NZD/USD remains subdued following the improved data from New Zealand.

China's Caixin Manufacturing PMI rose to 50.4 in June from 48.3 in May.

The US Dollar struggles amid rising Fed uncertainty and US fiscal concerns.

NZD/USD edges lower after registering more than 0.50% losses in the previous session, trading around 0.6090 during the Asian hours on Tuesday. The pair remains subdued following the release of the economic data from New Zealand and its close trading partner, China.

NZIER Business Confidence rose by 22% quarter-over-quarter in the second quarter, up from the previous 19%. Moreover, the seasonally adjusted Building Permits rose by 10.4% month-on-month in May, reaching a seasonally adjusted total of 3,151 units.

China's Caixin Manufacturing Purchasing Managers' Index improved to 50.4 in June from 48.3 in May, according to the latest data released on Tuesday. The reading surpassed the market forecast of 49.0. This is important to note that any economic change in China could impact AUD as both countries are close trade partners.

The downside of the NZD/USD pair could be restrained as the US Dollar (USD) extends its losing streak amid growing uncertainty over the Federal Reserve (Fed) policy outlook and a rising fiscal concern in the United States (US). Additionally, traders adopt caution over a sweeping tax and spending bill currently under consideration in the Senate, which could add $3.3 trillion to the national debt.

Traders are likely awaiting the US employment data during the week, including the US June ISM Manufacturing Purchasing Managers Index (PMI) data due later on Tuesday. The labor market figures would help in shaping the US Federal Reserve (Fed) policy stance for July.

New Zealand Dollar PRICE Today

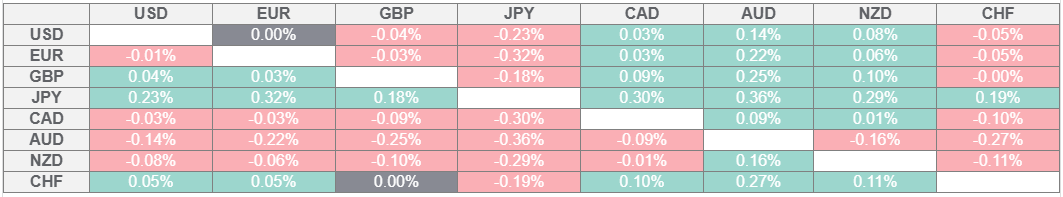

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.