Crypto Market Sees $1 Billion Wipeout Following Donald Trump’s Tariff Confirmation

Crypto markets crashed during the late hours of the US session on Monday, causing millions in liquidations as Bitcoin (BTC) extended its leg down. The crash followed reports on US President Donald Trump’s tariffs against Mexico and Canada, triggering a sell-off.

It marks the second instance where the president’s tariffs influence crypto markets, highlighting Bitcoin’s growing reaction to macroeconomic events.

Bitcoin and Crypto Markets React To Trump’s Tariffs

Trump said the US was ‘on time with the tariffs’ on Canada and Mexico. According to Reuters, this followed an inquisition on whether tariffs would be placed on Canadian and Mexican goods once the agreed deadline for a pause arrives next week. In response, Trump reportedly articulated his view that its neighbors and allies had mistreated the US.

“We’re on time with the tariffs, and it seems like that’s moving along very rapidly…We’ve been mistreated very badly by many countries, not just Canada and Mexico. We’ve been taken advantage of,” Reuters reported, citing Trump at the White House.

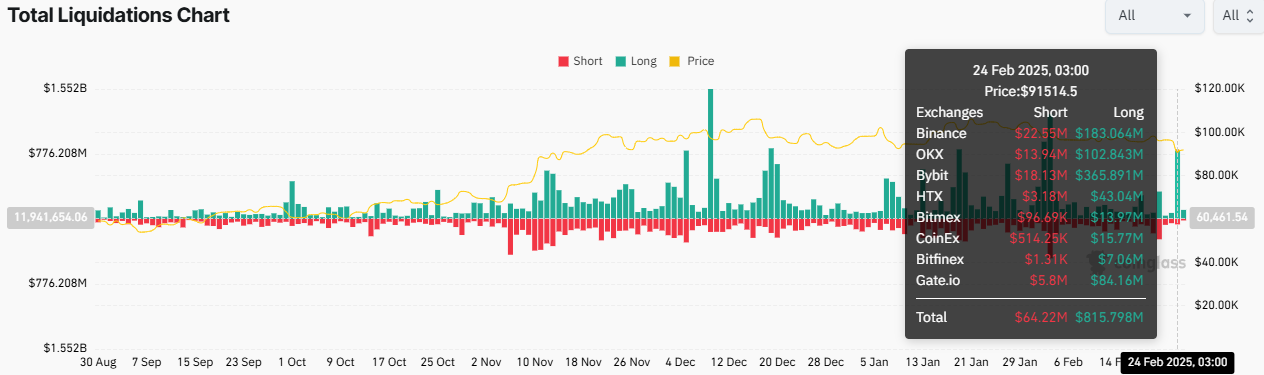

In this report’s immediate aftermath, Bitcoin’s price slipped below the $92,000 threshold. Similarly, crypto markets crashed, with the total market capitalization losing up to 7% of its value. Meanwhile, data on Coinglass shows the crash saw nearly $1 billion in total liquidations across the crypto industry.

“In the past 24 hours, 299,006 traders were liquidated, the total liquidations come in at $918.18 million,” Coinglass indicated.

Total Crypto Liquidations on Monday. Source: Coinglass

Total Crypto Liquidations on Monday. Source: Coinglass

Coinglass data also shows that the majority of rekt positions comprised longs as Bitcoin’s price dropped to $91,514. This is not the first time the Trump tariffs narrative has influenced crypto markets.

In hindsight, over $2 billion was wiped out from the crypto market in early February, causing a historic liquidation event. As BeInCrypto reported, the incident followed President Trump imposing a 25% tariff on imports from Canada and Mexico.

Following reports of a reprieve on Trump tariffs, crypto markets recovered. Bitcoin’s Coinbase Premium soared to a local high in the immediate aftermath of the pause three weeks ago. These events align with a recent JPMorgan survey, which showed tariffs and inflation would be the top market influences in 2025.

Inflation and Tariffs to Influence Markets in 2025: JPMorgan Chase Survey Findings

Inflation and Tariffs to Influence Markets in 2025: JPMorgan Chase Survey Findings

Eddie Wen, the global head of digital markets at JPMorgan, also cited market fluctuations in response to new headlines about the Trump administration’s plans, citing “knee-jerk reactions in the marketplace.”

Amidst these corrections, however, MicroStrategy (now Strategy) chair Michael Saylor saw the recent crash as an opportunity to buy Bitcoin at a discount. His recent remarks, “Bitcoin on sale,” align with those of Robert Kiyosaki.

As BeInCrypto reported, the author of Rich Dad Poor Dad urged investors to buy BTC as markets crash, calling it a prime wealth-building moment amid global economic uncertainty.

Meanwhile, James, a popular crypto analyst on X, highlighted that Trump has wiped out up to $734 billion of the crypto market since his second term commenced on January 20.

“Trump has wiped out 20% of the crypto market since he took office. $734 billion,” James wrote on X.

BTC Price Performance. Source: BeInCrypto

BTC Price Performance. Source: BeInCrypto

As of this writing, Bitcoin traded for $92,047, representing a 3.4% drop since Tuesday’s session opened.