Australian Libertarian Party Unveils Bitcoin Reserve Plan: Will BTC Surge?

The Libertarian Party of Australia has formally unveiled its new Bitcoin Policy Whitepaper, with a centerpiece proposal advocating for the establishment of an Australian Strategic Bitcoin Reserve (SBR). The announcement was made on March 8 during the BitcoinAlive event.

The event showcased the Libertarian Party’s vision for integrating Bitcoin into Australia’s financial and regulatory framework. While the party remains relatively small compared to the nation’s two major political contenders, it aims to influence broader debate on crypto policy. This stance places Australia alongside various US states that are working toward legislative recognition of Bitcoin reserves, as well as the US federal government’s announcement last week.

Establishing An Australian Strategic Bitcoin Reserve

One of the most prominent features of the Whitepaper is the call to create an Australian Strategic Bitcoin Reserve. Referring to Bitcoin’s “decentralized and limited-supply nature,” the Libertarian Party states that: “Bitcoin’s fixed supply of 21 million coins ensures that its scarcity protects against inflation […] This robustness enhances its appeal as a reliable store of value and positions it as an ideal component of Australia’s financial strategy.”

The proposal suggests that such a reserve would hedge against inflation, diversify national assets, and “strengthen the nation’s financial resilience.” According to the document, funding would derive from several possible sources, including allocations from Australia’s Future Fund, budget surpluses, and proceeds from government asset sales.

Throughout the 23-page White Paper, a repeated theme is that of personal and financial autonomy—concepts foundational to Bitcoin’s decentralized ethos. One recommendation asserts the right to self-custody, arguing that individuals should be able to hold Bitcoin themselves without reliance on central intermediaries. It reads: “The right to self-custody is paramount for achieving true financial sovereignty and privacy in an increasingly digitized economy.”

The paper’s authors contend that self-custody protects against “governmental overreach,” referencing past global financial crises that eroded public trust in centralized institutions.

Beyond the reserve, the White Paper advocates for comprehensive legal recognition and clearer regulatory standards. It calls for the removal of Capital Gains Tax (CGT) on everyday Bitcoin transactions and outlines a vision in which Australia “positions itself at the forefront of global innovation in financial services.” To that end, the document also proposes: “Treating Bitcoin as a legitimate and viable alternative to traditional financial systems, promoting financial autonomy and inclusivity.”

Such moves, the party believes, will encourage further Bitcoin adoption by eliminating “punitive taxation measures” that hamper everyday transactions. Additionally, the White Paper highlights how countries like Germany, Portugal, and Japan have already taken steps to clarify taxation and legal status for Bitcoin users and businesses.

Another point of emphasis is fair treatment of Bitcoin mining. Recognizing mounting concerns about energy usage, the policy encourages the integration of mining with renewable or “stranded” energy sources to stabilize power grids and reduce environmental impact: “Bitcoin mining should not be subject to regulations that disproportionately affect the industry. Any regulatory measures must be technology-neutral and focused on broader market stability, grid integrity, and environmental standards.”

According to the Libertarian Party, these approaches can help Australia avoid the pitfalls seen in other jurisdictions—such as China, where an outright mining ban led to significant industry disruption.

Reactions to the Libertarian Party’s announcement have been mixed. An Australian Bitcoiner remarked: “As an Australian the Libertarian Party is relatively new outside the big two party’s, they won’t get double digits of the vote when the election is finally held. The two majors have no BTC policy that I know of & we really are a backwards country—I won’t hold my breath for any either.”

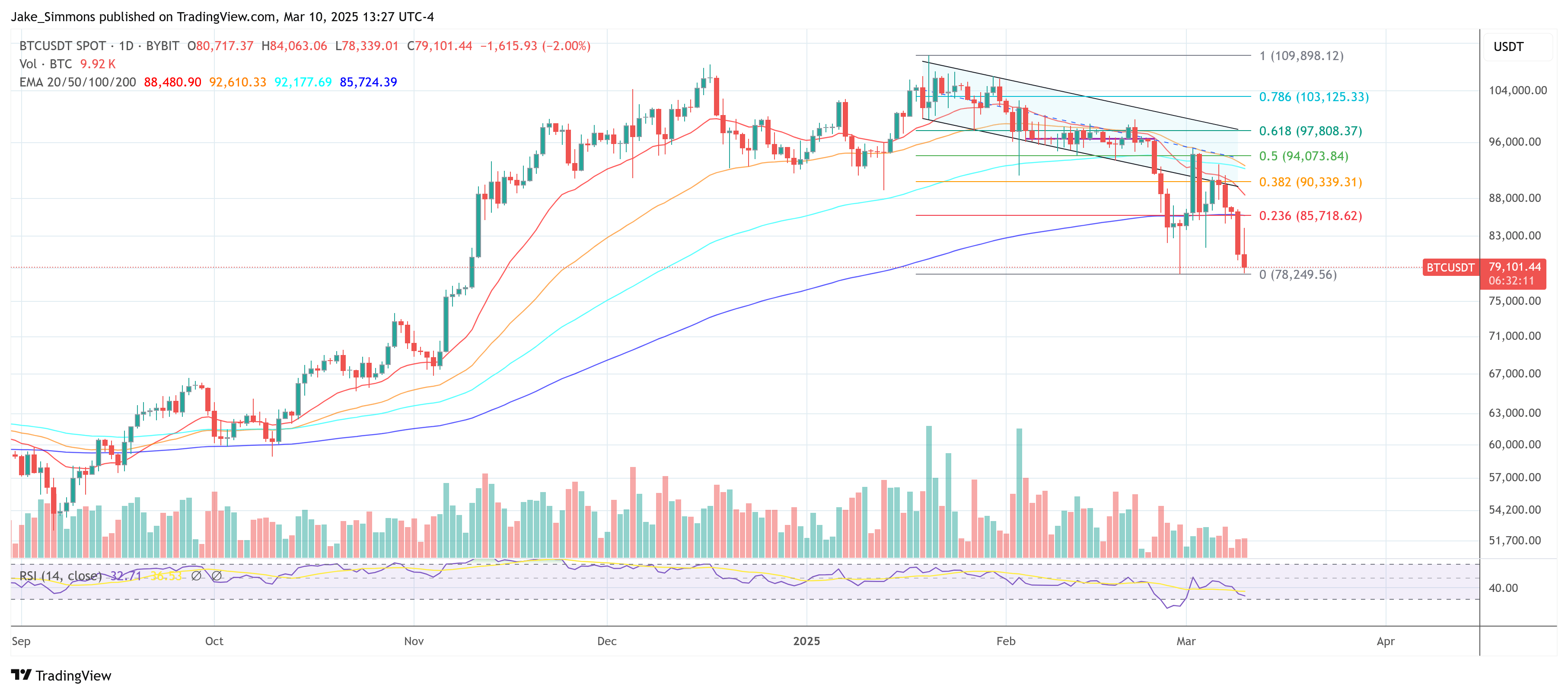

Thus, no immediate impact on the BTC price can be expected. At press time, BTC faced further downward pressure and traded at $79,101.