he wants.

Congress doesn’t need to approve this, because technically it’s just the Treasury replacing one type of debt with another. “The trade is cash flow neutral,” Arthur said. The Treasury doesn’t borrow new money—it just swaps the old bonds for fresh ones of the same size with a primary dealer.

Arthur warned this is only happening because Elon Musk, who’s running the Department of Government Efficiency (DOGE), couldn’t hit his promised savings.

Elon projected $1 trillion in cuts per year. That crashed to just $150 billion. Arthur said the government will keep spending like a degenerate gambler, and someone needs to buy the debt. Right now, that’s the leveraged traders.

By March, the FY25 deficit was already 22% higher than FY24 at the same time. Arthur said falling stock prices, tariffs, and shaky businesses mean tax revenue will drop. That’s a problem.

If the government spends the same but collects less, the deficit gets wider. Bessent will have no choice but to issue more debt. And to avoid a meltdown, RV funds have to load up. Buybacks are the only way to make that happen.

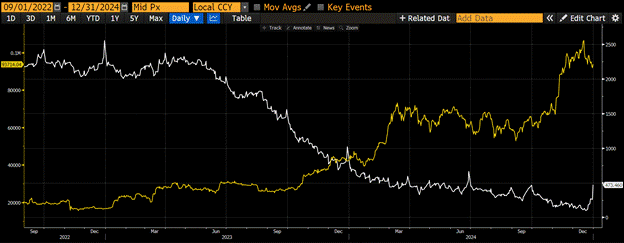

Arthur pointed out that the same trick happened back in Q3 2022. That was when Sam Bankman-Fried crashed, the Fed kept hiking, and former Treasury Secretary Janet Yellen had to stop the bleeding.

Powell wouldn’t help, so Yellen used T-bills to suck cash out of RRP accounts, which added $2.5 trillion of liquidity, and Bitcoin shot up almost 6x. Arthur said it’s happening again. People are waiting for Powell to ease rates. Arthur said, “He won’t. He can’t. He’ll sit there and stew.”

Even though some traders think Bitcoin is headed back below $60,000, Arthur thinks they’re clueless. “They don’t understand the buybacks are flooding the market with dollar leverage,” he said. The last time traders missed it, they got caught off guard and were forced to chase the rally.

May will confirm everything. On May 1, the Treasury’s QRA will drop, showing how much more debt Bessent plans to issue. Then mid-May, the April tax receipts will come in. If the deficit keeps widening, Arthur said the buybacks will go full throttle.

If that’s not enough to calm things down, Arthur said the Fed could still help indirectly. One option is to exempt Treasuries from the Supplemental Leverage Ratio (SLR), which would let banks buy bonds with no cap.

Another is a QT Twist, where cash from expiring mortgage bonds gets reinvested into fresh treasuries. That would push $35 billion a month into the market for years.

Arthur said Bitcoin will separate from tech stocks and sit next to gold as the digital hedge. And once Bitcoin clears $110K, Arthur expects a blowoff. “Maybe it just misses $200K.” After that, altcoins run. But he warned only a few tokens actually earn revenue and reward holders.

Until then? “Back up the truck, and buy everything,” said Arthur.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot