These crypto categories rallied over 50% in a day: Watch for gains

- Bitcoin price jumped as crypto traders reacted to the Federal Reserve’s decision to keep interest rates steady.

- Consensys portfolio and cross-chain communication tokens rallied between 77% and 85%, emerging as top-gaining cryptos in the past 24 hours.

- Top crypto tokens to watch for gains include Entangle, Axelar, LayerZero and ZKsync, among others.

Crypto traders rejoiced as Bitcoin’s (BTC) price climbed above support at $85,000 following the Federal Reserve’s (Fed) decision to keep interest rates steady and stick to their guidance of two interest rate cuts this year on Wednesday.

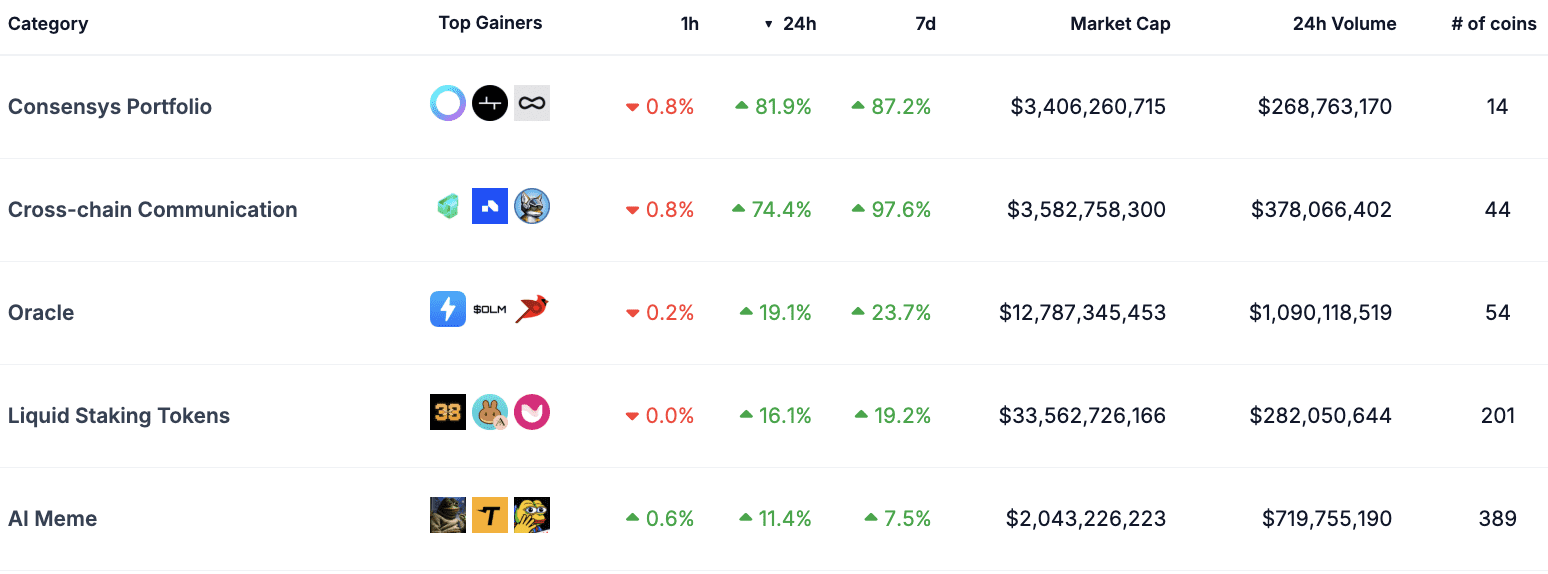

Two crypto token categories gained the most in the last 24 hours. The Consensys portfolio category, with most cryptocurrencies that rank between 100 and 1,000 in market capitalization, and the cross-chain communication tokens category rallied 74.4% and 81.9%, respectively.

Crypto token categories’ performance in 24 hours

Watch these two crypto token categories for gains

The rising correlation between US tech stocks, Bitcoin and cryptocurrencies becomes clearer with the response of these two crypto token categories on Wednesday.

The crypto tokens held in the Consensys portfolio and cross-chain communication categories emerged as the top gainers among other altcoins. Tokens like Entangle (NTGL), up 3.2% in the last 24 hours, Axelar (AXL), up 2%, LayerZero (ZRO), up 9.3% and ZKsync (ZK), up 3.5%, are the top gainers within the categories, ranking between 100 and 1,000 by market capitalization on CoinGecko.

With hackers using crypto mixers and transferring stolen funds across chains, the demand for cross-chain crypto communication tokens and the developments in the sector have increased its relevance.