XRP Surges 13%, But Low Demand Signals Gains May Be Short-Lived

XRP has soared by 13% in the past 24 hours, bouncing back alongside the broader cryptocurrency market after a few days of decline. This rebound comes as major cryptocurrencies, which had fallen to multi-month lows, recover from recent losses, offering a temporary relief rally to investors.

However, despite this double-digit price hike, on-chain and technical data suggest that this XRP surge may be short-lived.

XRP Rallies, But There Is a Catch

XRP’s price has rocketed 13% in the past 24 hours, rebounding with the general cryptocurrency market after days of decline. The downturn was caused by concerns over Donald Trump’s tariffs on Canada, Mexico, and China, first announced on February 1. However, with Trump agreeing to delay the 25% tariffs on Canada and Mexico for 30 days, market sentiment has improved, prompting traders to resume accumulation.

Interestingly, despite this recovery, XRP’s rally may be short-lived. Data suggests that the surge is not fueled by strong demand for the altcoin itself, raising concerns about its sustainability.

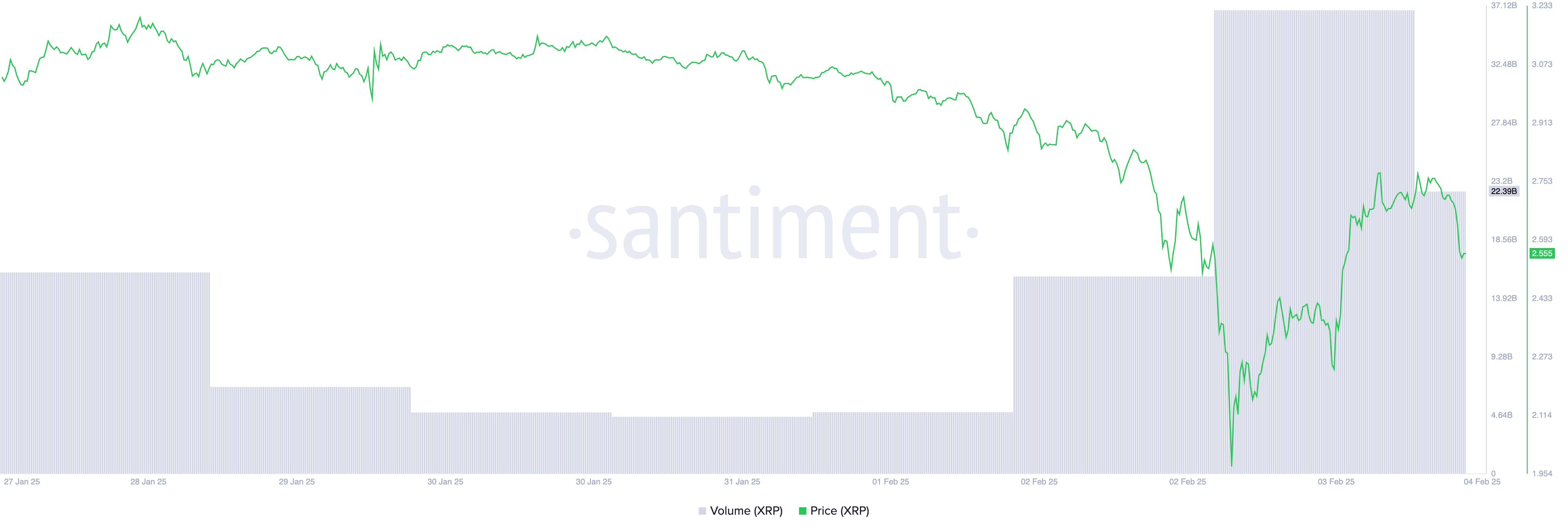

One such indicator is the token’s plummeting trading volume over the past 24 hours. Totaling $22.39 billion at press time, this has declined by 22% during that period.

XRP Price and Trading Volume. Source: Santiment

XRP Price and Trading Volume. Source: Santiment

When an asset’s price rises while trading volume declines, it suggests weak buying momentum, as fewer traders are actively driving the price higher. This indicates a lack of strong demand, making the rally unsustainable and increasing the risk of a price reversal.

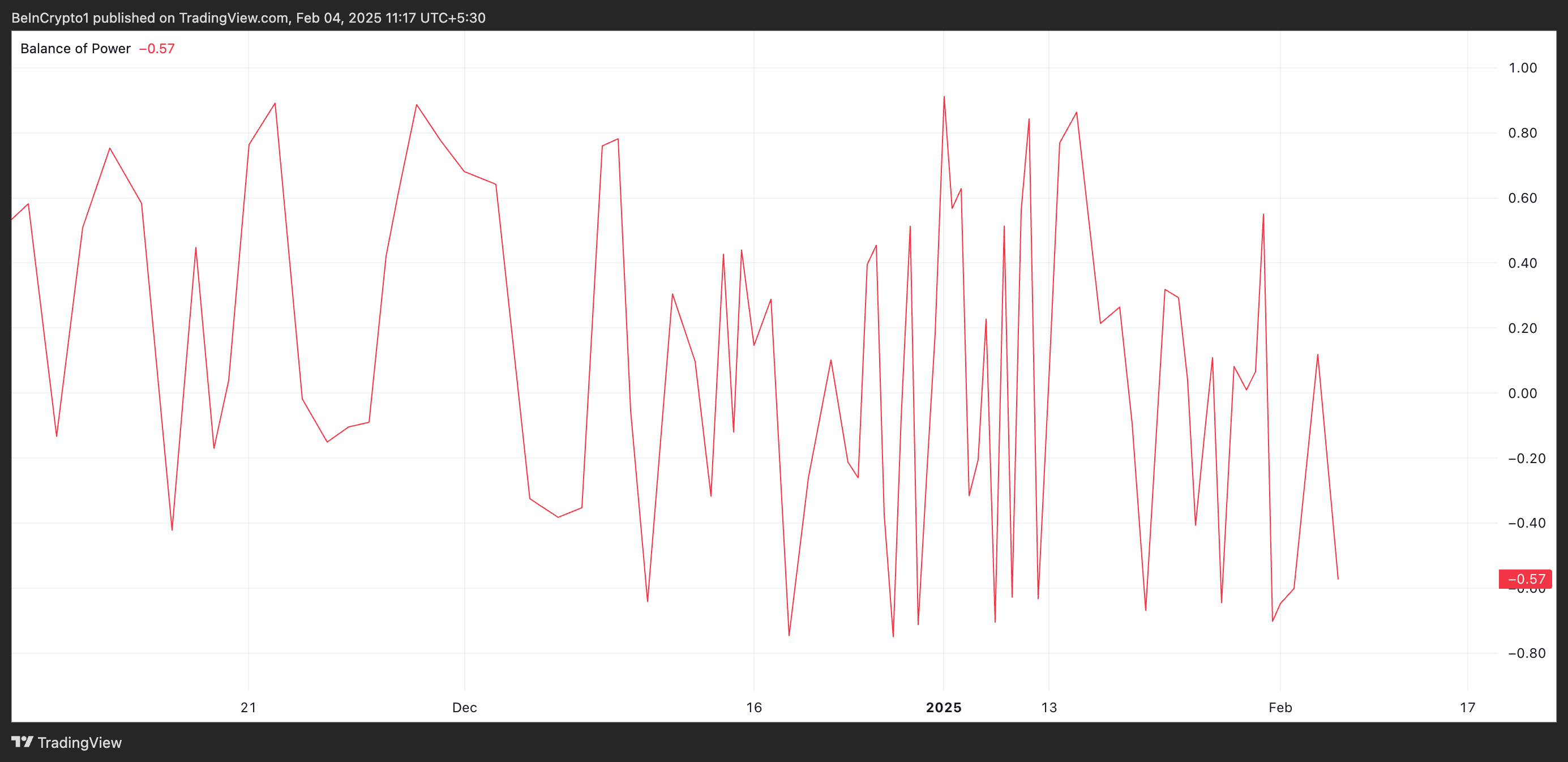

Furthermore, XRP’s negative Balance of Power (BoP) confirms that bearish pressure remains dominant. At press time, it stands at -0.57, reflecting the persisting bearish bias toward XRP despite its price hike.

XRP BoP. Source: TradingView

XRP BoP. Source: TradingView

The BoP indicator measures the strength of buyers versus sellers by analyzing price movements within a given period. As with XRP, when the BoP is negative, it indicates that selling pressure is dominant, suggesting a bearish trend and a higher likelihood of a trend reversal.

XRP Price Prediction: Can It Hold Recent Gains or Drop to $2.13?

As of this writing, XRP trades at $2.57. This represents a 45% hike from Monday’s intraday low of $1.77.

Once the general market rally wanes, XRP could shed its recent gains if demand remains low. In that scenario, its value could drop to $2.13.

If the bulls are unable to defend the support at this level, XRP’s price could slip below the $2 price zone to trade at $1.48, a low it last reached in November.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

On the other hand, a resurgence in XRP demand will invalidate this bearish outlook. In that case, the token’s price could climb toward $2.94.