How will BNB price react as Binance and Kraken delist USDT for EU countries?

- Binance will halt USDT trading in the EU from April 1, to comply with MiCA regulations.

- Non-compliant stablecoins like DAI and TUSD will also be removed, with USDC promoted as a MiCA-compliant alternative.

- Other exchanges, including Kraken and Crypto.com, are adjusting their policies to align with MiCA’s new stablecoin rules.

BNB price hovers near $593 as Binance and Kraken delist USDT for customer resident within the EU, triggering uncertainty under MiCA regulations.

Binance halts USDT spot trading in EU as MiCA shakes up stablecoin sector

On Monday, Binance officially discontinued spot trading pairs involving Tether’s USDT in the European Economic Area (EEA) to align with the European Union’s Markets in Crypto-Assets Regulation (MiCA).

As exchanges begin to comply with the new regulatory framework, this marks a significant shift in the region’s cryptocurrency regulations.

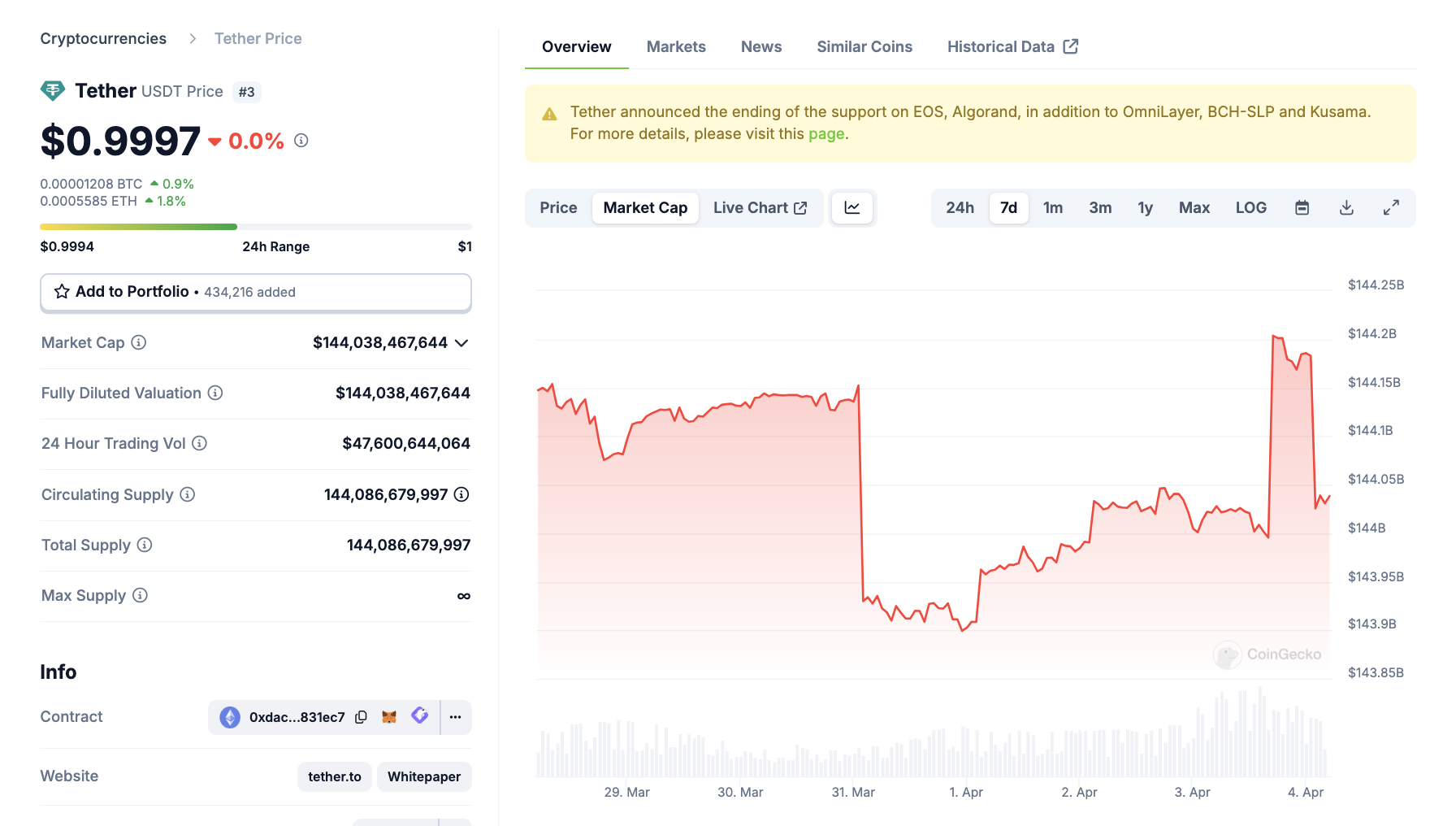

Tether (USDT) Stablecoin market cap, April 4 | Source: CoinGecko

Tether (USDT) Stablecoin market cap, April 4 | Source: CoinGecko

The move follows Binance’s early March disclosure that non-MiCA-compliant tokens, including USDT, would be delisted by March 31.

While spot trading for these tokens is now unavailable, EEA users can still custody the affected stablecoins and trade them in perpetual contracts on Binance.

Other non-compliant stablecoins removed from spot trading include Dai (DAI), First Digital USD (FDUSD), TrueUSD (TUSD), Pax Dollar (USDP), and TerraClassicUSD (USTC).

Other centralized exchanges follow Binance’s lead

Binance is not alone in adjusting to MiCA regulations. Kraken, another leading cryptocurrency exchange, announced its plan to delist USDT and other non-compliant stablecoins from spot trading in February.

By March 24, Kraken had shifted USDT to sell-only mode, preventing EEA users from purchasing the asset. The exchange’s delisting roadmap also includes PayPal USD (PYUSD), Tether EURt (EURT), and TrueUSD (TUSD).

Despite these trading restrictions, European Securities and Markets Authority (ESMA) officials have clarified that custody and transfer services for non-compliant stablecoins do not violate MiCA rules.

However, the regulator has advised European crypto service providers to halt all transactions involving the affected tokens, contributing to ongoing uncertainty regarding compliance.

BNB price forecast: $600 breakout remains in play despite Binance’s stablecoin shuffle

BNB price is currently hovering at $593.51, hovering near key support at $586.39, as shown in the Bollinger Bands.

The lower band is acting as a crucial level, and a decisive break below it could open the door to a sharper decline toward $560. With BNB failing to reclaim the $600 psychological level, upside momentum remains weak.

The Relative Strength Index (RSI) sits at 44.30, indicating bearish sentiment.

The RSI’s struggle to rise above the neutral 50 mark suggests that sellers are in control. If the RSI drops further, it would confirm growing downside pressure, making a bearish continuation more likely.

BNB Price Forecast

BNB Price Forecast

With Binance positioning USDC as the preferred regulatory-compliant stablecoin for EEA users, many EU-based traders now have to readjust their trading portfolio.

This increased market activity could spark demand for BNB, potentially halting losses at key support levels.

More so, BNB trading volume analysis reveals declining buying activity, a key bearish indicator.

Green candles with low volume signal weak demand, making BNB vulnerable to a breakdown. If sellers push the price below $586, the next support zone could be around $560.

However, reclaiming $600 and pushing past $616.84 could invalidate the bearish BNB price forecast and reintroduce positive momentum for a potential rally towards $700.