GameStop's plan to issue $1.3 billion convertible notes to buy Bitcoin could boost crypto market and meme coins

- GameStop announced that it will offer $1.3 billion worth of senior convertible notes in a private offering.

- The company stated it would use the proceeds from the convertible notes to purchase Bitcoin and for other corporate purposes.

- GameStop has historically stirred gains across meme coins but could begin having a wider impact on the general crypto market.

Video game retailer GameStop announced on Wednesday that it plans to issue senior convertible note offerings worth $1.3 billion. The company aims to use part of the proceeds from the offerings to buy Bitcoin.

GameStop plans to acquire Bitcoin through the sale of senior convertible notes

GameStop has announced plans to acquire Bitcoin as it explores opportunities in the cryptocurrency market. In a press release, the company revealed its intention to issue $1.3 billion in senior convertible notes with a 0% interest rate through a private offering to investors.

The notes are set to mature on April 1, 2030, unless they are redeemed or converted earlier. They will be generally unsecured obligations, will not accrue regular interest, and will maintain their principal amount throughout the holding period.

GameStop disclosed that the proceeds from the offering will be used for general corporate purposes and Bitcoin acquisition. However, the company did not specify the exact percentage or amount that will be allocated to its Bitcoin purchase.

The video game retailer earlier stated on Tuesday that it had made changes to its investment policy to include Bitcoin and stablecoins in its treasury reserve.

The company's latest venture into digital assets could positively impact the crypto market, similar to Strategy's — the largest corporate holder of BTC — influence.

GameStop has played a significant role in shaping the meme coin sector, particularly following its influence on the "meme" culture in 2021, contributing to various meme tokens' rise.

Notably, Dogecoin (DOGE) rallied over 370% in the short term during the GameStop short squeeze of 2021. Between January and May 2021, it stretched its rally by over 12,000% — other meme coins, including Shiba Inu (SHIB), also largely benefitted from the surge.

Additionally, the meme coin sector also saw notable gains when Keith Gill, aka Roaring Kitty — known for instigating the GameStop short squeeze on the r/wallstreetbets subreddit — returned online last year.

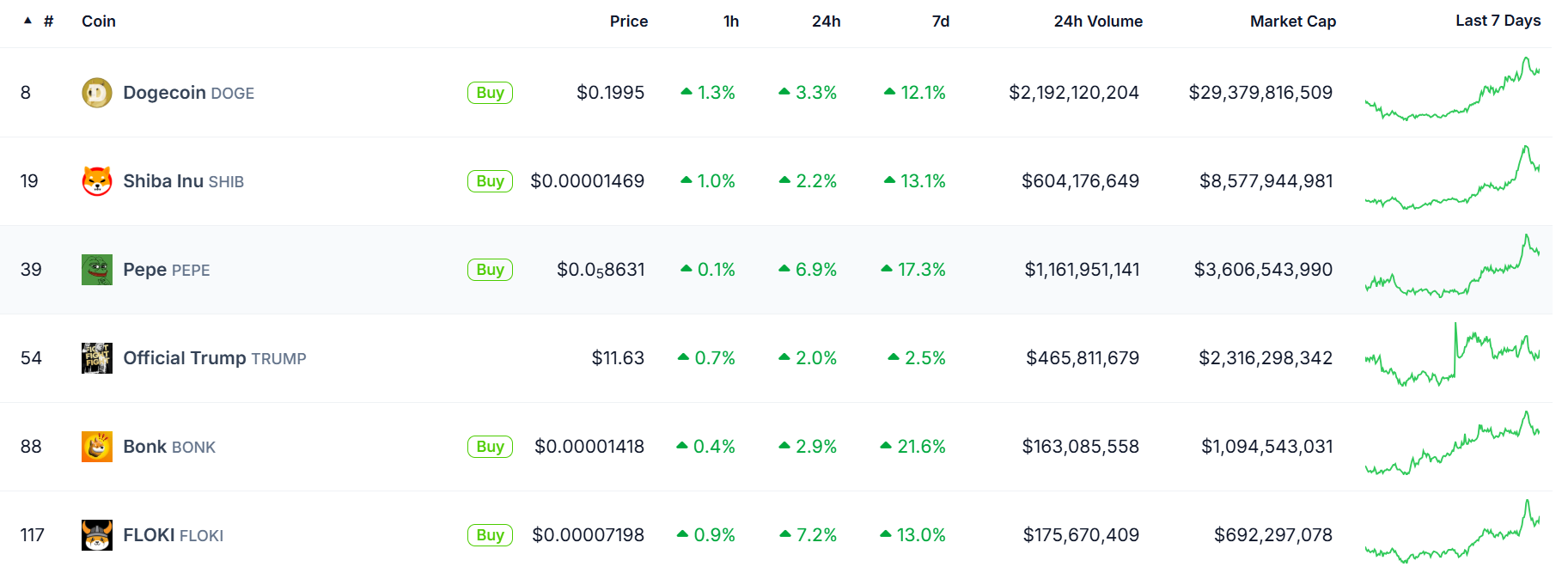

Since the GameStop Bitcoin announcement, GME stock has surged by 11%, while the broader meme coin market has also recorded notable gains, with DOGE, SHIB, PEPE and FLOKI trading in the green for a second consecutive day.

Meme coin category. Source: CoinGecko

Beyond the meme coin sector, GameStop's decision could impact the general crypto market.

"While this is not a first in the corporate adoption story, the symbolic weight of GME's meme status could rekindle speculative fervour among retail participants," QCP analysts stated in a note to investors on Wednesday. "As the 2021 playbook reminds us, retail flows, if coordinated, have the power to challenge institutional positioning," they added.

The crypto market is currently down 2%, suggesting market participants have not yet reacted to the GameStop announcement.