Ethereum Worth $1.3 Billion Sold In a Week After Price Fails $3,500 Breach

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has faced persistent struggles throughout the year.

Despite multiple attempts to reclaim momentum, Ethereum has fallen below $3,000 on occasion, reflecting an inability to sustain recovery. This lack of upward movement has triggered investor caution, leading many to sell their holdings to secure profits.

Ethereum Investors Run Out Of Patience

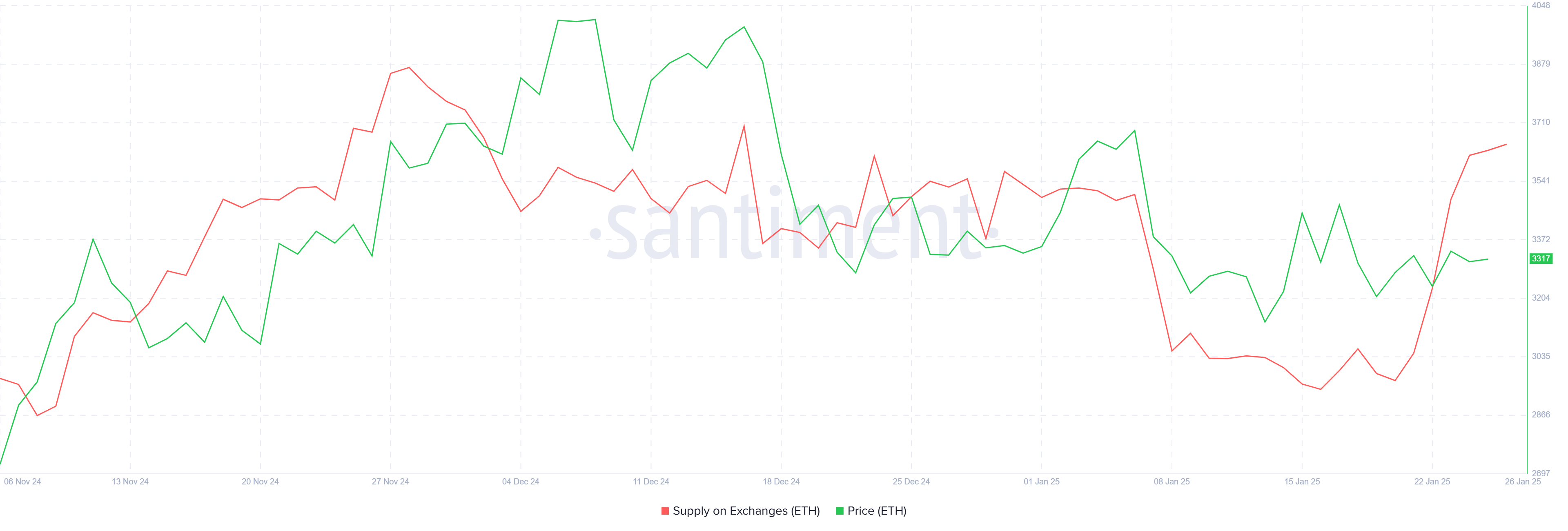

Investor sentiment surrounding Ethereum has shifted notably, with holders moving to offload their assets amid growing skepticism. Over the past week, more than 410,000 ETH, worth over $1.3 billion, has been sold. This spike in sell-offs is evident in the increased ETH supply on exchanges, a clear signal that investors are capitalizing on recent price action rather than holding for long-term gains.

This rise in selling pressure highlights the waning confidence among market participants, who appear unconvinced of Ethereum’s ability to sustain a meaningful recovery. The absence of strong upward price action has further fueled uncertainty, leading to a shift toward profit-taking behavior.

Ethereum Supply On Exchanges. Source: Santiment

Ethereum Supply On Exchanges. Source: Santiment

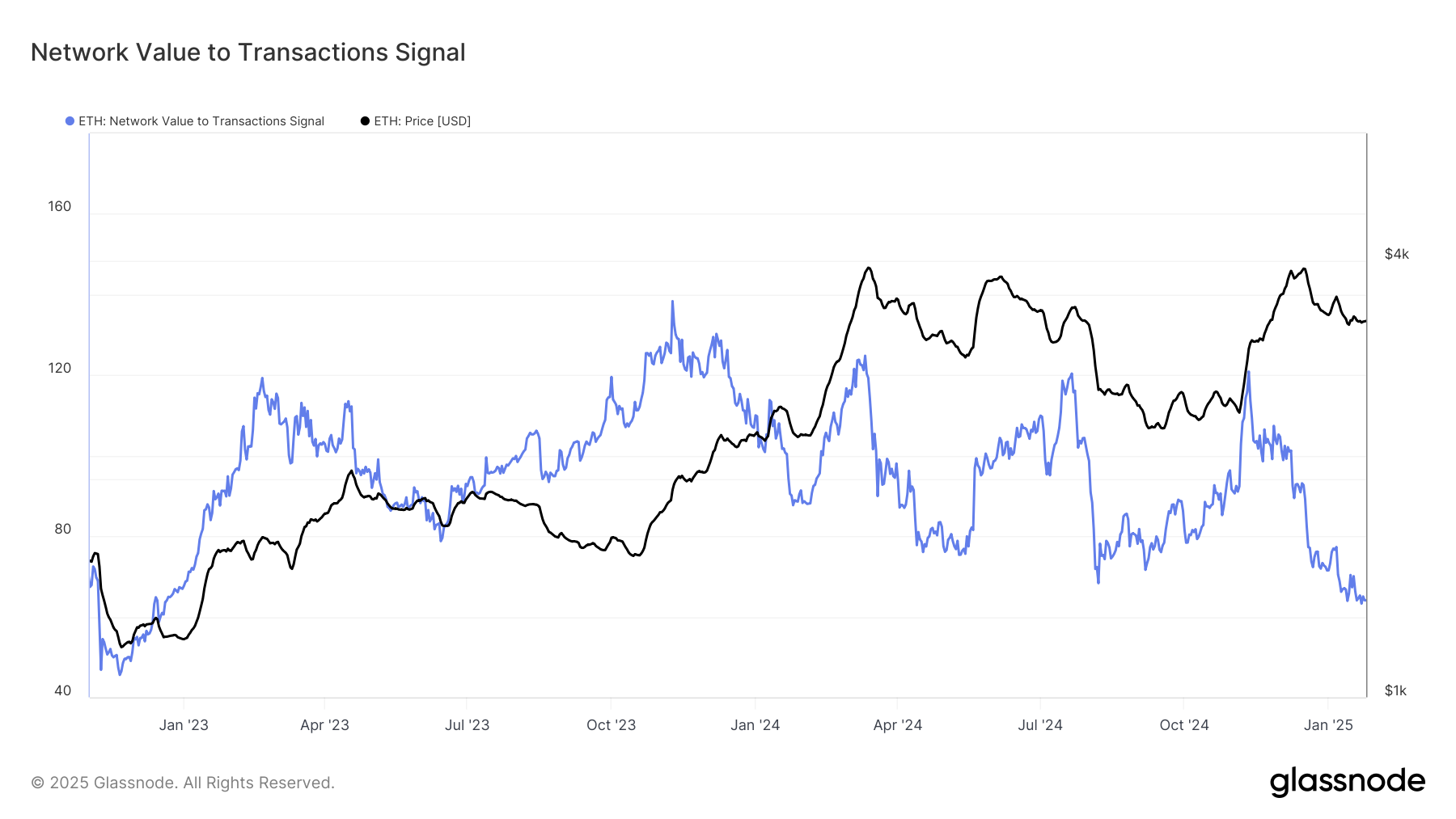

Ethereum’s macro momentum presents a mixed outlook. The Network Value to Transaction (NVT) signal, a key metric for assessing valuation, has dropped to a 25-month low. This suggests that Ethereum is currently undervalued, which historically indicates a potential for recovery and a rally in the medium to long term.

The undervaluation shown by the NVT signal could prevent Ethereum from experiencing sharp corrections, offering some hope for a reversal in sentiment. If this undervalued status attracts renewed interest, ETH may have a chance to stabilize and push beyond its current barriers.

Ethereum NVT Signal. Source: Glassnode

Ethereum NVT Signal. Source: Glassnode

ETH Price Prediction: Invalidating Barriers

Ethereum’s price is currently holding above the support level at $3,303, following a failed attempt to breach the $3,530 barrier. Last week, the cryptocurrency dipped to $3,131, highlighting its ongoing struggle to maintain bullish momentum.

Given the current conditions, Ethereum is likely to continue consolidating under the $3,530 resistance level. A failure to reclaim this critical barrier could see ETH falling back to $3,131, further weakening market confidence.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingView

On the other hand, a successful breach of $3,530 could mark a turning point for Ethereum. Such a move would likely push the price toward $3,711, restoring investor confidence and invalidating the bearish outlook. However, sustained buying pressure and favorable market conditions will be critical for this scenario to unfold.