Australian Dollar remains subdued following PBoC’s Interest Rate Decision, RBA eyed

The Australian Dollar holds losses after People's Bank of China cut its one-year Loan Prime Rate to 3.00% from 3.10%.

The Reserve Bank of Australia is expected to cut interest rates by 25 basis points on Tuesday.

The US Dollar weakened following Moody’s Ratings downgrade of the US credit rating from Aaa to Aa1.

The Australian Dollar (AUD) dips against the US Dollar (USD) on Tuesday, following a gain of over 0.50% in the previous session. The AUD/USD pair remains under pressure after the People's Bank of China (PBoC) announced its Interest Rate Decision. The PBoC announced a reduction in its Loan Prime Rates (LPRs) on Tuesday. The one-year LPR was lowered from 3.10% to 3.00%, while the five-year LPR was reduced from 3.60% to 3.50%. Given the close trade relationship between Australia and China, any change in the Chinese markets can significantly impact the Aussie Dollar.

Market attention now turns to the Reserve Bank of Australia's (RBA) upcoming rate decision scheduled for later in the day. The central bank is expected to cut interest rates by 25 basis points, following last week's stronger-than-anticipated employment data.

The AUD/USD pair strengthened on Monday as the US Dollar weakened in the wake of Moody’s Ratings downgrading the US credit rating from Aaa to Aa1. This move aligns with similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now projects US federal debt to climb to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to widen to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues.

In addition, the risk-sensitive Australian Dollar gained support from renewed optimism surrounding a 90-day US-China trade truce and hopes for further trade deals with other countries. Meanwhile, US Treasury Secretary Scott Bessent told CNN on Sunday that President Donald Trump intends to implement tariffs at previously threatened levels on trading partners that do not engage in negotiations “in good faith.”

Australian Dollar depreciates despite a weaker US Dollar amid a dovish Fed

The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, is remaining subdued and trading lower at around 100.40 at the time of writing.

Economic data released last week pointed to easing inflation, as both the Consumer Price Index (CPI) and Producer Price Index (PPI) signaled a deceleration in price pressures. This has heightened expectations that the Federal Reserve may implement additional rate cuts in 2025, contributing to further weakness in the US Dollar. Additionally, disappointing US Retail Sales figures have deepened concerns over an extended period of sluggish economic growth.

US President Donald Trump told Fox News that he is working to gain greater access to China, describing the relationship as excellent and expressing willingness to negotiate directly with President Xi on a potential deal.

Trump administration plans to add several Chinese chipmakers to its export blacklist, known as the "entity list." According to the Financial Times, Trump administration officials expressed concern late Thursday that imposing export controls on key Chinese firms at this stage could undermine the recently reached trade agreement between China and the US during talks in Geneva over the weekend.

The National Bureau of Statistics (NBS) reported on Monday that China’s Retail Sales rose by 5.1% year-over-year (YoY) in April, falling short of the 5.5% forecast and down from 5.9% in March. Industrial Production grew by 6.1% YoY during the same period, beating the expected 5.5% but slowing from the previous 7.7% growth.

According to the Australian Bureau of Statistics (ABS), employment surged by 89,000 in April, significantly higher than the 36,400 increase in March and far above the forecasted 20,000. Meanwhile, the Unemployment Rate remained unchanged at 4.1%.

Australia's seasonally adjusted Wage Price Index rose by 3.4% year-over-year in Q1 2025, up from a 3.2% increase in Q1 2024 and surpassing market forecasts of a 3.2% gain. This marks a recovery from the prior quarter, which recorded the slowest wage growth since Q3 2022. On a quarterly basis, the index climbed 0.9% in Q1, surpassing the projected 0.8% rise.

Australian Dollar hovers around 0.6450, support appears at nine-day EMA

AUD/USD is trading near 0.6450 on Tuesday, with technical indicators on the daily chart pointing to a bullish bias. The pair remains above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) holds above the 50 mark, suggesting continued upward momentum.

On the upside, immediate resistance is located at the six-month high of 0.6515, posted on December 2, 2024. A sustained break above this level could open the door to the seven-month high of 0.6687 from November 2024.

Support is initially seen at the nine-day EMA of 0.6429, followed by the 50-day EMA around 0.6363. A clear drop below these levels would likely weaken the short- to medium-term outlook, potentially triggering a deeper decline toward the March 2020 low of 0.5914.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

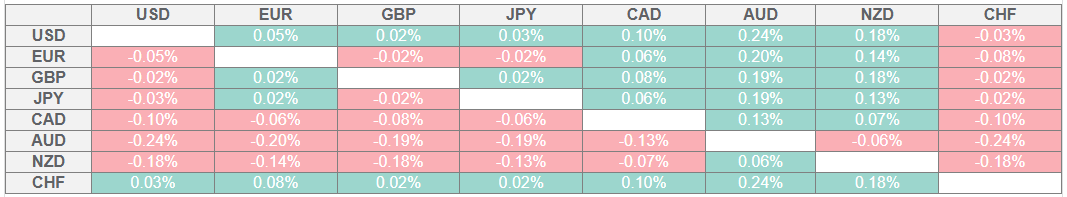

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

PBoC Interest Rate Decision

The People’s Bank of China’s (PBoC) Monetary Policy Committee (MPC) holds scheduled meetings on a quarterly basis. However, China’s benchmark interest rate – the loan prime rate (LPR), a pricing reference for bank lending – is fixed every month. If the PBoC forecasts high inflation (hawkish) it raises interest rates, which is bullish for the Renminbi (CNY). Likewise, if the PBoC sees inflation in the Chinese economy falling (dovish) and cuts or keeps interest rates unchanged, it is bearish for CNY. Still, China’s currency doesn’t have a floating exchange rate determined by markets and its value against the US Dollar is fixed mainly by the PBoC on a daily basis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.