Michael Saylor buys another $2B BTC after presenting $81 trillion ‘Bitcoin strategic reserve plan’ to SEC

- Strategy (formerly MicroStrategy) announced another 20,356 BTC purchase worth $1.99 billion at $97,514 per bitcoin.

- FOX News reported that Michael Saylor met with the US SEC taskforce on Friday.

- Saylor’s strategic Bitcoin reserve plan aims to generate up to $81 trillion to ease the US debt crisis.

Bitcoin price dipped 3.6% on Monday, despite Strategy (formerly MicroStrategy) announcing another round of BTC purchases worth $1.99 billion. Will Michael Saylor’s Bitcoin Strategic reserve plan influence prices in the days ahead?

Michael Saylor presents $81 trillion Bitcoin strategic reserve plan to US SEC

Michael Saylor, CEO of US-based IT firm Strategy (formerly Microstrategy) presented his strategic Bitcoin reserve plan to the US Securities and Exchange Commission, a move that could generate between $16 trillion and $81 trillion in wealth for the US Treasury.

Michael Saylor presents Bitcoin Strategic Reserve plan to US SEC, Feb, 2025 | Source: Eleanor Terrett, FOX news.

According to FOX news reports, Saylor’s framework aims to address the country’s mounting national debt crisis, which reached $36.2 trillion as of February 5, 2025.

Of this, $28.9 trillion represents public debt, while $7.3 trillion falls under intergovernmental obligations.

Saylor’s proposal is part of his "Digital Assets Framework," introduced on X in December 2024. The framework classifies digital assets into six categories: Digital Commodities, Digital Securities, Digital Currencies, Digital Tokens, Digital NFTs, and Digital ABTs.

Michael Saylor Bitcoin Strategic Reserve Framework Document, December 2024 | X.com/Saylor

Under these definitions, Bitcoin falls under Digital Commodities, denoting decentralized assets without issuer control.

Digital Securities encompass tokenized equity or debt, while Digital Currencies cover stablecoins pegged to fiat.

Digital Tokens include fungible assets with utility functions, Digital NFTs represent unique intellectual properties, and Digital ABTs refer to assets tied to real-world commodities.

Saylor’s framework proposes a compliance cost cap of 1% of assets under management and an annual maintenance cost ceiling of 10 basis points.

The SEC established its Crypto Task Force in January, moving beyond an enforcement-heavy approach that stifled industry clarity.

The new task force seeks to create regulations that foster innovation while protecting investors.

Last week, Saylor had suggested the US government should secure 20% of Bitcoin’s total supply.

This, he argues, would reinforce America’s dominance in the digital economy and provide a long-term hedge against inflation.

Strategy adds another $2 billion in Bitcoin

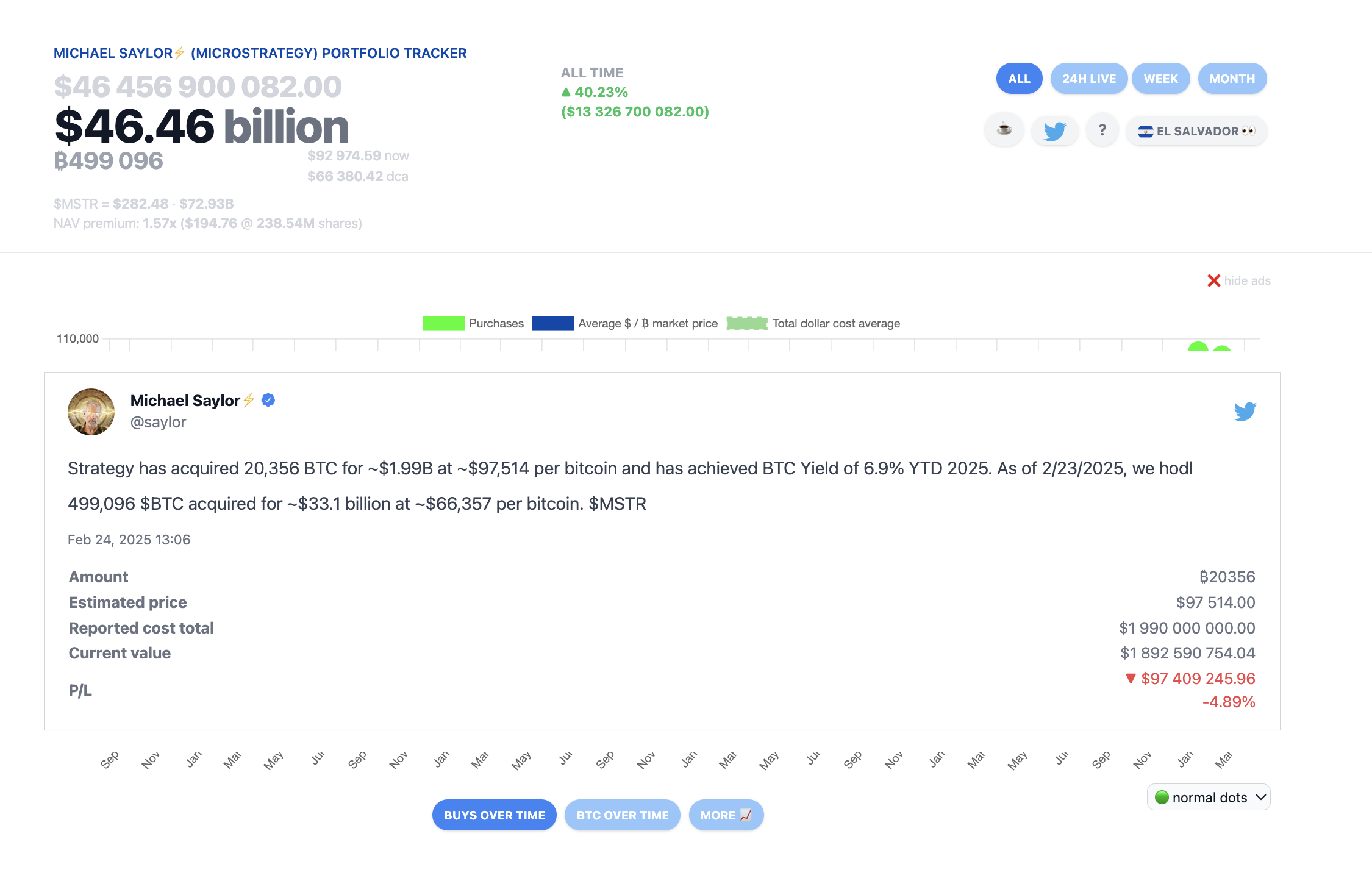

Michael Saylor’s Bitcoin acquisition spree continues. On Friday, Strategy, formerly MicroStrategy, announced a fresh purchase of 20,356 BTC, spending approximately $1.99 billion at an average price of $97,514 per coin.

The move strengthens the company’s position as the largest corporate holder of Bitcoin.

Saylor confirmed the purchase on X, stating that Strategy’s Bitcoin holdings have now reached 499,096 BTC.

The firm has spent roughly $33.1 billion on its Bitcoin reserves at an average price of $66,357 per coin.

The latest acquisition reflects a year-to-date Bitcoin yield of 6.9% in 2025, further solidifying the company’s strategy of leveraging Bitcoin as a corporate treasury asset.

Strategy’s (Formerly MicroStrategy) Total Bitcoin (BTC) Holdings as of Feb 24 2025 | Source: SaylorTracker.com

Strategy’s (Formerly MicroStrategy) Total Bitcoin (BTC) Holdings as of Feb 24 2025 | Source: SaylorTracker.com

Strategy’s aggressive Bitcoin purchases align with Saylor’s broader vision of institutional adoption.

The company has consistently used debt and equity raises to fund its Bitcoin accumulation, betting on the asset's long-term appreciation.

With Bitcoin trading nearly 20% below its record highs, Strategy’s ongoing buying spree positions it to benefit significantly from future price gains, if the US officially adopts the Bitcoin Strategic reserve plan.

Bitcoin Price Forecast: Bearish sentiment from Bybit hack overshadows positives

Bitcoin price hovers around $93,585, facing mounting selling pressure after a sharp 3.6% decline within the intraday session.

The fallout from Bybit's security breach continues to weigh on sentiment, exacerbating Bitcoin’s ongoing downtrend.

While Michael Saylor’s ambitious $81 trillion Bitcoin reserve plan has sparked long-term optimism, its impact remains distant, leaving BTC vulnerable to short-term market forces.

From a technical point of view, Bitcoin price faces renewed selling pressure as the 20-day EMA crosses below the 50-day EMA, confirming death cross formation.

This bearish crossover signals growing downside risks, reinforcing dominant negative sentiment.

Historically, such a pattern suggests weakening momentum and the potential for further declines unless buyers step in decisively.

More so, Bitcoin price action is trapped beneath the 50-day and 100-day exponential moving averages (EMAs) at $96,951 and $97,531, respectively.

The rejection from these levels signals a continued struggle for bullish momentum.

BTC’s failure to reclaim these EMAs suggests the path of least resistance remains downward. A daily close below $93,000 could accelerate declines toward $90,000, a psychological and historical support level.

Bitcoin price forecast | BTCUSDT

The Relative Strength Index (RSI) at 38.34 indicates oversold conditions, but with a downward trajectory, further affirming the weak momentum.

The RSI’s failure to hold above its moving average at 44.71 further reinforces the bearish bias.

If selling pressure intensifies, BTC could see an extended downturn towards the $88,000 region.

However, if Bitcoin manages to reclaim the $96,000 level and break above the EMAs, it could invalidate the bearish thesis.

A decisive move above $97,500 would signal renewed buying strength, potentially pushing BTC back toward the $100,000 mark.