3 Altcoins That Could Trigger Major Liquidations in the First Week of March

The first week of March has seen significant market volatility. Unexpected news from President Trump, including plans to include altcoins in US crypto reserves and new tax policies, has influenced capital flows. As a result, liquidation volume surged to $1 billion.

Liquidation maps for several altcoins indicate an imbalance. This could signal the potential for major liquidations.

1. XRP (XRP)

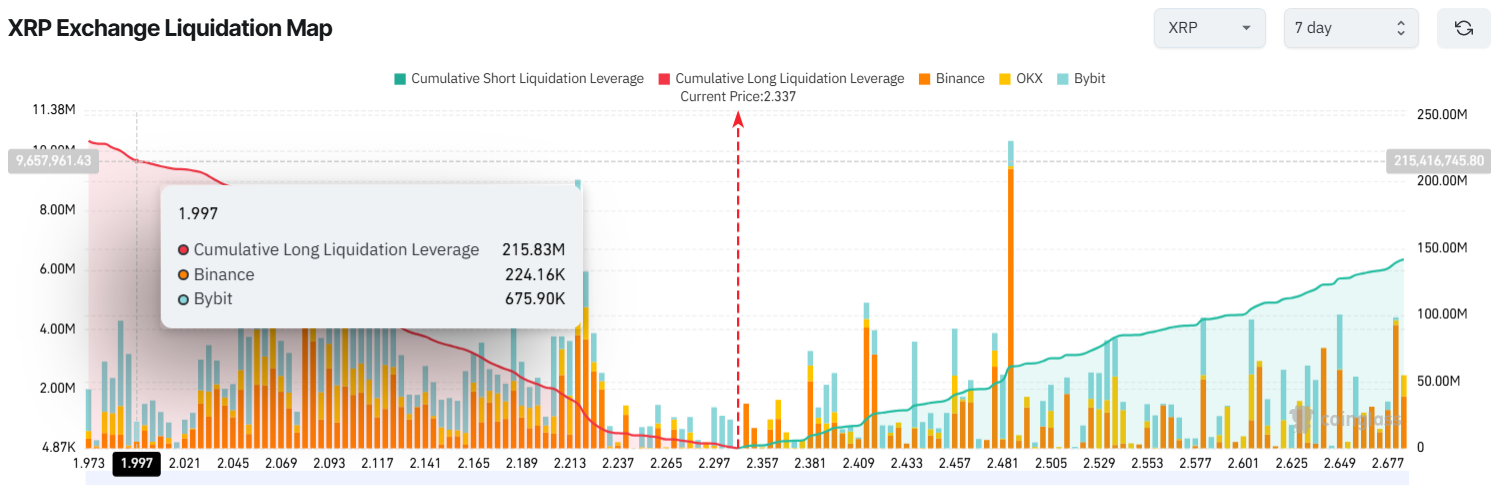

The 7-day liquidation heatmap for XRP suggests that if the price drops below $2, total long liquidations could exceed $215 million.

XRP Exchange Liquidation Map. Source: Coinglass.

XRP Exchange Liquidation Map. Source: Coinglass.

Chart data indicates that traders are leaning more towards long positions on XRP rather than shorting it. As of now, XRP is trading around $2.33 after a 20% decline since March 3.

Whale Alert reported that on March 3, 500 million XRP was unlocked from escrow. This happened right after President Trump announced that XRP would be part of the US crypto reserve.

Additionally, on-chain investigator ZachXBT revealed that Ripple co-founder Chris Larsen still holds over 2.7 billion XRP (worth $7.18 billion). Addresses linked to him moved over $109 million worth of XRP to exchanges in January 2025.

These developments could raise concerns and potentially trigger a liquidation event.

2. Solana (SOL)

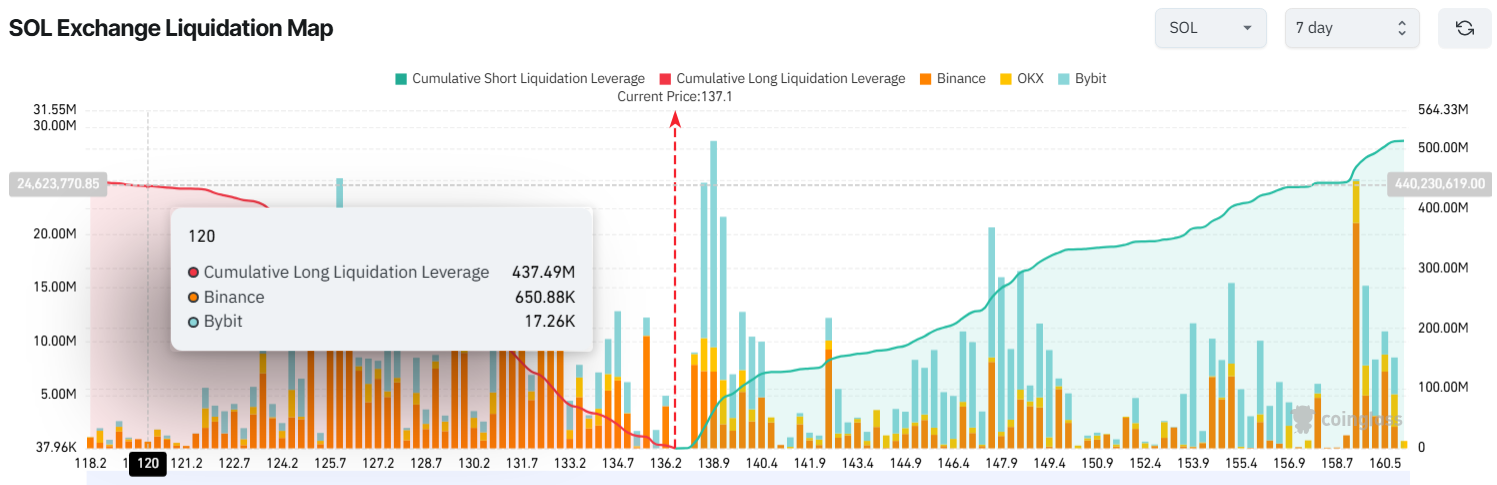

The 7-day liquidation heatmap for Solana (SOL) indicates that long liquidations could surpass $437 million if SOL drops to $120. This would mark an additional 11% decline from its current price of $136.3.

SOL Exchange Liquidation Map. Source: Coinglass.

SOL Exchange Liquidation Map. Source: Coinglass.

On-chain tracking account Lookonchain recently reported that a wallet linked to FTX/Alameda, holding 3.03 million SOL (worth $431 million), has begun transferring SOL to Binance.

“Of the 3.03 million SOL ($431.3 million) unstaked by FTX/Alameda today, 24,799 SOL ($3.38 million) has been deposited to Binance,” Lookonchain reported.

Although the amount transferred to Binance is less than 0.1% of the total holdings, investors might speculate that more SOL will follow. This could create selling pressure and trigger further liquidations.

3. Cardano (ADA)

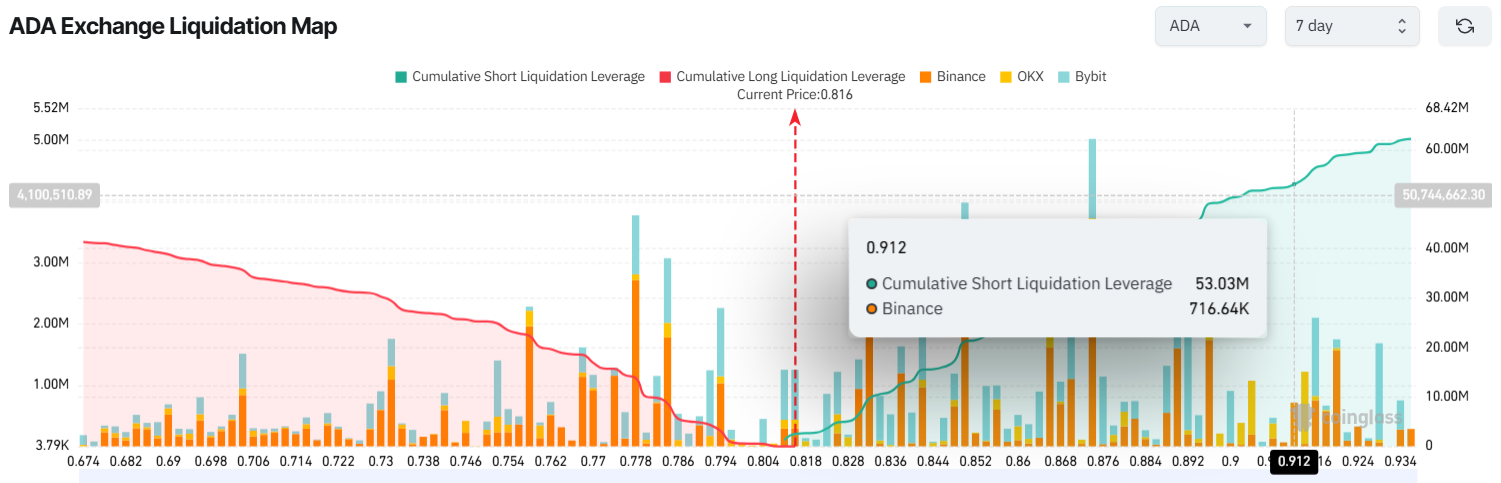

The 7-day liquidation heatmap for Cardano (ADA) suggests that short liquidations could exceed $50 million if ADA surpasses $0.90. This represents a 10% increase from its current price of $0.81.

ADA Exchange Liquidation Map. Source: Coinglass.

ADA Exchange Liquidation Map. Source: Coinglass.

While ADA’s liquidation volume is lower than XRP or SOL, it is the most volatile among the three. According to Kaiko’s latest report, ADA has the lowest market depth among the five altcoins included in the US crypto reserve.

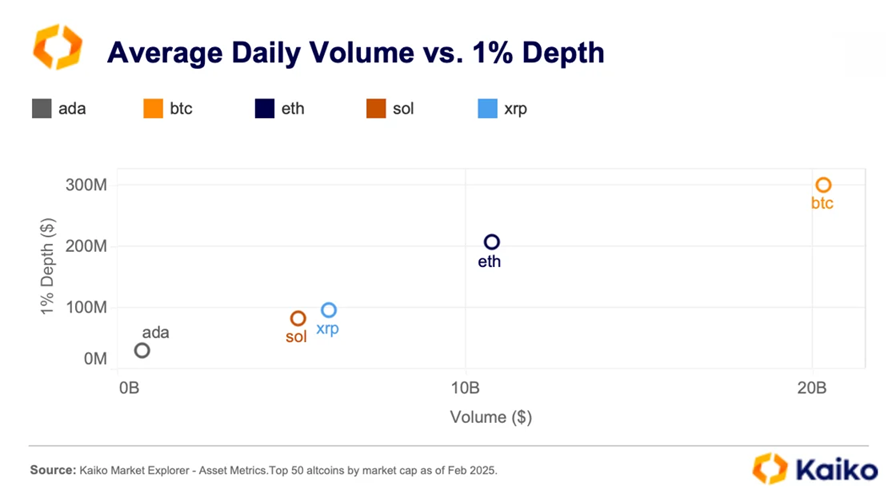

ADA, SOL, XRP, ETH, BTC 1% Market Depth. Source. Kaiko.

ADA, SOL, XRP, ETH, BTC 1% Market Depth. Source. Kaiko.

Market depth measures liquidity, indicating the market’s ability to absorb large buy or sell orders without significant price fluctuations.

“Notably, ADA lags all other assets in the strategic reserve and could see the strongest price impact,” Kaiko reported.

Therefore, in the face of similar market shocks, ADA is likely to experience the highest volatility, increasing the risk of liquidation.

Liquidation maps continuously adjust to price movements. However, current data reflects a highly sensitive market, with unpredictable news increasing risks for short-term traders—especially those using high leverage.