Bitcoin Struggles to Break $100,000 as Fear and Greed Index Reflects Investor Caution

Bitcoin’s price has struggled to reclaim the $100,000 mark, facing repeated rejections that have triggered sharp pullbacks. Despite these setbacks, BTC has demonstrated resilience and has held above critical support levels.

While long-term holders are losing confidence, new investors are using the bearish market as an opportunity to accumulate at lower prices.

Bitcoin Investors Are In Fear

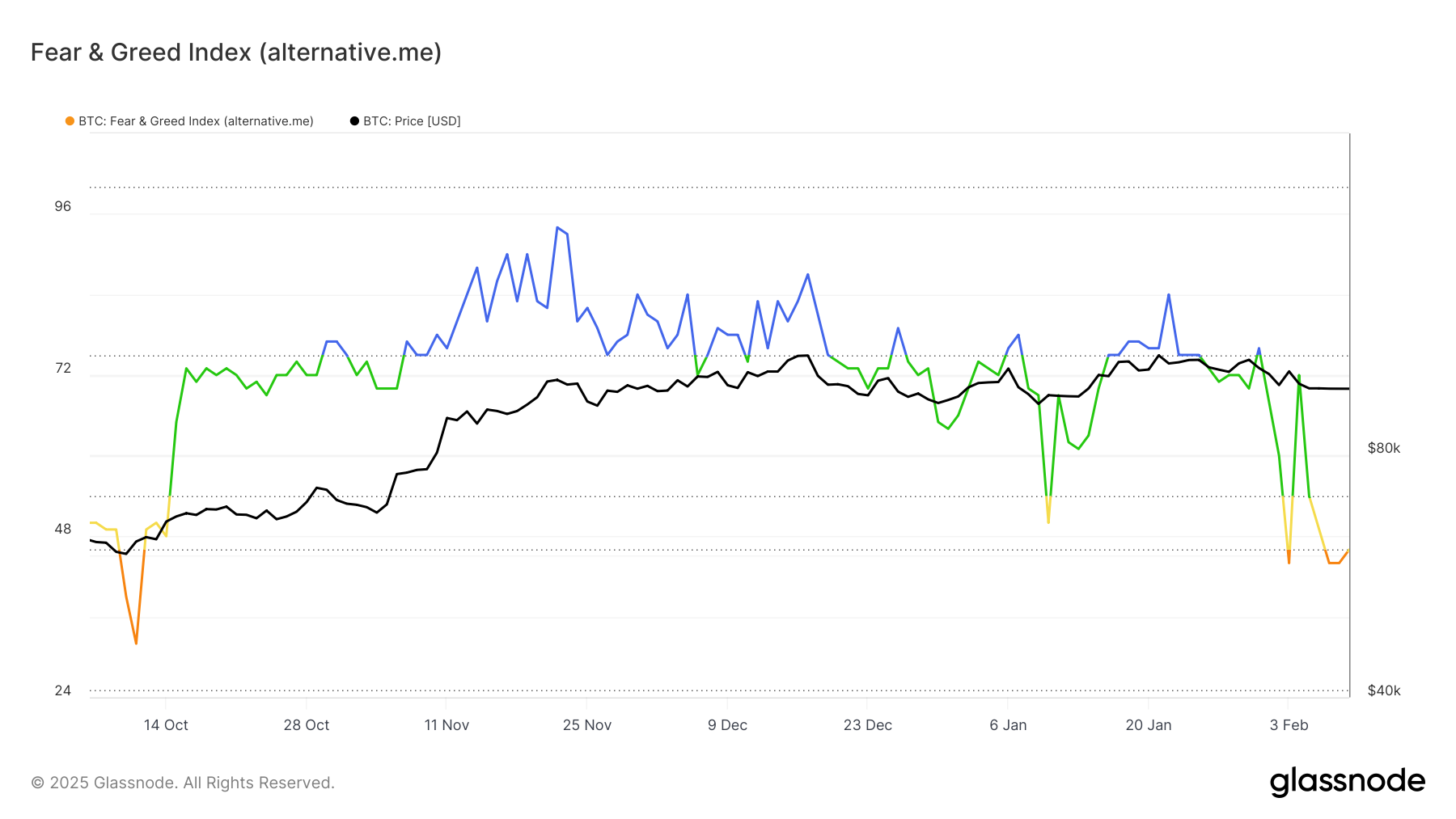

The Fear and Greed Index currently indicates a bearish sentiment, reflecting growing uncertainty among BTC holders. The index has dipped into the Fear zone for only the second time since October 2023. This shift suggests that many existing investors are reluctant to participate actively in the market, waiting for a clearer recovery signal.

A prolonged stay in the Fear zone could limit BTC’s short-term momentum. Many traders may hesitate to buy or sell until market conditions improve. Without renewed optimism, Bitcoin could struggle to generate the necessary demand for a strong breakout toward new highs.

Bitcoin Fear And Greed Index. Source: Glassnode

Bitcoin Fear And Greed Index. Source: Glassnode

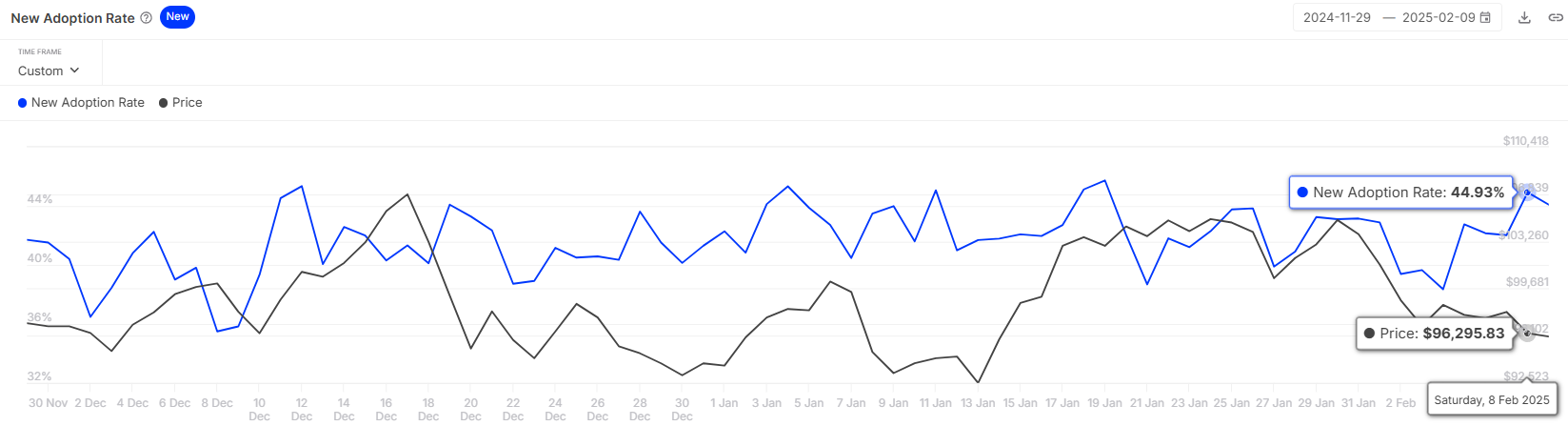

Bitcoin’s adoption rate, which measures new address participation in daily transactions, has shown signs of improvement. Currently at 44%, the metric indicates growing interest from first-time investors. This increase suggests that new market participants are taking advantage of BTC’s lower price levels to position themselves for future gains.

If the trend continues, it could provide a much-needed boost for Bitcoin’s price movement. A rising adoption rate often precedes major rallies as fresh capital enters the market with new investors accumulating BTC; the likelihood of a long-term uptrend strengthens despite near-term price fluctuations.

Bitcoin Adoption Rate. Source: IntoTheBlock

Bitcoin Adoption Rate. Source: IntoTheBlock

BTC Price Prediction: Reclaiming Lost Support

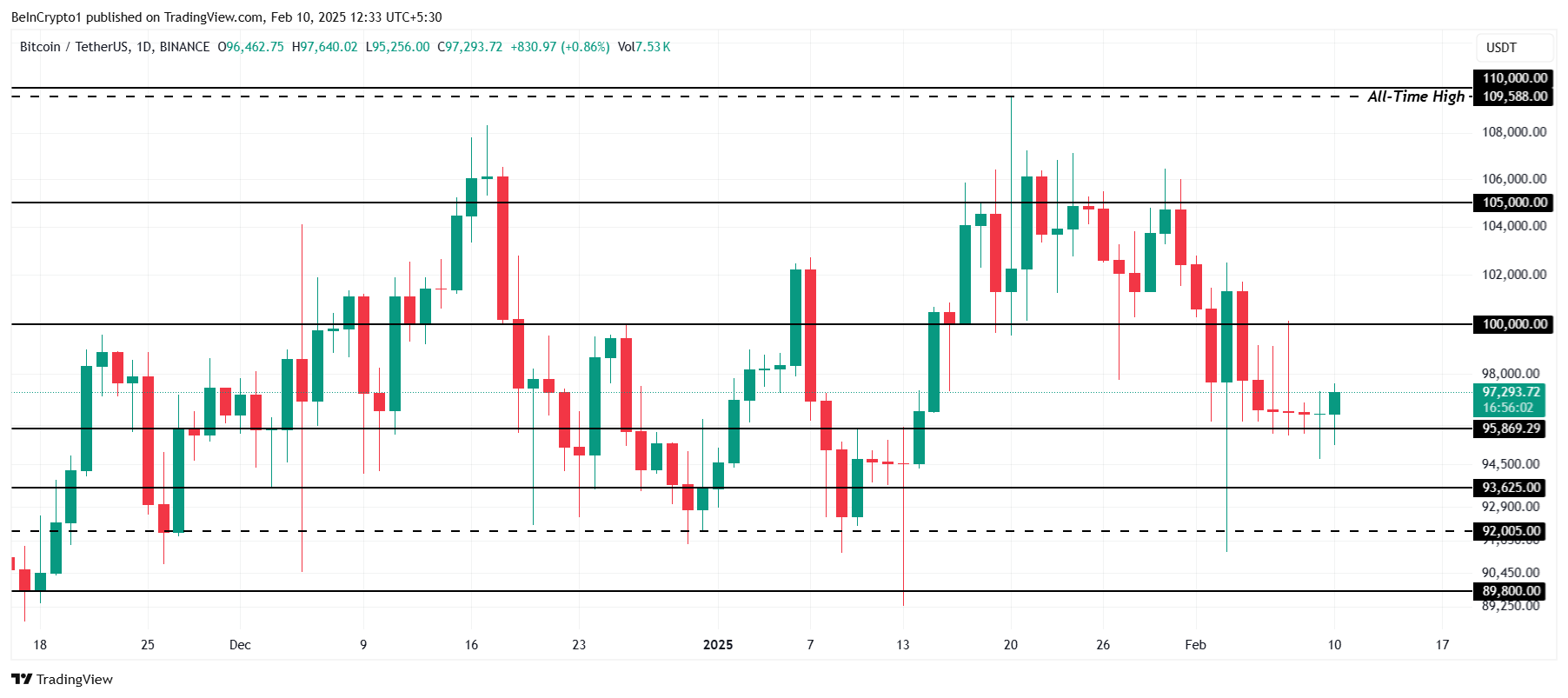

Bitcoin’s current price of $97,293 reflects its ability to maintain support above $95,869. This level has held firm for the past week, providing a foundation for potential recovery. As long as BTC remains above this support, a move toward the $100,000 resistance remains possible in the near term.

However, mixed market signals could keep Bitcoin trapped in a consolidation phase. If bearish sentiment persists and new investors fail to drive strong demand, BTC may struggle to break past $100,000. A prolonged consolidation phase could extend for several days, preventing a decisive breakout.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

A shift in momentum would be necessary to invalidate the neutral-to-bearish outlook. If Bitcoin successfully flips the $100,000 barrier into support, it could pave the way for sustained upside movement. A confirmed breakout would signal renewed investor confidence, pushing BTC toward higher price targets.