Bitcoin Price Faces 3-Month Stagnation at $85,000, Fear Plagued Holders Pullback

Bitcoin has been facing consistent struggles over the past few months, with recent attempts at recovery falling short of expectations.

The cryptocurrency king, currently priced at $83,768, has encountered resistance at $85,000 multiple times this month. This failure to break the resistance is causing increased uncertainty among investors.

Bitcoin Investors Are Uncertain

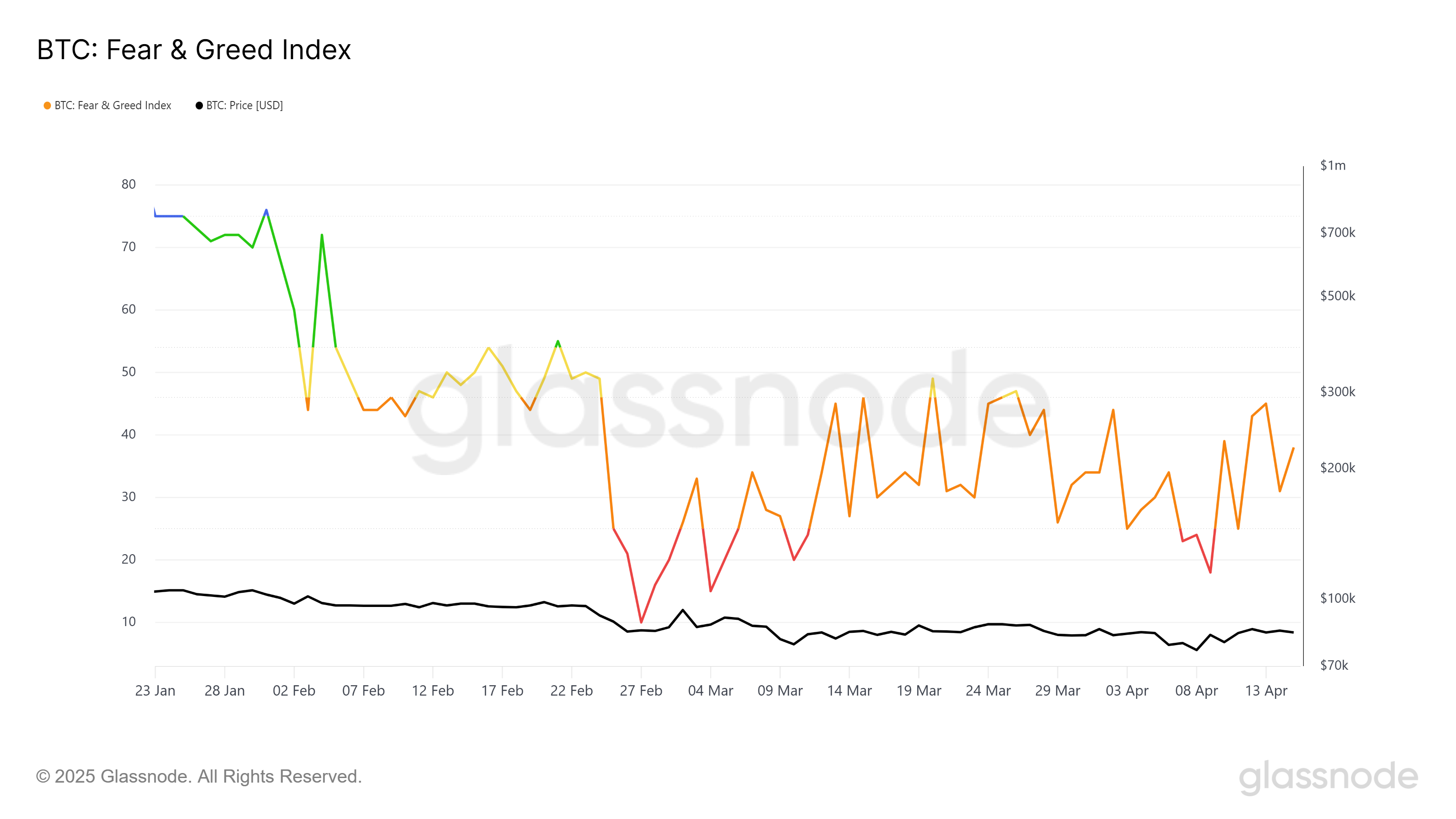

Bitcoin’s Fear and Greed index reveals a prevailing sense of fear among BTC holders. Since early March, this fear has intensified as the market conditions remain unresponsive to positive cues. As Bitcoin’s price stagnates and struggles to regain bullish momentum, investor confidence continues to wane.

The current atmosphere is reflected in the overall sentiment, with many investors refraining from making significant moves in the market. This indicator also suggests that Bitcoin holders are avoiding riskier investments and holding back from market participation.

Bitcoin Fear And Greed Index. Source: Glassnode

Bitcoin Fear And Greed Index. Source: Glassnode

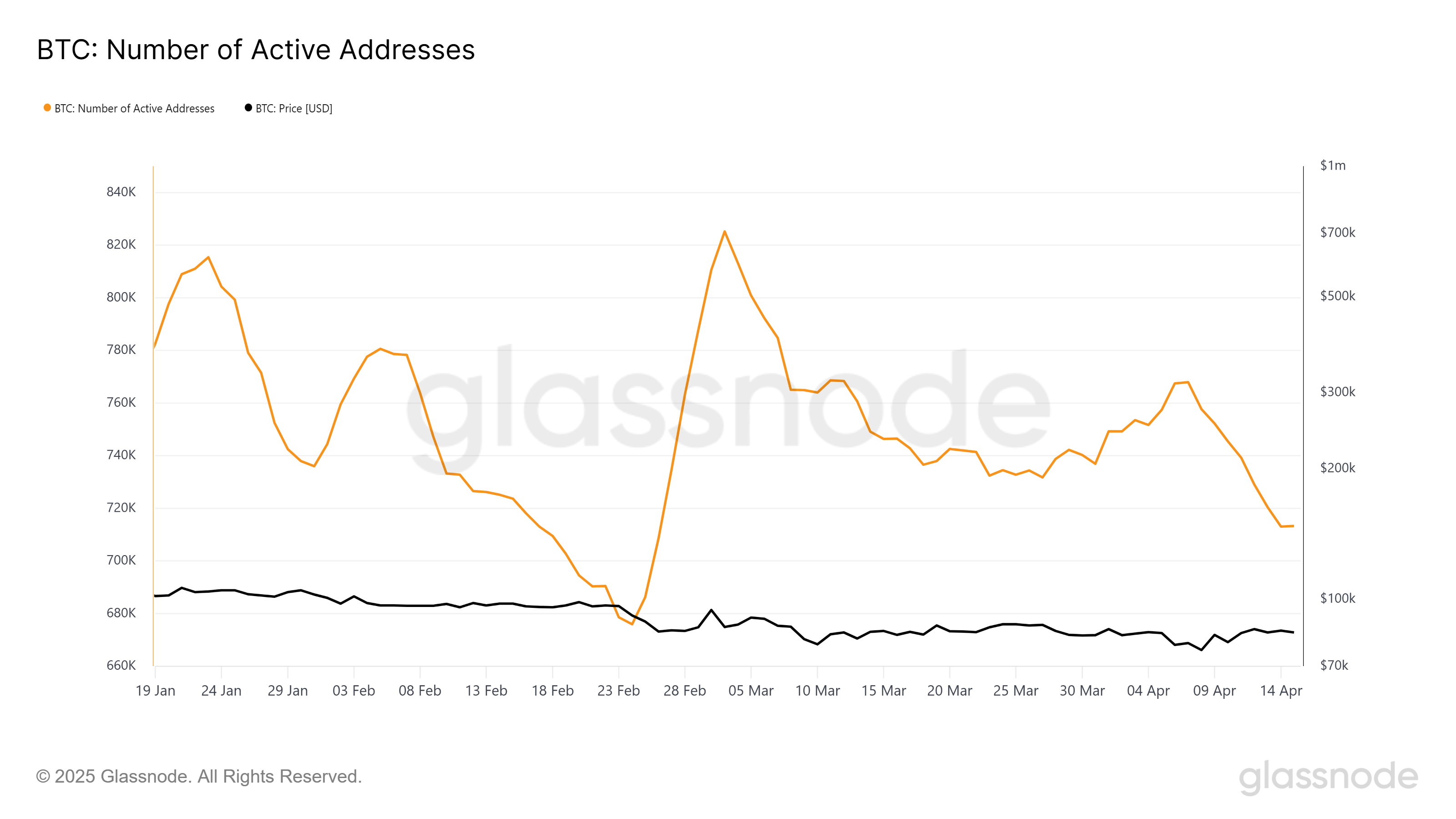

The overall macro momentum of Bitcoin also points to hesitation among market participants. Active addresses on the Bitcoin network are at a nearly two-month low, suggesting reduced engagement.

This decline is indicative of holders pulling back and showing less interest in making transactions or moving their coins. The lack of enthusiasm to participate in the network indicates that investors are uncertain about the future direction of the market.

Bitcoin Active Addresses. Source: Glassnode

Bitcoin Active Addresses. Source: Glassnode

Can BTC Price Breach $85,000

Bitcoin is currently experiencing a downtrend that has persisted for three months, with the price hovering at $83,768. Despite several attempts to breach the $85,000 resistance, Bitcoin has failed to maintain upward momentum. The repeated rejections at this level indicate significant resistance, which may result in further price stagnation.

If the bearish sentiment continues and investor fear remains elevated, Bitcoin could fall below the current support of $82,619. A drop to $78,481 is a possibility, extending the downtrend and deepening the losses for holders. This could further reinforce the sense of uncertainty in the market.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin manages to breach the critical $85,000 resistance level, it could spark a rally towards $87,344. Successfully breaking this barrier may invalidate the current bearish outlook, pushing Bitcoin towards $89,800 and providing a fresh outlook for the cryptocurrency.