Cardano (ADA) Price Jumps 15% In a Week, But Whales Are Yet to Show Confidence

Cardano (ADA) price is showing signs of recovery, up more than 4% in the last 24 hours and over 15% for the week, as it tries to bounce back from a 24% loss over the past 30 days. Its market cap now stands at $29 billion, while trading volume has surged over 100% in the last day, reaching $895 million.

Despite this rebound, whale activity remains stable, indicating that large holders are not aggressively accumulating yet. If ADA maintains its momentum and forms a golden cross, it could push toward $1.16, but failure to hold support may trigger another downturn.

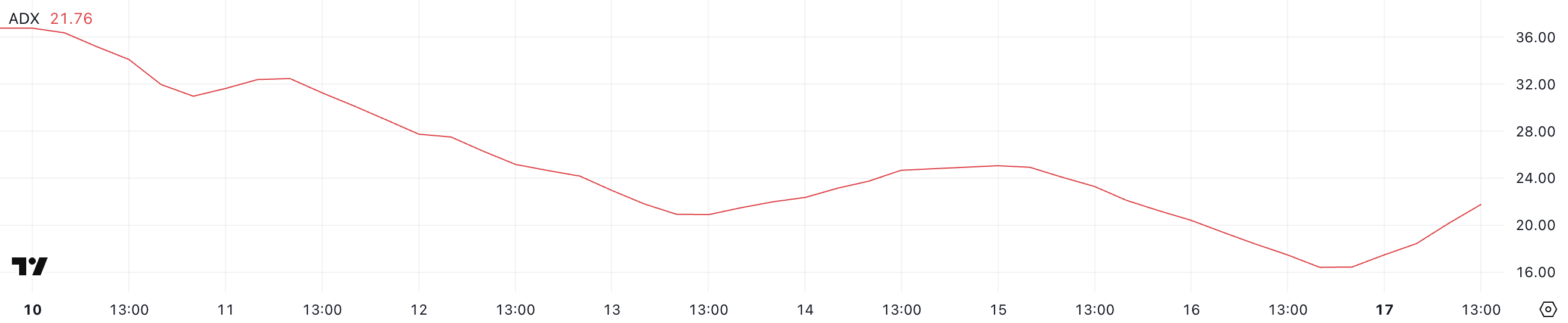

ADA ADX Shows the Trend Could Be Changing

Cardano ADX has risen to 21.7 from 16.2 in just one day, signaling a strengthening trend.

The ADX (Average Directional Index) measures trend strength on a scale from 0 to 100, with values below 20 indicating a weak trend and above 25 suggesting a strong one. Since ADA’s ADX has now crossed 20, it suggests growing momentum, though it is not yet in a fully confirmed trend.

ADA ADX. Source: TradingView.

ADA ADX. Source: TradingView.

This increase in ADX indicates that ADA is attempting to shift from a downtrend to an uptrend. While the trend reversal isn’t confirmed yet, a continued rise in ADX above 25 would signal stronger bullish momentum.

If buying pressure increases, ADA price could establish an uptrend, but if momentum weakens, it may struggle to sustain its recovery.

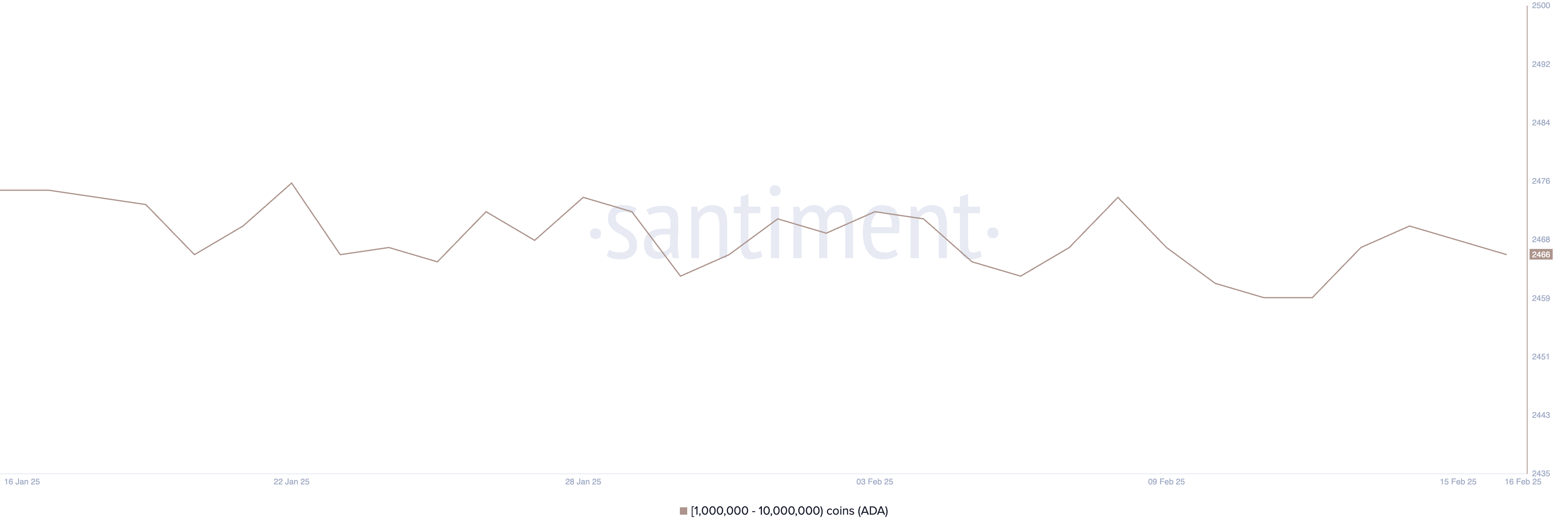

Cardano Whales Are Not Convinced Yet

The number of Cardano whales – addresses holding between 1 million and 10 million ADA – currently stands at 2,466 and has remained relatively stable in recent weeks.

Tracking these large holders is important because whales can influence price movements through significant buy or sell actions. A rise in whale activity often signals accumulation or distribution phases, impacting market sentiment and liquidity.

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment.

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment.

The stability in the number of ADA whales suggests that large holders are neither aggressively buying nor selling. This could mean that ADA is in a consolidation phase, where price movement remains steady until new catalysts emerge.

If whales start accumulating, it could signal confidence in a potential uptrend, while a decline in whale holdings might indicate increased selling pressure.

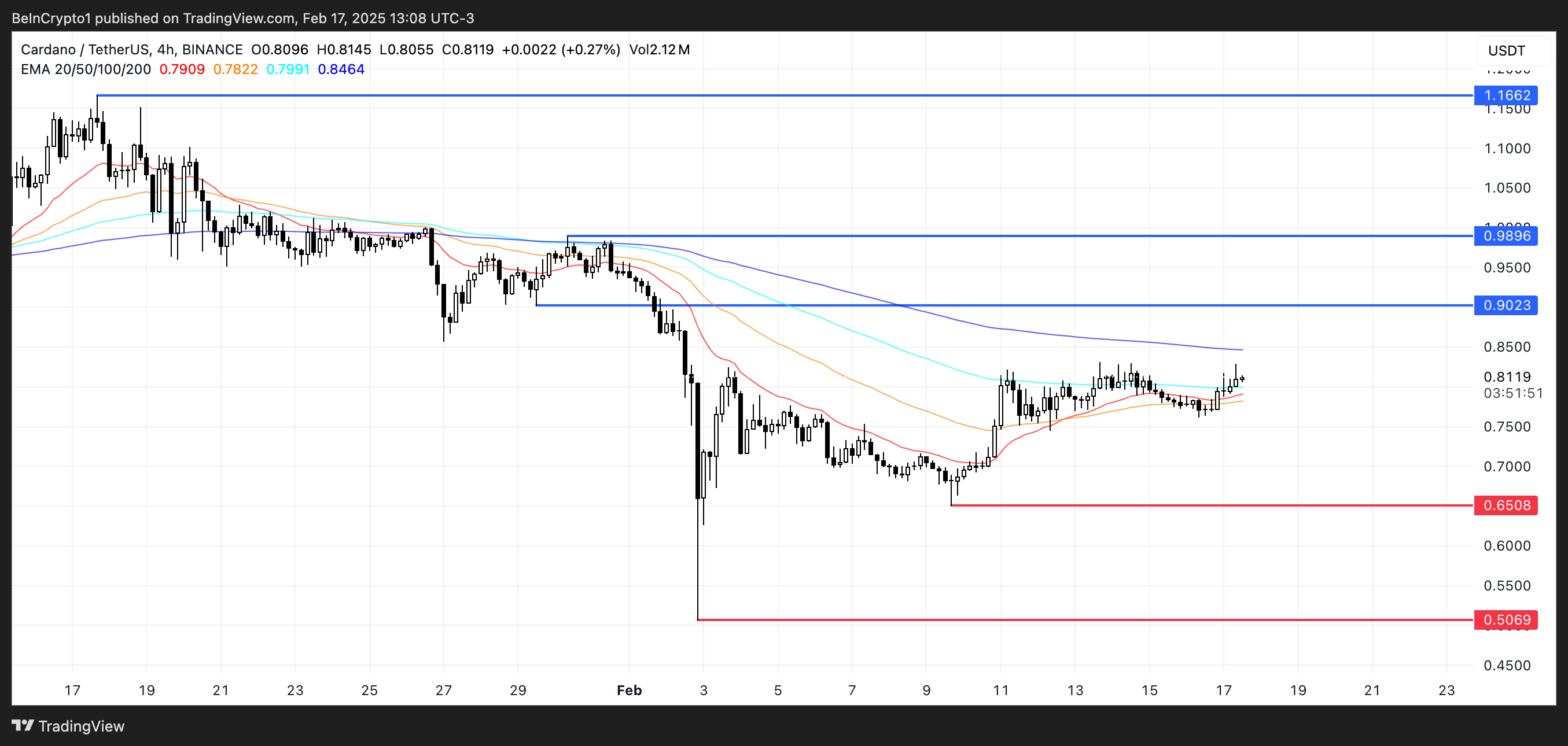

ADA Price Prediction: Will ADA Reclaim Levels Above $1 In February?

ADA’s EMA lines show short-term moving averages trending upward, signaling potential bullish momentum. If a golden cross forms, Cardano price could continue rising to test resistance at $0.90.

A breakout above this level could push it to $0.98, and if momentum strengthens, ADA price could reach $1.16, trading above $1 for the first time since mid-January.

ADA Price Analysis. Source: TradingView.

ADA Price Analysis. Source: TradingView.

On the downside, if the uptrend fails to gain strength, ADA price could retest support at $0.65.

Losing this level might trigger a deeper decline to $0.50, marking a potential 37% correction.