Bitcoin exchange reserves drop to 3-year low of 2.5M as demand surges

Bitcoin reserves on major exchanges have plunged to their lowest level in three years, as CryptoQuant data confirms that only 2.5 million BTC remains on platforms.

The news comes as Bitcoin demand hits new highs, while physical gold is also being scooped up at record rates. Analysts say the shrinking supply could trigger a “supply shock” scenario, where strong demand drives prices up rapidly.

Global trade tensions have flared up after new import tariffs were announced by both the US and China. As a result, investors appear cautious, pulling money from ETFs. Data from Farside shows US spot Bitcoin ETFs saw net outflows of $186 million on February 10, reversing the previous day’s inflows of $171 million.

A slip in Bitcoin’s price below $95,000 will liquidate over $1.52 billion worth of leveraged long positions across all exchanges, per data from Coinglass.

Bitcoin network activity collapses to a one-year low

Bitcoin’s price might be holding for now, but network activity tells a different story. CryptoQuant’s Network Activity Index shows a dramatic drop to its lowest level in a year, down 15% from November 2024’s record high. The current index reading is 3,760, a number not seen since February last year.

The daily number of Bitcoin transactions has fallen by 53% since September 2024, with just 346,000 transactions recorded today compared to an all-time high of 734,000. The decline is closely tied to the crumbling of the RUNES protocol, which once drove token minting and transfers on the network.

CryptoQuant data shows that the daily use of OP RETURN codes—critical for the RUNES protocol—has nosedived. In April 2024, when RUNES launched, OP RETURN code usage spiked to 802,000 per day.

Today, that figure has plummeted to just 10,000, and in the mempool, the space where pending transactions wait to be processed, transactions waiting for confirmation have dropped from 287,000 in December to just 3,000 today—a 99% decline. It’s a level of inactivity not seen since March 2022.

There’s also growing concern that Bitcoin is overvalued based on network activity. CryptoQuant’s Metcalfe valuation model, which calculates fair value using network data, shows that Bitcoin should be priced somewhere between $48,000 and $95,000.

This is based on its trading behavior within the red and blue Metcalfe bands over the past year. If the price doesn’t find stronger fundamentals soon, market corrections to at least $70k levels seem unavoidable, as was already predicted by BitMEX founder Arthur Hayes.

Gold demand also surges

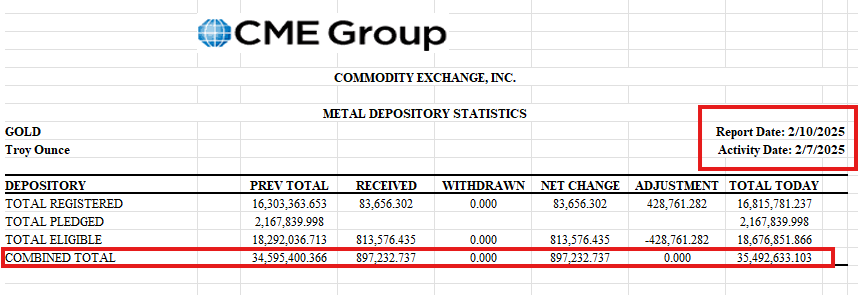

As aforementioned, physical gold buying is going wild. In just two months, inventories in the top three COMEX gold vaults have surged by 15 million ounces, which is a 115% increase. COMEX, a subsidiary of CME Group, reports that this surge has pushed total gold holdings above levels seen during the peak of the 2020 pandemic.

The gold rush is centered in the US, where demand for secure storage has spiked. January alone saw more than 19,000 contracts delivered, setting an all-time record. COMEX vaults, located under and around Manhattan, New York, are bursting at the seams, with a total of 35.5 million troy ounces stored right now.

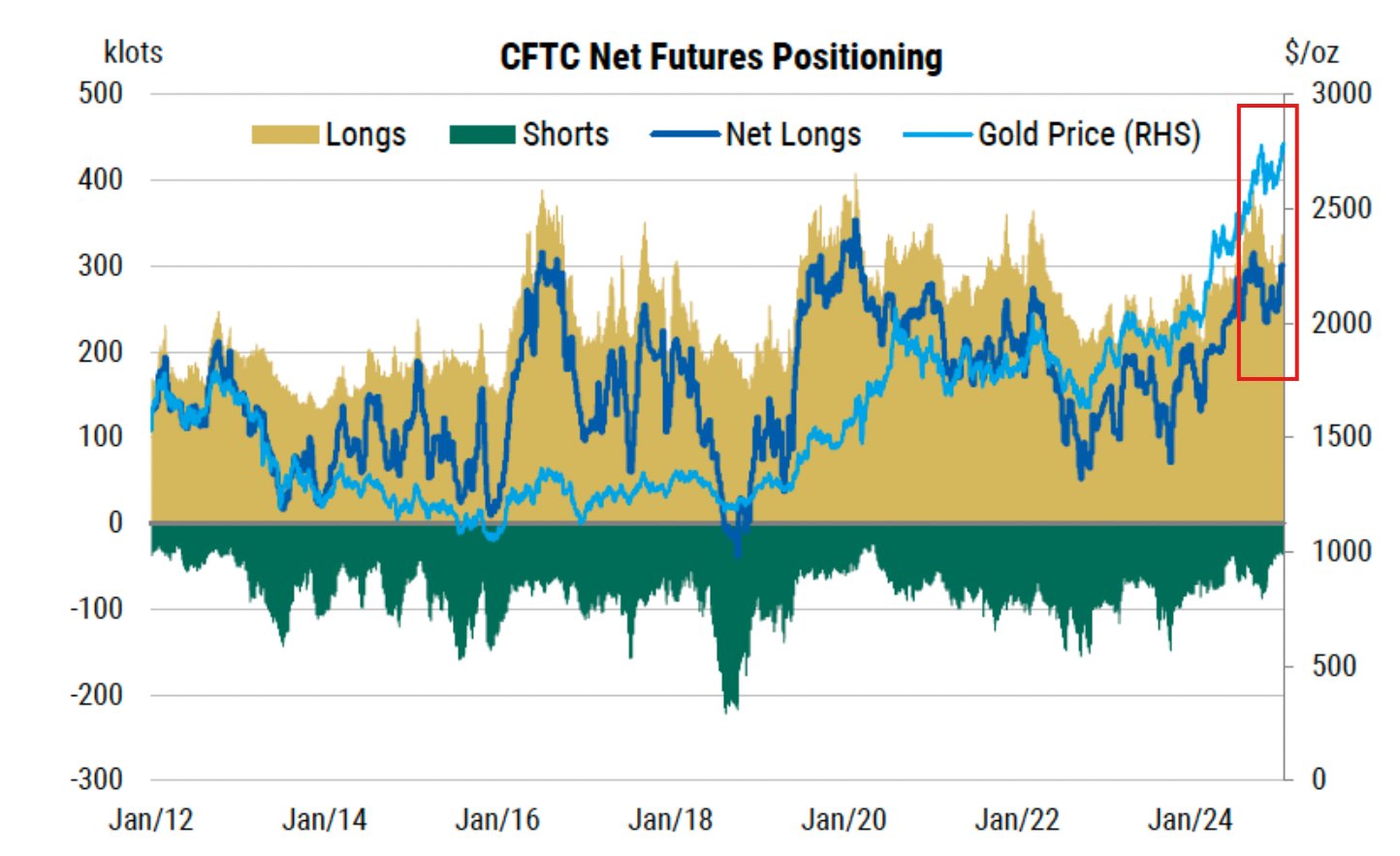

Gold prices are up 40% year-over-year, defying expectations. And normally, a price surge of this magnitude would trigger a massive correction, but that hasn’t happened yet. Instead, data from the CFTC shows that net long positions are on track to break their 2024 highs, while short positions are at their lowest levels since the start of the 2020 pandemic.

China has also joined the buying spree, as its central bank purchased five tonnes of gold in January, its third consecutive month of doing that. Also, Chinese gold ETFs have tripled in value over the past 18 months, with $9.5 billion now locked in these funds, according to data from the CFTC.

Interestingly, gold has actually outperformed the US stock market over the past 12 months, as the precious metal delivered double the returns of the S&P 500’s 22% rally.

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet