Bitcoin Price Forecast: BTC recovers as dominance increases, signaling a shift amid market stress

- Bitcoin price recovers slightly, trading above $84,000 on Tuesday after falling 4.29% the previous week.

- Crypto Finance reports that Bitcoin’s dominance rose to 61.4%, reflecting a shift toward BTC as a resilient asset amid market stress.

- Economic uncertainties, Trump’s tariffs and stagflation risks may pressure Bitcoin due to its correlation with Equities amid risk-off sentiment.

Bitcoin (BTC) price recovers slightly, trading above $84,000 at the time of writing on Tuesday after stabilizing on Monday following a 4.29% decline the previous week. Crypto Finance reports that Bitcoin’s dominance rose to 61.4%, reflecting a shift toward BTC as a resilient asset amid market stress and supporting its recovery. However, traders should remain cautious as economic uncertainties, United States (US) President Donald Trump’s tariffs and stagflation risks may pressure Bitcoin downward due to its correlation with Equity markets amid risk-off sentiment.

Bitcoin recovers as dominance hits 61.4%, and Tether adds $735 million worth of BTC

Bitcoin price stabilized around $82,500 on Monday after a 4.29% fall last week. However, during the early European session on Tuesday, BTC recovers slightly, trading above $84,000 and gaining 2% in the day.

According to a Crypto Finance report on Tuesday, the growing divergence between BTC and the rest of the market suggests continued defensive positioning within crypto.

“Bitcoin dominance increased to 61.4%, underscoring a rotation toward BTC as the relatively more resilient asset during market stress,” says the report.

The report further explains that as long as macro uncertainty and elevated volatility persist, BTC will likely retain its relative strength. However, if risk appetite returns, some mean reversion in ETH/BTC and broader altcoin performance could follow. The market structure favors caution for now, with Bitcoin dominance likely to remain elevated in the short term.

Additionally, Bitcoin’s recovery was further supported by the news that Tether, the company that issues the USDT stablecoin, withdrew 8,888 BTC worth $735 million from Bitfinex’s hot wallet on Tuesday, adding to its Bitcoin reserves. The firm’s Bitcoin reserve wallet currently holds $92,647 BTC, worth $7.65 billion, making it the sixth-largest Bitcoin wallet.

Such an event is generally a positive sign for Bitcoin. The withdrawals from an exchange’s hot wallet to a non-exchange address (like Tether’s reserve wallet) are often interpreted as a positive price signal because Bitcoin is no longer readily available for sale on the exchange, reducing selling pressure in the short term. Tether’s purchase also signals strong institutional demand for Bitcoin.

Bitcoin could face downward pressure as economic uncertainties, Trump’s tariffs and stagflation risks elevate risk-off sentiment

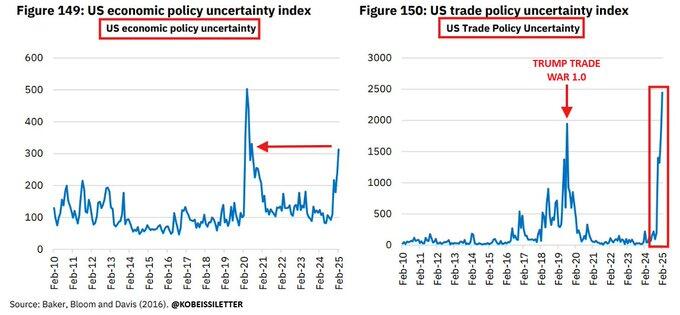

The Kobeissi Letter report on Monday highlights that the US Trade Policy Uncertainty Index is currently 25%, “ABOVE the Trump Trade War 1.0 high,” and says ‘This has NEVER happened in history.’

As explained in the previous report, high uncertainty and volatile market conditions often precede a risk-off sentiment in investors as they migrate toward safer assets like Gold, potentially dampening crypto demand.

US Economic Policy Uncertainty Index Chart

Moreover, the chart below by analyst Ray Wang shows that the tariffs threatened on the European Union (EU) will impact a whopping $600 billion of imports. These tariffs could lower US GDP by 70 basis points (bps) and add 40 bps to inflation.

“We believe stagflation has already begun,” says The Kobeissi Letter, which aligns with Goldman Sachs' warnings of a 35% recession chance within the next year.

The current economic environment marked by Trump’s tariffs, stagflation risks, and high uncertainty points to a challenging short-term outlook for Bitcoin, with likely downward pressure due to its correlation with Equities amid risk-off sentiment.

However, over the medium to long term, Bitcoin could benefit as a hedge against inflation, stagflation, and a weakening US Dollar (USD), especially if the Federal Reserve (Fed) pivots to a more dovish stance.

Traders should remain cautious and brace for volatility in the coming weeks, particularly around the tariff implementation date on Wednesday, the so-called “Liberation Day” by President Trump. At the same time, long-term investors might find opportunities to accumulate Bitcoin during dips if stagflation fears continue to grow.

Bitcoin Price Forecast: BTC recovers above $84,000

Bitcoin price was consolidating between $85,000 and $88,000 last week. However, it closed below its lower consolidation boundary on Friday and declined 5.53% until Sunday. BTC stabilized around $82,500 to start the week. At the time of writing on Tuesday, it recovers slightly, trading above $84,000.

The Relative Strength Index (RSI) indicator on the daily chart reads 45 and points upward toward its neutral level of 50, indicating weakness in bearish momentum. The RSI must move above its neutral level of 50 for the recovery rally to play out.

The Moving Average Convergence Divergence (MACD) lines coil against each other, indicating indecisiveness among traders.

In case BTC recovers, it could retest its daily resistance at $85,000. However, a successful break above this level could extend the recovery rally to the key psychological level of $90,000.

BTC/USDT daily chart

On the contrary, if BTC finds rejection from its daily resistance at $85,000, it could extend the decline to retest its next support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.