FTX Begins Repaying its Creditors As Market Hopes for an Altcoin Season

After months of waiting, the FTX repayments to creditors have finally begun. However, despite widespread beliefs that this would be a bullish signal, crypto markets are in the red today.

The exchange’s defunct FTT token briefly spiked, continuing to gain alongside major reimbursement announcements. However, it fell hard as analysts struggled to make a clear prediction for the future.

FTX Repayments Begin At Last

When major crypto exchange FTX collapsed in 2022, it sent huge shockwaves through the entire industry. The fallout from the crash itself has mostly subsided, but one key issue remained: reimbursements for creditors.

After years of stagnation, progress has been building for a few months, and former FTX users have begun reporting that their repayments are finally coming in.

FTX Users Confirm Kraken Repayments. Source: Reddit

FTX Users Confirm Kraken Repayments. Source: Reddit

However, a concerning trend has developed in the markets today. After FTX began the road to issuing repayments, most of the community assumed that this would serve as a bullish incentive.

In essence, this initial repayment phase would inject $1.2 billion of liquidity into the market directly through the hands of veteran traders. Surely, prevailing thought went, this would greatly juice asset prices.

The FTX repayments have begun, however, and it’s looking anything but bullish. The platform’s defunct token, FTT, recently bucked the market by gaining while the largest assets declined.

FTT briefly spiked in accordance with this trend, but it already sank back down. Meanwhile, the largest cryptoassets are posting uniformly negative returns.

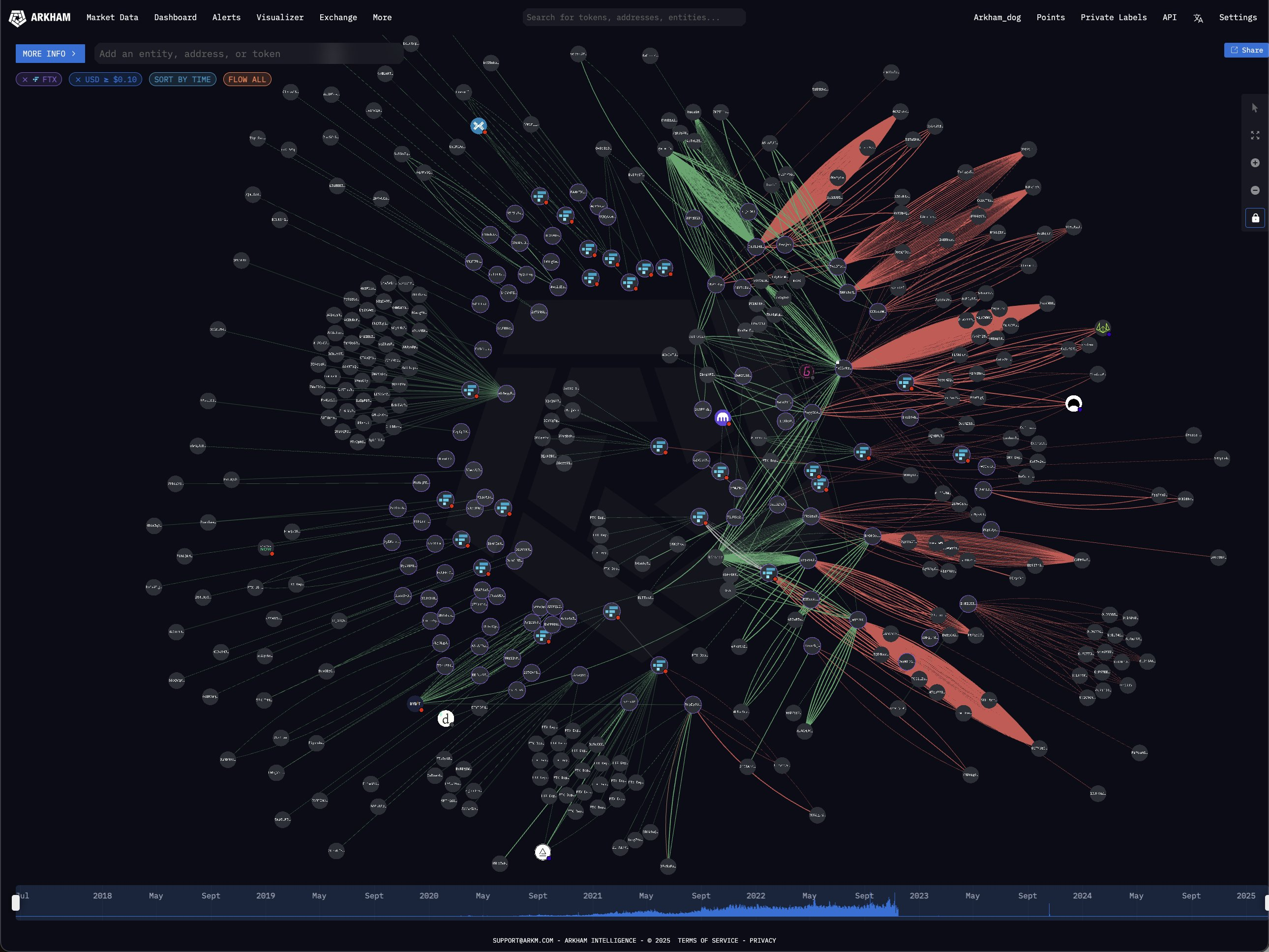

Users are Cashing Out Their FTX Repayments from Kraken and Bitgo. Source: X/Arkham

Users are Cashing Out Their FTX Repayments from Kraken and Bitgo. Source: X/Arkham

Several prominent industry analysts have already reacted with alarm. Theoretically, the FTX repayments were supposed to herald an altcoin season.

Users were repaid based on the value of their tokens in 2022, with an attached interest rate. This would generally be lower than their rate of growth, encouraging future investment. However, this hasn’t happened.

“These are some of the trickiest conditions to navigate in a long time. This feels more like a paradigm shift than a capitulation bottom. The amount of bullish news we’re getting right now is insane. A few months ago we’d be flying on headlines like these. But it can’t even budge markets. Just shows how demand has dried up,” analyst Miles Deutscher said via social media posts.

A few factors might explain this lack of momentum. First of all, crypto markets are very chaotic at the moment, and existing bearish momentum hasn’t helped anything.

Second, meme coins have swallowed a lot of altcoin demand, dampening enthusiasm for many token projects. Investors that may have chosen these altcoins in 2022 have other plans today.

Above all, however, we’re in an unprecedented moment. Last year, the Bitcoin ETFs caused the halving to break trends present in all prior halvings.

Since then, institutional investment in crypto has flown to all-time highs, and we live in a world of billion-dollar scams. The FTX repayments didn’t cause the desired effect, and nobody knows their actual impact. It’s all in the air.