Bitwise: 69% of Bitcoin Supply Held by Individuals as Institutions Fall Behind

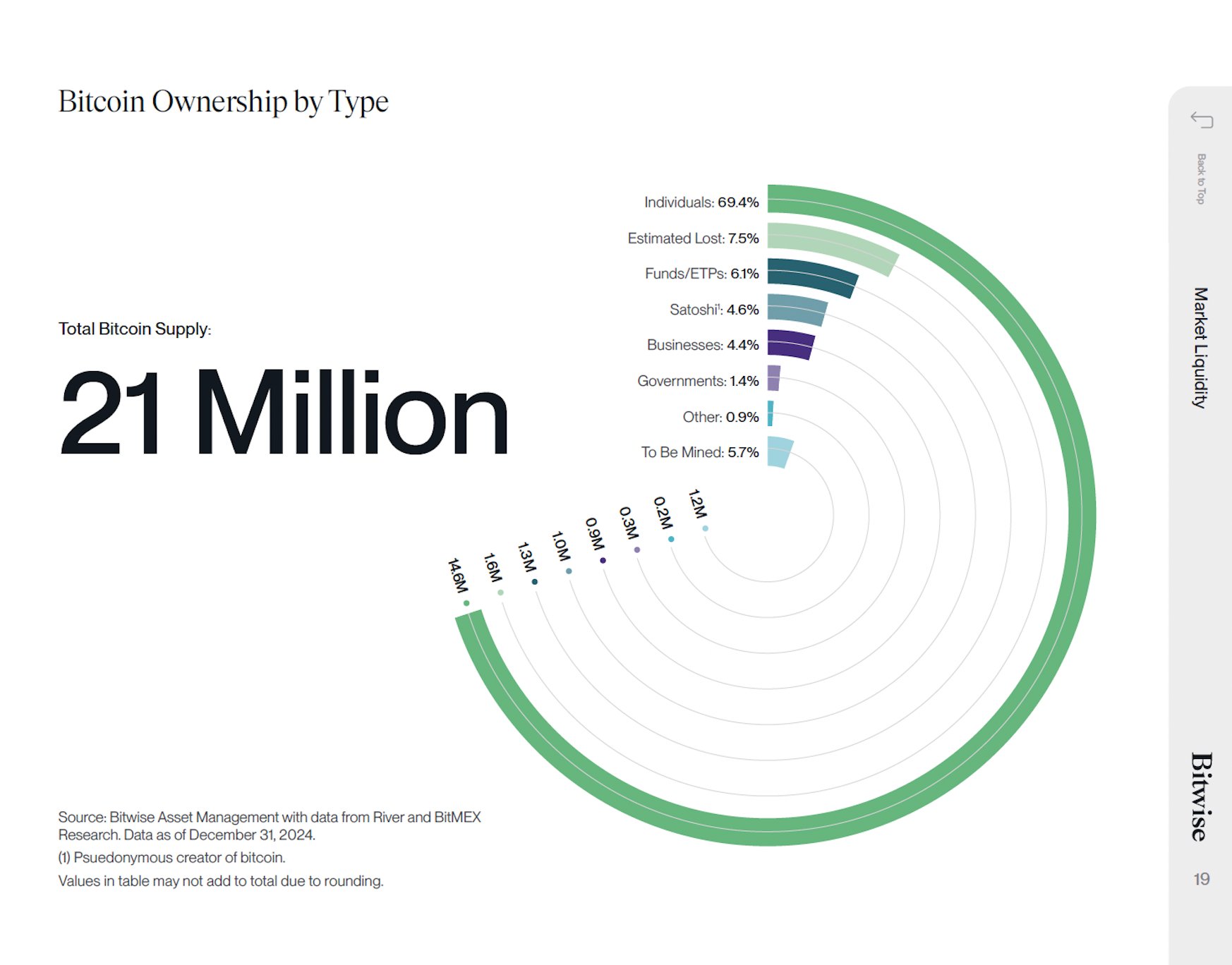

According to Bitwise Asset Management, individual holders control most of Bitcoin’s (BTC) total supply. 69.4% of the 21 million BTC in circulation belong to private investors.

Given this concentration of ownership among individuals, large institutions and governments seeking to acquire Bitcoin may face challenges.

Institutions Face Scarcity as Bitcoin Supply Declines

In a recent X post, Bitwise outlined Bitcoin’s total supply distribution. Apart from individual holders, approximately 7.5% of Bitcoin is considered lost. Funds and exchange-traded products (ETPs) control 6.1%.

The wallet associated with Satoshi Nakamoto, Bitcoin’s pseudonymous creator, holds 4.6%. Moreover, governments and businesses collectively own just 5.8% of Bitcoin.

Bitcoin Supply Dynamics. Source: X/Bitwise

Bitcoin Supply Dynamics. Source: X/Bitwise

The asset manager highlighted that if companies and governments wish to acquire Bitcoin, they will primarily need to purchase it from individuals willing to sell.

“That market dynamic between buyers and sellers could get very interesting,” the post read.

Hunter Horsley, CEO of Bitwise, also pointed out that despite consistent buying from corporates and ETFs, Bitcoin’s price has still faced downward pressure. He also stressed that the bulk of Bitcoin’s value remains in the hands of individual holders.

“Every new buyer must find a seller. Obvious but important as ever,” Horsley added.

Is a Bitcoin Supply Shock Coming?

Meanwhile, only 5.7% of Bitcoin remains to be mined. In addition, OTC (Over-the-Counter) markets are running low on Bitcoin. A crypto analyst highlighted that just 140,000 BTC remains in the OTC market.

“There’s almost no Bitcoin left even for institutions,” he claimed.

The analyst explained ETFs collectively purchased 50,000 BTC last month. Yet, price movements remained subdued. This suggested that institutions source Bitcoin from OTC markets rather than exchanges to avoid triggering price surges.

Nonetheless, this strategy may no longer be viable with OTC supply depleting.

“Every billion dollars worth of money going into BTC raises its price by 3-5%. Thats why OTC drying up is so insane,” the analyst remarked.

He added that if MicroStrategy (now Strategy) continues its aggressive acquisitions or ETFs maintain their January-level accumulation, OTC Bitcoin could be depleted. A similar scenario would unfold if the US and the states began buying Bitcoin as part of their reserves.

Strategy has maintained a consistent Bitcoin acquisition plan. On February 10, the firm purchased 7,633 BTC for approximately $742.4 million. This marked its fifth Bitcoin purchase in 2025 alone. According to Saylor Tracker, the firm now holds 478,740 BTC, valued at $47.12 billion.

Institutions such as BlackRock are also adding pressure to supply. The asset manager reportedly acquired $1 billion worth of BTC in January. In fact, it bought 227 BTC today, according to Arkham Intelligence.

Nevertheless, as supply tightens, institutions may soon be forced to buy directly from exchanges, potentially driving Bitcoin’s price significantly higher.

This supply shock threat looms as Bitcoin adoption accelerates. In a previous report, BlackRock noted that cryptocurrency reached 300 million users faster than the internet and mobile phones.

Brian Armstrong, CEO of Coinbase, also weighed in on the adoption timeline comparison.

“Bitcoin adoption should get to several billion people by 2030 at current rates,” Armstrong predicted.

He added that the comparison depends on how one defines the official starting points for Bitcoin, the internet, and mobile phones. However, Armstrong acknowledged that the overall trend is still accurate despite these variables.