Elon Musk’s D.O.G.E will crash the US job market soon

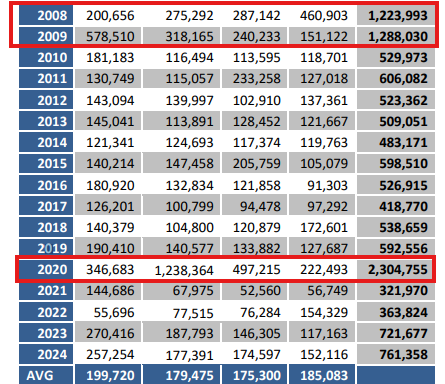

The US job market is spiraling, and it’s not because of a recession or a financial crisis, it’s Elon Musk’s D.O.G.E. February 2025 recorded 172,017 job cuts, according to a Thursday report from coaching company Challenger, Gray & Christmas, which is a 103% increase compared to 2024, with the total year-to-date (YTD) layoffs hitting 221,812, the highest seen since 2009.

The biggest shock is that government layoffs surged by 41,311% in just a year, an increase so big that the analysts had to double-check the numbers. In Washington, DC, alone, job cuts went from just 60 in 2024 to 61,795 in 2025, triggering an economic domino effect.

The capital’s housing market is in free fall, jobless claims are piling up, and businesses dependent on federal contracts are collapsing under the pressure, per the report.

D.O.G.E will crash the jobs market

February’s 245% month-over-month increase in job cuts is now the highest monthly total since July 2020, according to Challenger, Gray & Christmas, who said in the report that they expect these losses, plus the D.O.G.E cuts, to crash the US job market within the second quarter of this year.

New unemployment claims surged by 22,000 in the last week of February, hitting 242,000 nationwide. The hardest-hit region is Washington, DC, where unemployment claims jumped 26% in just a week due to D.O.G.E layoffs.

The city’s for-sale home inventory surged 31.6% year-over-year, surpassing the 2008 housing crisis high of 23.8%. Companies with government contracts are shedding workers as federal spending freezes leave projects in limbo, said Challenger, Gray & Christmas.

The impact of D.O.G.E-related cuts is being felt beyond the labor market. Interest rates have dropped by 60 basis points in six weeks, and even as inflation remains high, the market is already anticipating a downturn.

According to Labor Economist Julia Pollak, this trend is unusual. “Even in past downturns, we didn’t see federal job losses at this scale. The layoffs we’re seeing now could set the labor market back years.”

The crisis is unfolding against a backdrop of Trump’s fast-changing tariff policies, combined with interest market volatility in crypto and stocks, are hurting corporate decision-making.

On Thursday, the White House announced that it’ll be pausing some of the 25% the tariffs of Mexican and Canadian goods under USMCA until April 2.

Economists are largely anticipating the levies will lead to potentially higher prices for consumers and slower growth. Data at the start of the year showed consumers trimmed spending in January and that businesses and consumers are becoming more pessimistic about the economy.

The Trump administration is also restructuring federal hiring, making it harder for non-political appointees to secure jobs. Reports confirm that the White House is screening potential hires for loyalty to Trump’s second-term agenda.

Treasury Secretary Scott Bessent warned that sanctions on Russian energy could be expanded, which would only make things worse.

European leaders have also been briefed that Trump is linking a US-Ukraine minerals deal to a ceasefire with Russia, a decision that will have major geopolitical consequences.

At the same time, US import surges are breaking records, with gold traders rushing bullion into New York depositories. This unexpected spike in gold imports has widened the US trade deficit, which brings additional pressure on domestic markets.

Philadelphia Fed President Patrick Harker acknowledged those risks yesterday, saying, “Business and consumer confidence is starting to wane, that’s not a good sign.”

The Federal Reserve’s next meeting is scheduled for March 18-19, where chair Jerome Powell and his team will address the dangers of president Trump’s layoffs and determine whether interest rates should be cut after all, though they’ve said many times during recent meetings that they weren’t gonna do that anytime soon.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot