Bitcoin Drops as China Escalates Trade War With 34% Tariff on US Imports

On April 4, 2025, China responded to the latest US tariff imposition by imposing an additional 34% tariff on all goods imported from the US. This escalates the already tense trade war between the two largest economies in the world.

Bitcoin dropped 3% within hours of the announcement, briefly falling below $82,000. This latest development has caused concern among investors, analysts, and participants in the cryptocurrency sector about its potential impact.

Bitcoin Investors Worry About The Escalating Trade War

According to Xinhua News Agency, China will impose a 34% tariff on all products imported from the US starting April 10. Xinhua reported that the US’s “Reciprocal Tariff” violated WTO rules, severely damaging the legal and legitimate rights of WTO members and undermining the multilateral trade system and the international trade order based on rules.

“This is a typical act of unilateral hegemony that harms the stability of the global economic and trade order. China firmly opposes this,” The spokesperson for the Ministry of Commerce said in an interview about China’s lawsuit against the US’s “Reciprocal Tariff” at the WTO.

Previously, President Trump had imposed a 34% tariff on China in addition to the 20% tariffs already imposed in two phases. This means a total of 54% tariffs were applied to China.

News from China has caused concern among crypto investors. On April 4, Bitcoin’s price dropped from $84,600 to $82,000, a 3% decrease.

Bitcoin Price Performance. Source: BeInCrypto.

Bitcoin Price Performance. Source: BeInCrypto.

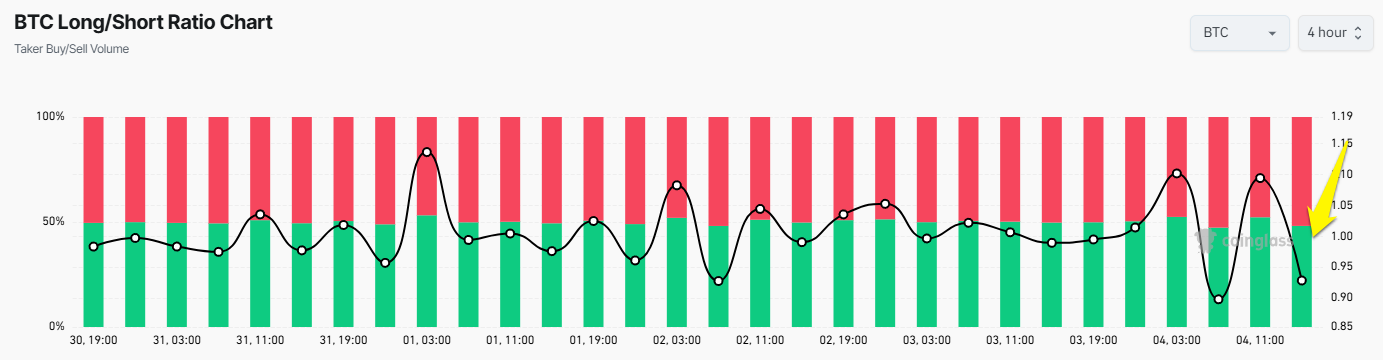

At the same time, following the news, the Long/Short ratio of Bitcoin dropped below 1, indicating a growing sentiment for short-selling, which has become dominant in the market.

BTC Long/Short Ratio Chart. Source: Coinglass.

BTC Long/Short Ratio Chart. Source: Coinglass.

Both Bitcoin and other markets have been affected. The S&P 500 fell from 5,260 points to 5,250 points, while the Dow Jones Industrial Average dropped from 41,100 points to 40,500 points. China’s actions have raised concerns about the potential escalation of the global trade war.

“The ‘Third World War’ of the trade war has begun,” The Kobeissi Letter commented.

What Will Happen to Bitcoin When The US-China Trade War Escalates?

This cryptocurrency, often praised as a hedge against economic instability, tends to behave like a risky asset during sudden uncertain periods. Historical patterns support this reaction—during the US-China trade war in 2018-2019, Bitcoin experienced significant sell-offs as tariffs escalated, only recovering when the narrative of value preservation took precedence.

A significant portion of the global cryptocurrency hardware supply chain comes from China, where companies like Bitmain dominate the production of ASIC mining machines—important devices for Bitcoin mining.

With the US now facing a 34% tariff on technology imports from China, the cost of importing these mining machines is expected to rise dramatically. Bitcoin miners in the US, already facing high energy costs and competitive pressure on hashrate, may see their profits shrink further.

However, the long-term outlook for Bitcoin may not be as bleak as the initial market reaction. Some analysts suggest that prolonged trade wars and economic friction could enhance Bitcoin’s appeal as a decentralized asset unaffected by government intervention. If tariffs lead to inflation or weaken fiat currencies like the USD, investors may turn to cryptocurrencies as a safe haven.

“It’s not gold, and it’s not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset – one that doesn’t crumble like high-growth stocks but also doesn’t attract the same flight-to-safety flows as traditional safe havens,” Nexo Dispatch Editor Stella Zlatarev told BeInCrypto.

This sentiment aligns with research indicating that instability often causes initial price drops but can pave the way for growth as acceptance increases.