Crypto AI Agents Struggle as Market Cap Drops 13% and New Token Launches Slump

Crypto AI Agents have seen a sharp decline, with their total market cap dropping 13% in the last 24 hours to $6.42 billion. The sector’s biggest coins are struggling, with VIRTUAL, AI16Z, and FARTCOIN all posting significant losses over the past week.

Meanwhile, growth in new crypto AI agents has slowed dramatically, and engagement within the ecosystem has plummeted by 60% in just a few weeks. With both investor interest and market activity fading, the sector faces an uphill battle to regain momentum unless a strong catalyst reignites demand.

Crypto AI Agents Coins Market Cap Is Down

The crypto AI agents market has taken a significant hit, with its total market cap dropping 13% in the last 24 hours to $6.65 billion.

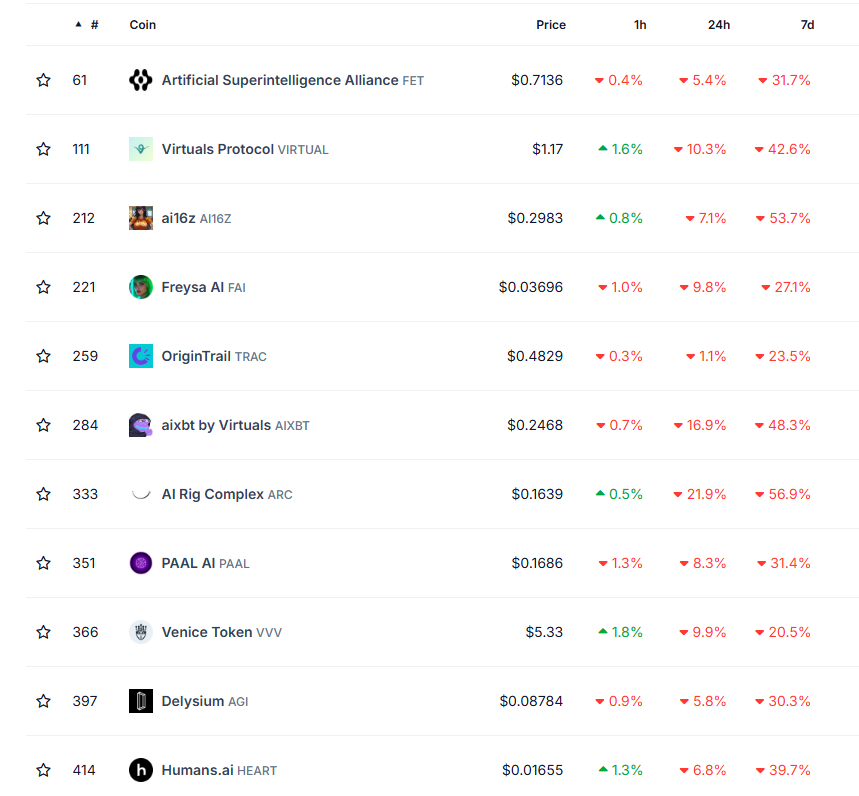

All of the top 10 crypto AI agents cryptos have posted losses over the past seven days, with FARTCOIN plummeting 61%, AI16Z down 59%, and the largest one, VIRTUAL, losing 40% of its value.

This broad sell-off highlights the ongoing weakness in the AI crypto sector, as investors continue to exit positions amid the correction, a movement that has been happening and intensifying since DeepSeek’s launch.

Top Crypto AI Agents and Their Weekly Price Changes. Source: CoinGecko

Top Crypto AI Agents and Their Weekly Price Changes. Source: CoinGecko

VIRTUAL, once the dominant artificial intelligence protocol, briefly surpassed major players like TAO, FET, and RENDER when its market cap peaked at $4.6 billion on January 1.

However, since then, it has faced a steep decline, with its valuation now sitting at just $811 million. With this downturn, only five crypto AI agents cryptos still hold a market cap above $300 million, and just 15 remain above the $100 million mark, showing how deep the correction has been across the sector.

Solana Is Still the Leader in Crypto AI Agents

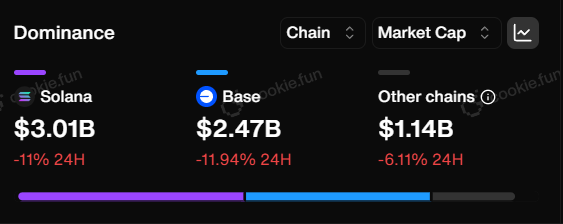

Solana remains the most dominant chain in the crypto AI agents sector, with its AI-related coins holding a combined market cap of $3.2 billion.

However, this dominance has taken a hit, with the total value dropping 18.6% in the last 24 hours as the sector experiences a broad correction.

Crypto AI Agents Dominance by Blockchain. Source: Cookie.fun

Crypto AI Agents Dominance by Blockchain. Source: Cookie.fun

Base chain follows as the second-largest player, with its crypto AI agents coins collectively valued at $2.74 billion. Coins like VIRTUAL, TOSHI, FAI, and AIXBT have been key drivers of its growth in the sector.

Interestingly, Ethereum is notably absent from the top ranks, while other chains collectively account for just $1.19 billion in market cap.

Only two of the top 15 coins are outside of Solana and Base: ChainGPT (CGPT), which operates on BNB and currently holds a market cap of $118 million, and TURBO, which operates on Ethereum and has a market cap of $265 million.

Can Crypto AI Agents Regain Their Strong Momentum?

The growth of crypto AI agents has significantly slowed down after a surge in January. Between January 7 and January 24, their number increased from 1,250 to 1,387, marking an 11% rise.

However, since then, growth has nearly stalled, with only 13 new AI agents added, representing less than a 1% increase. This slowdown suggests that interest in launching new crypto AI agents are fading, potentially signaling a cooling phase in the sector.

Crypto AI Agents Count, Market Cap, and Smart Engagement. Source: cookie.fun.

Crypto AI Agents Count, Market Cap, and Smart Engagement. Source: cookie.fun.

At the same time, engagement within the ecosystem has dropped sharply, with the number of smart accounts interacting with these projects falling from 19,069 on January 17 to just 7,541 now – a staggering 60% decline.

This drop in activity highlights weakening enthusiasm, as fewer users appear to be trading or utilizing these agents.

With both new project creation and user participation declining, regaining strong momentum in the near term appears challenging unless renewed interest or market catalysts emerge.